Financial Industry

The Wall Street Journal recently ran an article headlined “The Problem for Small Town Banks: People Want High-Tech Services.” The gist of the article (available to subscribers only, alas) is that consumers in search of higher-tech interactions with financial institutions are bypassing smaller community banks in favor of “larger lenders offering online transactions.” The small…

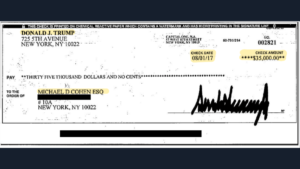

Read MoreBy now, images of the checks submitted into evidence by Michael Cohen as he testified before Congress have become ubiquitous. One of the checks, shown below, illustrates the power of data that is generated on a check. You see the courtesy and legal amounts, the date issued, maker/payer, payee and payee address, check number, and,…

Read MoreBAI Banking Strategies has assembled the wisdom of industry thought leaders in their new report: Decisions bankers need to make for 2019, a free download that will be worth your time to read as we make headway into 2019 and its new challenges, including the modernization priority that we hear about again and again. Venturing into the New Year, BAI has sought out its own thought…

Read MoreBAI Banking Strategies hosts Daniel Faggella, founder and CEO of Emerj, on their newest podcast entitled TURNING AI INTO ROI. It’s an interesting and fast-moving 15 minutes. BAI had proclaimed AI their trend of the year for 2018, and show so signs of moving the title elsewhere for 2019. One of the salient points Mr.…

Read MoreA year ago we noted that Amazon was looking at offering checking accounts, and more recently Abby Hayes at Doughroller has reiterated that the online giant is still interested. The Wall Street Journal reported that Amazon was/is chatting with various banks, including JP Morgan Chase & Co, about creating a branded online checking account. – Besides…

Read MoreBAI Banking Strategies notes the seeming treadmill race to keep up with bank fraud in the US. The article’s author, David Vergara, head of security product marketing for OneSpan, notes: To address the challenges and stop the loss of billions of dollars to fraud each year, banks need a profoundly innovative approach that enables vast…

Read MoreBAI Banking Strategies looks forward to the new year with a podcast which includes a list of recommended strategies for bank branches. Their recommendations include: Fix your distribution strategy Become a data nerd Learn to use robotics and AI Partner with fintechs Invest in front-line tools Meanwhile, Bank News has advice for community bank branches…

Read MoreOur own Vice President of Marketing, Joe Gregory, is featured in an article in Banking CIO Outlook magazine (you can read the story here). OrboGraph is proud to be featured as one of Banking CIO Outlook’s Top 10 KYC Solution Providers for 2018. Gregory notes that OrboGraph’s embrace of AI and Deep Learning technologies provides…

Read MoreThe Wall Street Journal recently reported that Venmo sustained a transaction loss rate of 0.40% in March, up from 0.25% in January, according to internal PayPal documents they reviewed. As reported in Digital Transactions: The losses sent Venmo’s first-quarter operating loss to approximately $40 million, a 40% increase over what PayPal had expected, the documents revealed.…

Read MoreBob Legters of American Banker goes out on a limb and makes the following predictions for the new year. Visit the link for his expansion of each prediction. Legters begins with specifying things he thinks we won’t see in 2019, followed by developments he believes will come to fruition before year’s end. How many do…

Read More