2018 Conference Highlights: Survey Results for Reg CC Readiness

RemoteDepositCapture.com image

We’re continuing our look at some of the highlights from our 2018 Healthcare and Check Payment Technology Conference in Nashville, TN, via a presentation by Paul A. Carrubba, Partner at Adams and Reese LLP, and John Leekley, Founder & CEO, RemoteDepositCapture.com, entitled “Best Practices for July 2018 Reg CC Changes.”

After Paul Carrubba’s overview of Reg CC Amendments that will go into effect on July 1, 2018 (view our Reg CC Resource Page or the free, 1-hour webinar hosted by RemoteDepositCapture.com), John Leekley presented the results of RemoteDepositCapture.com’s survey on Reg CC readiness in the industry. Covering 54 financial institutions, the findings are informative.

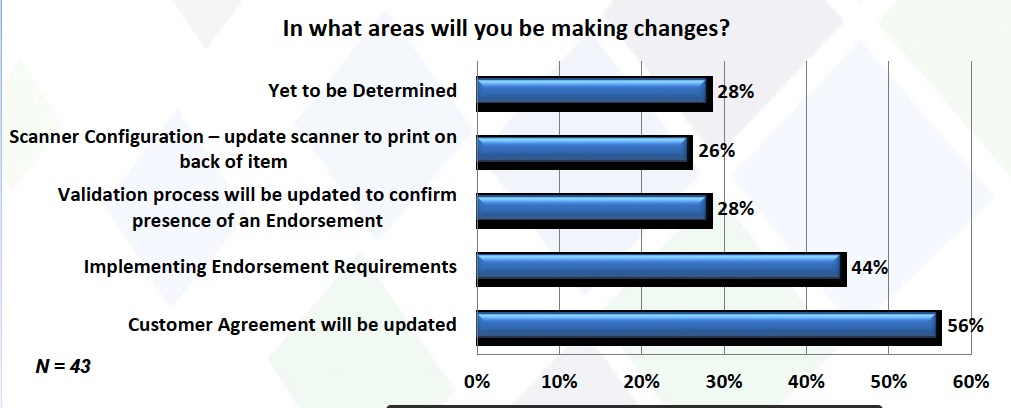

For example, most financial institutions are still deciding on changes that will be made — with less than 60 days left to go. To see 28% of FI’s surveyed admit that they are still determining where changes will be made to meet the new Reg CC requirements is fairly startling (see attached chart).

Also of interest: only 10% of FI’s use either an automated review to intelligently read the endorsement (if no endorsement or incorrect endorsement, item is rejected) or automated review to detect presence of an endorsement (if no endorsement, item is rejected). A hefty 31% still do a manual review (off all or random items).

Application and platform modernization has already surged – – the numbers from RemoteDepositCapture.com’s survey seem to indicate that another “11th hour catch-up” surge is imminent – – July 1st is just around the corner! Technology solutions, such as Anywhere Validate, are available to FI’s to automate the detection of restrictive endorsements.