Check Fraud Prevention

Congress passed a $2 trillion stimulus bill — the largest in United States history — that promises to revive a coronavirus-stricken economy. These are payments that will be sent directly to Americans, with many adults getting $1,200. For every qualifying child age 16 or under, the payment adds an additional $500. The plan is for…

Read MoreOrboGraph’s dynamic webinar entitled Change is Inevitable – How Will You Respond? — co-hosted with NICE Actimize — provided fresh insight into the nature of fraud. The webinar provides information and scenarios to show how fraudsters are becoming more sophisticated in their methods of committing fraud and how incorporating new technologies like Artificial Intelligence and…

Read MoreFrom the Federal Reserve Bank of Atlanta comes an informative overview of check usage entitled U.S. Consumers’ Use of Personal Checks: Evidence from a Diary Survey. The authors look at 1,600 individual transactions to gain an understanding of what check payments are currently used for—by dollar value, and by payee—and who uses checks (in terms of demographics and income).

Read MoreOrboGraph recently co-hosted with Nice Actimize a dynamic webinar entitled Change is Inevitable – How Will You Respond? Along with OrboGraph’s Joe Gregory, Allegra Angus and Nithin Mangalore of Nice Actimize discussed with attendees different aspects of check fraud trends, best practices for combating check fraud, including incorporating machine learning and image analysis.

Read MoreThe array of digital payment vehicles available is dizzying — Google Pay, Apple Pay, PayPal, Venmo — the list is long. Still, checks remain popular. And, it turns out, a better payment instrument when it becomes necessary to stop payment due to error or suspected fraud! MoneyWise describes easy step-by-step directions for canceling or stopping…

Read MoreDouble-layered fraud: fraudsters who actually defrauded other recruits who thought they were “in on it” – both banks and accomplices alike we defrauded. To better detect fraud, banks need to strategically align their technologies.

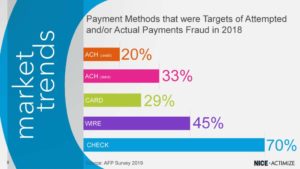

Read MoreFraud attempts affected an estimated $25.1 billion held in deposit accounts, ABA’s survey found, with $22.3 billion protected per the Banking Exchange Prevention was the equivalent of $9 for every $10 in attempted fraud, per Dodd Frank Update Attempted check fraud spiked 43% in two years, per PYMNTS.com The American Bankers Association’s (ABA) 2020 Deposit…

Read MoreAccelerated funds availability allows depositors to instantly access the money they deposit via check. That way, there’s no waiting period for the check to clear and no penalty if the check writer’s account has insufficient funds. An article at BAI Banking Strategies by Victoria Dougherty, director of Payment Management Solutions, Fiserv, opens by wondering why…

Read MorePaymentsJournal.com took a look at the world of corporate payments and listed nine things corporate treasurers can expect in 2020. This includes: a categorical rise of real-time banking (No. 1) explosive new records for the volume of payments managed by corporate treasurers (No. 3) a warning that fear of fraud and security breaches will increase…

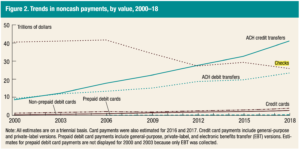

Read MoreThe Federal Reserve released the 2019 Federal Reserve Payments Study Executive Report on December 19, 2019. Based on 2018 compared to 2015, aggregate payment growth in “core noncash payments,” including debit card, credit card, ACH, and checks, were up as a whole by 6.7% representing an incremental 30.6 billion transactions valued at $97B! Comparing actual…

Read More