Artificial Intelligence and Deep Learning

In a world where COVID-19 has made on-site collaboration a more and more distant memory — with no end in sight for the growth of remote work as the norm — PaymentsJournal reports: The need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.

Read MoreWe have receive a tremendous amount of positive feedback from our recent #OrboZone launch, with a countless number of clients, partners, and industry experts raving about their “experience.” But what is #OrboZone? It’s dynamic content that combines high-impact videos, visual galleries, energizing music, and entertaining activities for your WFH environment.

Read MoreHere’s a paradox we enjoy seeing: Even as it’s proclaimed all over the place that “checks are in decline,” and “checks are alien to Millennials” — we see a forward-looking, technologically innovative payroll infrastructure startup system launch and call itself — Check.

Read MoreAn article at PaymentsJournal.com cites a 2019 survey by Aite Group indicating that only 18% of banks were at that point moving from a transaction-based revenue model to a data-based approach. While this figure is unlikely to have changed significantly since, PaymentsJournal.com goes on to note that data-driven payments are increasingly on the agenda for banks and we can expect more movement towards this.

Read MoreA recent webinar sponsored by Fiserv highlighted reconciliation challenges faced by modern financial institutions as so many consumers adopt digital channels for payments. Fiserv’s 2020 Expectations & Experiences: Consumer Payments survey found that digital payments are indeed on the rise and confidence with virtual payment cards — the Apple Wallet, for instance — is growing.

Read MoreThe trading platform Blocktrade recently published their predictions for the coming year in the fintech and payment worlds. “We all know that 2020 was a highly unusual year – the Covid pandemic not only impacted the global economy, it also accelerated ongoing changes and developments in the Fintech and Payment industry.”

Read MoreWe have seen the banking and payments industries recover from the challenges of the COVID-19 Pandemic with a resurgence of checks and sustained volumes of other payments. With this recovery, banks and financial institutions can now refocus on automation and fraud prevention projects which have been delayed while the economy recovers.

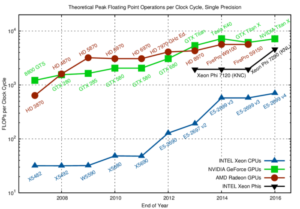

Read MoreLast week, we took a deep dive into a video by Mythbusters on CPU vs GPU, detailing how GPU provides a higher rate of speed and accuracy than CPU, essential for check processing and fraud detection. But, why are GPU processors necessary for artificial intelligence and machine learning?

Read MoreBack in August, we explored the importance of Nvidia’s data centers to real-time check processing. The blog post garnered a huge amount of attention from our readers, yielding requests to take a deeper dive of the featured video from Mythbusters and the subject of GPUs vs CPUs.

Read MoreThe Amazon Web Services website reports that Capital One is completing its migration as the first US Bank to go all-in on the cloud — and it’s making waves in the industry. “Capital One, one of the largest banks in the United States, announced in November 2020 that it had completed the migration from all eight of its on-premises data centers to Amazon Web Services (AWS), becoming the first US bank to report that it was all in on the cloud.

Read More