Check Image Quality

Ensenta/EPS has put together an excellent report exploring NINE DRIVERS OF MOBILE DEPOSIT GROWTH (You can download a copy HERE). They come out of the gate by noting that large financial institutions continue to invest in increasingly better mobile deposit user experiences for two reasons: Improving return on investment (ROI) Growing their deposit base Given…

Read MoreModern bank consumers are more and more comfortable interacting with their accounts online, often from a portable device. It’s never been easier to make deposits — using an app on an always-handy phone — and see the “funds available” right in an account, reassuring the user that the money is indeed deposited and… available. MyBankTracker…

Read MoreForbes magazine reports on a recent AI Today podcast wherein Casey Royer of USAA, a large US bank serving the military community, shared information on how the bank is adopting AI, how they’re using AI to broaden USAA banking offerings, make their operations more effective and efficient, and offer greater value to their growing customer…

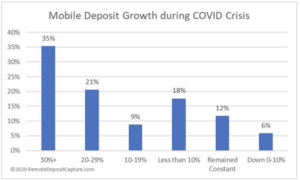

Read MoreRemoteDepositCapture.com had a hunch that the Covid-19 pandemic would lead to an increase in RDC deposits (Mobile Deposit, Desktop, ATM, etc.). So, in late February, they started polling the industry, asking the following question: For Financial Institutions: What has been the rate of growth or decline in your mobile deposit volume over the past year?…

Read MoreOrboGraph will soon be launching a website refresh with the official market announcements around OrbNet AI and OrboAnywhere 4.0. Check recognition is a process which is not perfect, but the gap of unread items is closing. As technology approaches reading all legible items, it is important to look closely at “defect” items which did not…

Read MoreA new podcast at PYMNTS.com features a conversation with Michael Reed, division president of payments at Deluxe. The podcast covers a wide range of timely payments topics, including: Checks still widely used with Reed reporting $7 trillion total transactional amounts with $2 trillion from lockbox. How work-from-home mandates have forced businesses to rethink how they…

Read MoreLast month, FT Partners hosted a VIP Video Conference to review their new industry research report, Understanding the Impact of COVID-19 on FinTech, which is available HERE. They were joined by three leading FinTech CEOs and discussed their approaches to the COVID-19 era. Video Conference Panelists: Steve McLaughlin, Founder and CEO of FT Partners Greg…

Read MoreAt our 2019 Healthcare and Check Payment Technology Conference in Charlotte this past May, we were fortunate enough to hear from Rod Springhetti, the VP Product Management at Deluxe Corporation, as he spoke about AI implementation. Mr. Springhetti is known across the industry as a leading authority on AI implementation, and his insights were of…

Read MoreWhen contemplating Gen Z — those people born between 1996-2015 — many people assume they are another iteration of Millennials (early 1980s to early 2000s). That means they are a digital-obsessed generation with no interest in, for instance, visiting a bank teller. It turns out that’s not the case. In a podcast interview with BAI…

Read MoreTechnavio, a leading global technology research and advisory company, has released a report indicating that the industry is poised to grow by USD 15.14 billion during 2019-2023, progressing at a CAGR of over 48% during the forecast period. Entitled Global Artificial Intelligence-as-a-Service (AIaaS) Market 2020-2024, a free sample of the report can be obtained via…

Read More