Best Practices for Detection of Counterfeit, Forged, and Altered Checks

- Check fraud of all types is on the rise

- Perpetrators have many profiles and approaches

- Preemptive solutions for check fraud

As noted many times both here and in the general media, check fraud persistent and pervasive -- and now compounded by fraudsters constructing corona virus-related scams.

Financial institutions should be on high alert for scams and fraud schemes that target the institution itself and/or its customers. It is equally important for financial institutions to evaluate their current check fraud processes and technologies and identify any possible gaps.

These gaps in protection limit a financial institution's ability to achieve the highest levels of best practice processes and procedures.

Based on feedback from multiple customers and clients, please review several best practices for detection of counterfeit, forged, and altered checks:

1. Understand fraudsters and their motivations.

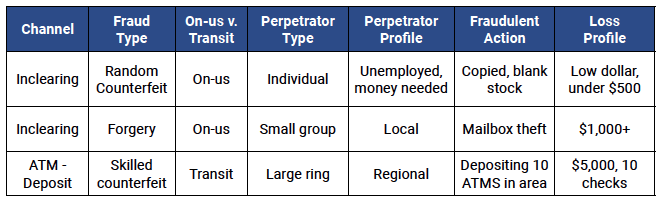

OrboGraph has assembled a Check Fraud Perpetrator Profile Summary that depicts the most pervasive forms of check fraud as well as the types of perpetrators -- from individuals to international organizations -- that are responsible.

Let's take a look at three different levels of fraud attempts at one sample financial institution, along with the respective perpetrator types and profiles:

The types of fraud and related perpetrator profiles that hit a financial institution.

As you can see, the "bad actors" range from an individual -- often a "one-timer" who may never attempt anything like this again -- all the way up to well-organized large rings that can coordinate their efforts and move on to another bank when finished here. And don't forget about the Matt Cox's of the world.

2. Understand current fraud schemes.

Once a financial institution understands the profile of fraudsters, it is important to understand what current scams and fraud schemes are regularly being deployed. We have detailed multiple different fraud scams in our blog including:

While this is just a small sample, we encourage check fraud specialists and analysts at financial institution to stay abreast of current and emerging check fraud schemes.

3. Educate your customers.

Equally important for banks is providing education for their customer base on check fraud schemes and how to prevent being a victim. There are various resources available to the public including the FTC Scam Bingo Card for individuals and HelpWithMyBank.gov for businesses and banks.

It is recommended that banks provide consistent communication to its customers base along with devoting a section of their website as a fraud and scam alert resource. Not only will this reduce the number of victims, it also increases customer satisfaction knowing their banks are watching out for them.

4. Evaluate Image Analysis technologies in conjunction with analytics.

There is no "one size fits all" solution for check fraud detection. Rather, banks need to work with vendors to find the right combination of solutions to ensure full coverage for check fraud detection. We recently cohosted a webinar with NICE Actimize detailing strategies incorporating multiple technologies for full scope check detection.

It is noted that many banks currently deploy an analytics-based solution, or one based on machine learning, that analyzes transactional data only. While this is an important component of check fraud prevention, it is essential for banks to incorporate an image-analysis based solution. See more details on the Anywhere Fraud webpage.

Anywhere Fraud is built on the foundation of targeted analyzers performed on an account level. These account profiles leverage self learning algorithms to adapt to the image and transactional characteristics of each account. The system builds a history of image snippets and transactional data of check writers for batch or real-time fraud detection capabilities.

To discover the benefits of deploying image analysis detection for check fraud detection, email info@orbograph.com.