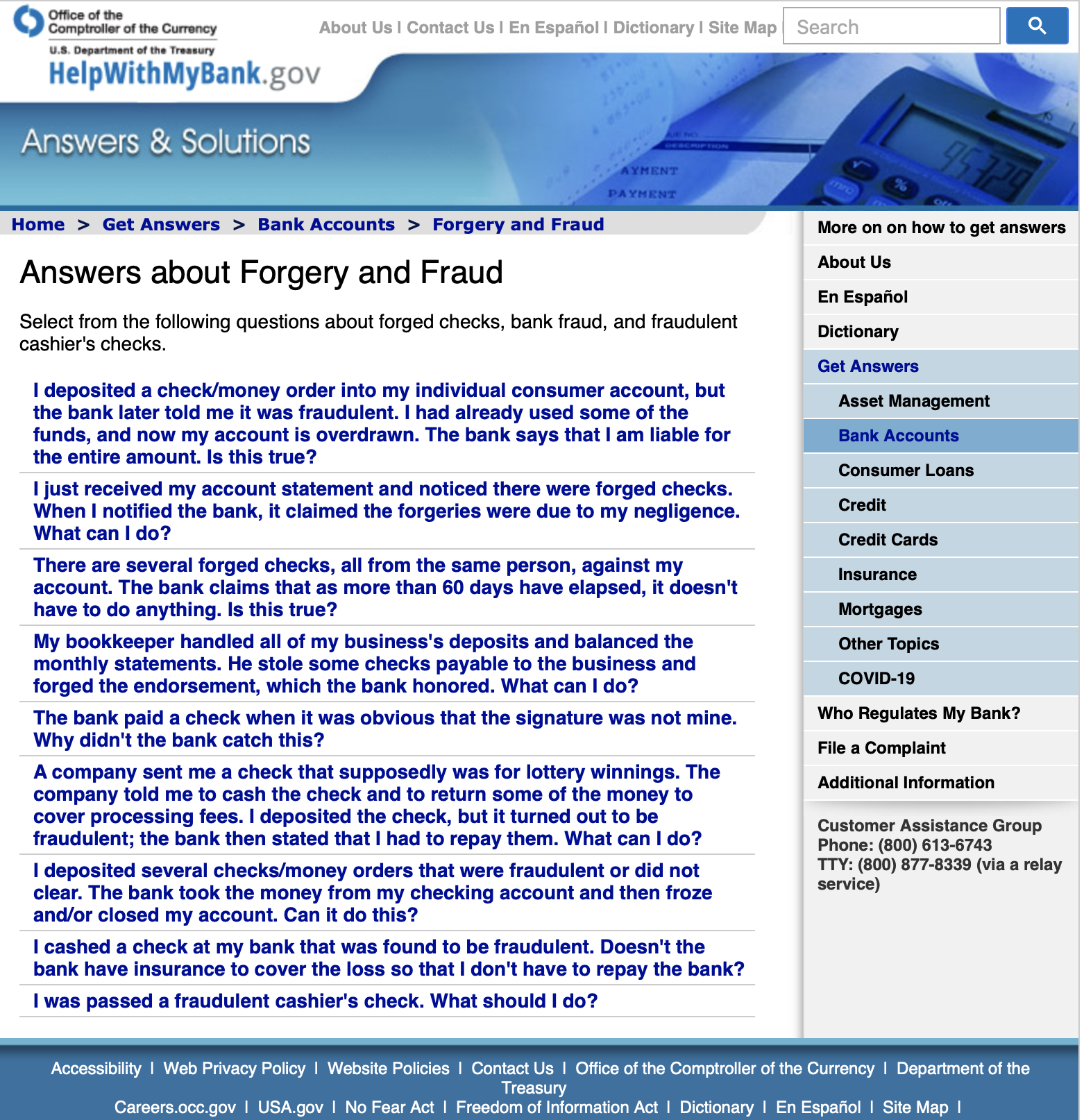

HelpWithMyBank.gov Delivers “Bank Friendly” Check Fraud & Forgery Resource

- The federal government has created a helpful anti-fraud page

- The site contains PROACTIVE as well as REACTIVE solutions

- Check fraud attempts continue to grow, necessitating consumer vigilance

The Office of the Comptroller of the Currency (under the jurisdiction of the US Department of the Treasury) has rolled out an easy-to-use check fraud and forgery resource at HelpWithMyBank.gov that represents a valuable and easily accessible tool for banks and their customers.

The page describes a series of common scenarios linking to easy-to-implement solutions, giving banks a useful and powerful ally in solving and preventing these crimes.

The site is, in fact, a great primer for individuals and businesses to review before finding themselves in a sticky situation.

An example:

PROBLEM: My bookkeeper handled all of my business's deposits and balanced the monthly statements. He stole some checks payable to the business and forged the endorsement, which the bank honored. What can I do?

ANSWER: Even though a bank pays over a forged endorsement, it is the account holder's responsibility to discover the problem and notify the bank.

There is very little the bank can do to protect you from the actions of your employees. It is your responsibility to have separation of duties — for example, the same person should never make the deposits and balance the monthly statements.

If you have an account with multiple forgeries (e.g., stolen checks), you should consider closing the account.

Other examples include:

- I was passed a fraudulent cashier's check. What should I do?

- The bank paid a check when it was obvious that the signature was not mine. Why didn't the bank catch this?

And, the now-classic...

- A company sent me a check that supposedly was for lottery winnings. The company told me to cash the check and to return some of the money to cover processing fees. I deposited the check, but it turned out to be fraudulent; the bank then stated that I had to repay them. What can I do?

Given the growing pervasiveness of fraud in general -- and check fraud in particular -- an easily accessible information source like this is the right idea at the right time! Educating customers on the different fraud scenarios and schemes is a critical component in stopping fraudsters (check out previous articles on Costco Scam and the Classic Check Fraud Scheme Targeting Millennials).

In addition to educating its client base, banks need to assess their current fraud procedures and technologies to ensure they are deploying the right tools to protect themselves and their clients. Recently, we featured a webinar with NICE Actimize on how collaborative efforts via machine learning and image analysis appear to be the key to winning the fight against fraud. Image analysis represents the visual factor, while machine learning drives the behavioral component. When combined via collaborative systems, financial institutions have a potent defense against all.