Bank Branch

OrboGraph’s dynamic webinar entitled Change is Inevitable – How Will You Respond? — co-hosted with NICE Actimize — provided fresh insight into the nature of fraud. The webinar provides information and scenarios to show how fraudsters are becoming more sophisticated in their methods of committing fraud and how incorporating new technologies like Artificial Intelligence and…

Read MoreAn article at MarketWatch.com notes that “there are more than 30 million small businesses in the United States and the majority cite cash flow as the biggest challenge they face.” With the Coronavirus, this is probably an understatement. Market leader Jack Henry & Associates, Inc., provider of technology solutions and payment processing services primarily for…

Read MoreFrom the Federal Reserve Bank of Atlanta comes an informative overview of check usage entitled U.S. Consumers’ Use of Personal Checks: Evidence from a Diary Survey. The authors look at 1,600 individual transactions to gain an understanding of what check payments are currently used for—by dollar value, and by payee—and who uses checks (in terms of demographics and income).

Read MoreOrboGraph recently co-hosted with Nice Actimize a dynamic webinar entitled Change is Inevitable – How Will You Respond? Along with OrboGraph’s Joe Gregory, Allegra Angus and Nithin Mangalore of Nice Actimize discussed with attendees different aspects of check fraud trends, best practices for combating check fraud, including incorporating machine learning and image analysis.

Read MoreThe array of digital payment vehicles available is dizzying — Google Pay, Apple Pay, PayPal, Venmo — the list is long. Still, checks remain popular. And, it turns out, a better payment instrument when it becomes necessary to stop payment due to error or suspected fraud! MoneyWise describes easy step-by-step directions for canceling or stopping…

Read MoreAccelerated funds availability allows depositors to instantly access the money they deposit via check. That way, there’s no waiting period for the check to clear and no penalty if the check writer’s account has insufficient funds. An article at BAI Banking Strategies by Victoria Dougherty, director of Payment Management Solutions, Fiserv, opens by wondering why…

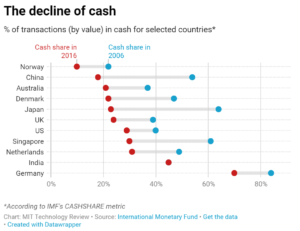

Read MoreIs cash becoming an endangered species? And, if so, is that good? Mike Orcutt, an associate editor at MIT Technology Review, has written what he calls an elegy for cash at the MIT Technology Review site, and includes some points to ponder regarding whether the demise of cash could actually be a negative development, as…

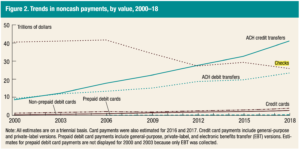

Read MoreThe Federal Reserve released the 2019 Federal Reserve Payments Study Executive Report on December 19, 2019. Based on 2018 compared to 2015, aggregate payment growth in “core noncash payments,” including debit card, credit card, ACH, and checks, were up as a whole by 6.7% representing an incremental 30.6 billion transactions valued at $97B! Comparing actual…

Read MoreIn today’s world, abbreviations are utilized on a daily basis. Simple contractions such as “don’t”, “couldn’t”, and “we’ll” are all commonly used in the English language. In the banking world, abbreviations are most common in the date field, as many in society choose to abbreviate the year from 01/08/2020 to 1/8/20. Seems harmless, right? Maybe…

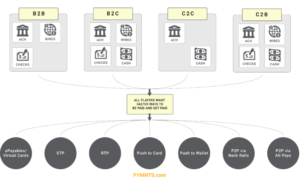

Read MoreWe love this time of year! It’s a week when everyone the payments industry can take a deep breath, celebrate successes, reflect, and then blog about the future. And now that 2020 is upon us, what better time to “look ahead” toward 2030! PYMNTS.com is one of the first publications to make a prediction related…

Read More