Keys to Successful Mobile Banking in 2019

As technological innovation continues to evolve society, so does the way it affects society’s interaction with businesses, including their banks!

According to Bankrate.com:

“The mobile app features these days are so comprehensive,” says Paul McAdam, senior director of banking services at J.D. Power. “We can deposit checks. We can transfer money within our bank. Not in all cases, but in many cases, we can transfer money to another financial institution. We can pay bills. We can do person-to-person transfers. From the standpoint of monitoring and moving money, it’s so easy.”

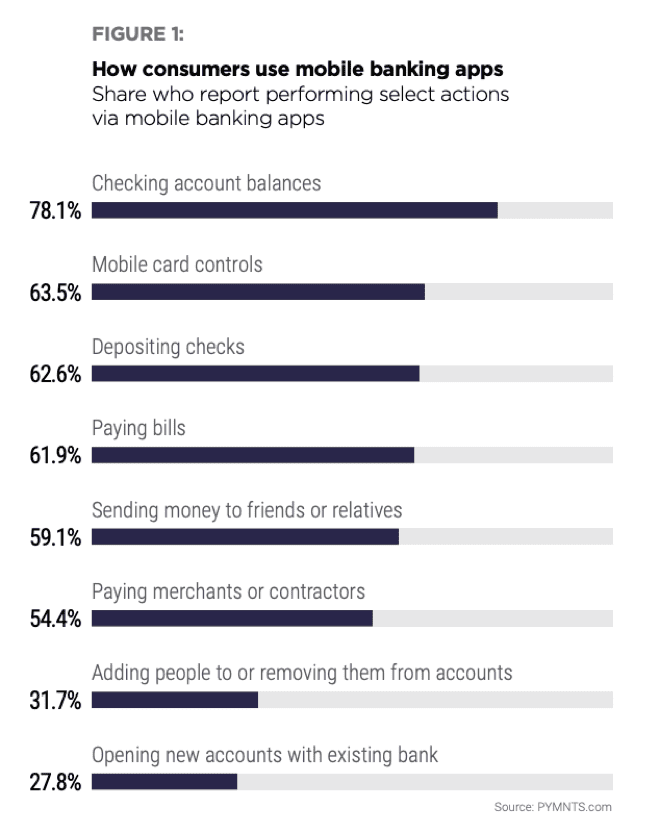

PYMNTS.com provides a comprehensive breakdown of how these consumers are utilizing their mobile banking apps:

Bankrate.com examines three of the many reasons that mobile banking is becoming more and more popular in the United States and abroad.

Good Security: Up to and including multi-factor authentication, where you need two (or more) kinds of verification to prove that it’s really you. Check security has also done much to inform security in instant payments, making Gen X and older consumers much more comfortable with capturing checks via smartphone, for instance.

Convenience: This is the easy one, of course. It’s terrific to be able to access banking records anywhere, anytime, and deposit a check via a snapshot. However:

In recent months, banks have been going one step further by offering money predictions via their mobile apps’ messaging. For example, U.S. Bank recently overhauled its mobile app to include messaging customers when its algorithms see an opportunity to save money, or alternatively, forecasts when they are at risk of overdrafting an account. These kinds of features are designed to be useful to the millions of Americans living paycheck to paycheck.

That’s AI deployment right into the consumer realm!

Control: The article suggests that we think of mobile banking as “remote control for your money” – – apps let you deposit a check and send someone money whenever you wish.

With the adoption of mobile banking continuing to rise, banks and financial institutions need to be cognizant of the potential risk and fraud scenarios associated, particularly with mobile RDC. Investing in technology to further expand check fraud prevention including image-analysis will help identify and flag fraudulent checks, forgeries, and alterations to protect the consumer and the bank.

This blog contains forward-looking statements. For more information, click here.