The 2019 Federal Reserve Payments Study Illustrates Dynamics of Robust Economy with Payment Diversity

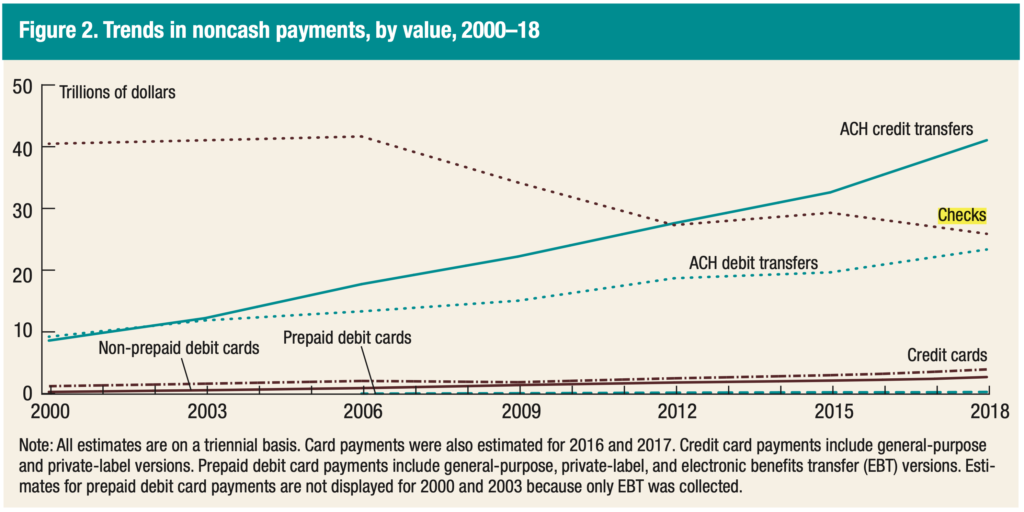

The Federal Reserve released the 2019 Federal Reserve Payments Study Executive Report on December 19, 2019. Based on 2018 compared to 2015, aggregate payment growth in “core noncash payments,” including debit card, credit card, ACH, and checks, were up as a whole by 6.7% representing an incremental 30.6 billion transactions valued at $97B!

Comparing actual transaction volume of 2018 to 2015, credit cards lead the way with a 9.9% increase, debit cards were up 8.4%, and ACH received the bronze medal with 6.0% growth. Meanwhile, checks were estimated to deliver a 7.2% decline based on years compared. It’s too bad we don’t have cash estimates as well.

What’s a “Check Person” to Think?

For those still committed to the check industry, a 7.2% drop doesn’t sound like a future with job security. However, there is an encouraging story behind the numbers for this legacy payment. The numbers are not so bad…

- First, there are actually 16B checks written; 14.5B paid, and; 1.5M being converted to ACH by the payee or lock box.

- Second, the baseline from 2015 may have moved. OrboGraph helped clarification of industry volumes at this webinar in 2016. At that time, the numbers estimated were 18B. If you reconcile the percentage drop from 18B in 2015 (reported in the webinar) to the 16B three years later, the drop is 3.7% per year.

- Lastly, the average value of an individual check rose significantly, from $1,609 in 2015 to $1,779 in 2018 (10% increase) with a total value of $26.20 trillion (not including converted) and from $1,468 to $1,635 (based on the $16B checks). Much of this due to continued utilization in the corporate and treasury world.

Double Dipping on the Impact of Checks

One of the unique attributes of a check payment deals with the number of touch points of the check payment process. For every check written by the maker (payor) of a check to a payee, a bank of first deposit (BoFD) typically takes a deposit and processes the item. The check is cleared and the paying bank then debits the account of the payor or maker of the check. Sometimes a clearinghouse must process the item, a 3rd party, BPO, or correspondent bank. This means that to a processing entity, a check is processed at least twice, if not three to four times.

From a processor’s standpoint, it means there are some 32B+ transactions which are fair game for processing. That might mean capturing and performing recognition, payment validation, verifying amounts, running fraud detection, checking compliance, and/or balancing.

More Can Be Accomplished

Ok, we get it. Checks are going to keep declining and the battle for market share advocated by existing and new payment companies with big marketing budgets will drive more volume in the direction towards credit, debit, and real-time payments. However, there is still a strong need to continue to automate and protect check processing with technologies like image analysis, AI, machine learning, and deep learning.

It’s still a healthy check environment where robust investment continues for platform modernization. Don’t let check volume numbers discourage you from striving for straight-through processing!

This blog contains forward-looking statements. For more information, click here.