19% of Healthcare Insurance Claim Payouts Made by Check

In the digital era, we tend to think payments are all traveling via this or that payments app. However, the latest PYMNTS/Ingo Money collaboration, “Insurance Disbursements Brief 2022,” noted the surprising prevalence of paper checks used for healthcare claim payments or disbursements.

As reported at PYMNTS.com:

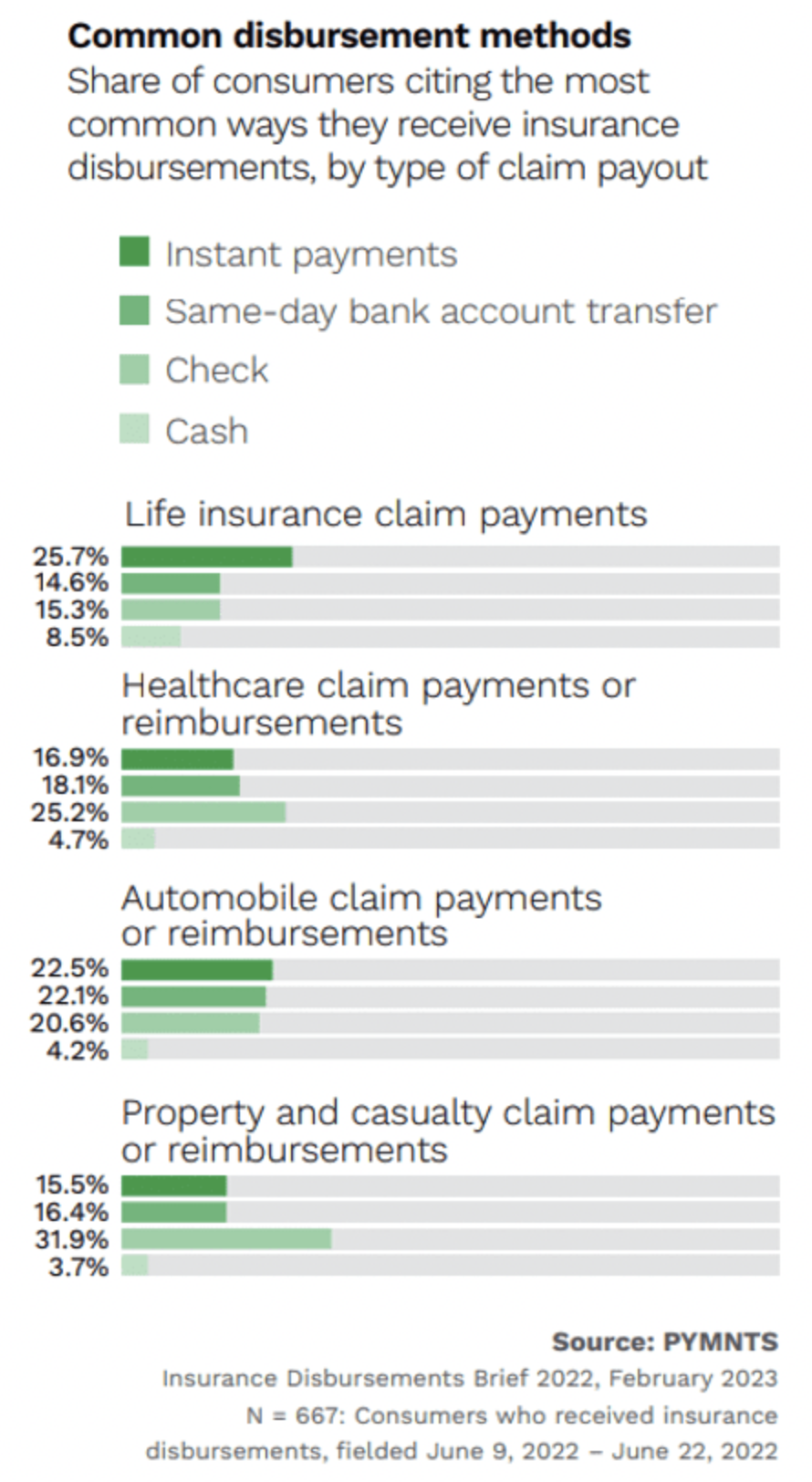

This is particularly key because healthcare disbursements represent the highest share of payouts surveyed consumers receive, at 19%. (The corresponding rate of check payments for property and casualty claims is even higher, but those payments are rarer overall.) Annual numbers in total number of claims vary, but healthcare disbursements have been the most common type of consumer payout since 2020. They represent 14% of all claims, meaning an estimated 24 million U.S. consumers received at least one insurance disbursement in the 12 months preceding June 2022.

With $1.37 trillion in total healthcare payouts in 2022, this represents a large number of paper checks disbursed.

This does not also include the number of checks written by patients to healthcare providers -- as patients have essentially become a payer, according to Josh Berman of Linchpin Healthcare.

Medical Payout Choices Are Limited

In many cases, the medical consumer's payout choices are indeed narrow:

Despite consumers’ demand for more options, many insurers across industry sectors have reduced or eliminated certain payment choices. For example, insurance companies overall gave consumers the option to choose instant payouts for 62% of received disbursements in 2022, a 12% decline from 2021. Specific to the sector, health insurance companies gave consumers receiving their disbursements a choice of receipt method 57% of the time, ranking last among the industry for payment choice.

Therefor, paper checks are often the payment and disbursement method deployed.

While this may not be the preference for some patients, there is still a portion of the population who do have a checking account -- often referred to as the "underbanked." This group prefers a check, as they can take it to their local check casher -- or Walmart -- and get instant cash to purchase necessities.

Click image to enlarge.

Checks Still Widely Used

Healthcare disbursements are certainly not the only payments that are still deploying checks. As we've reported in earlier posts, 22% of respondents to GOBankingRates’ Best Banks 2023 survey of 1,000 Americans said they still write checks at least once a month. Also, 78% of renters still pay by check. And, of course, The United States government has had to rely on checks as well when distributing stimulus payments.

Given this information, we can see the importance of checks as a payment. The challenge for financial institutions is to invest in the right technologies that automate paper check processing, including artificial intelligence and machine learning. Streamlining check deposits with technology like OrboAnywhere -- no matter the channel (i.e. mRDC, teller, ATM, etc.) -- achieves field performance of 99% automation and 99.5%+ accuracy, effectively eliminating any manual intervention.