Mobile Banking

Last month, FT Partners hosted a VIP Video Conference to review their new industry research report, Understanding the Impact of COVID-19 on FinTech, which is available HERE. They were joined by three leading FinTech CEOs and discussed their approaches to the COVID-19 era. Video Conference Panelists: Steve McLaughlin, Founder and CEO of FT Partners Greg…

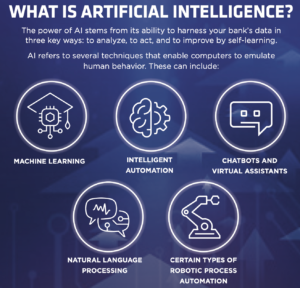

Read MoreAt our 2019 Healthcare and Check Payment Technology Conference in Charlotte this past May, we were fortunate enough to hear from Rod Springhetti, the VP Product Management at Deluxe Corporation, as he spoke about AI implementation. Mr. Springhetti is known across the industry as a leading authority on AI implementation, and his insights were of…

Read MoreWhen contemplating Gen Z — those people born between 1996-2015 — many people assume they are another iteration of Millennials (early 1980s to early 2000s). That means they are a digital-obsessed generation with no interest in, for instance, visiting a bank teller. It turns out that’s not the case. In a podcast interview with BAI…

Read MoreTechnavio, a leading global technology research and advisory company, has released a report indicating that the industry is poised to grow by USD 15.14 billion during 2019-2023, progressing at a CAGR of over 48% during the forecast period. Entitled Global Artificial Intelligence-as-a-Service (AIaaS) Market 2020-2024, a free sample of the report can be obtained via…

Read MoreThe unprecedented worldwide coronavirus pandemic has created a new set of values for people around the world. Toilet paper is a precious commodity (in spite of a robust supply chain, it should be noted); it is possible to be productive working from home (a good internet connection is a lifeline to remote meetings), and; you…

Read MoreCongress passed a $2 trillion stimulus bill — the largest in United States history — that promises to revive a coronavirus-stricken economy. These are payments that will be sent directly to Americans, with many adults getting $1,200. For every qualifying child age 16 or under, the payment adds an additional $500. The plan is for…

Read MoreOrboGraph’s dynamic webinar entitled Change is Inevitable – How Will You Respond? — co-hosted with NICE Actimize — provided fresh insight into the nature of fraud. The webinar provides information and scenarios to show how fraudsters are becoming more sophisticated in their methods of committing fraud and how incorporating new technologies like Artificial Intelligence and…

Read MoreFrom the Federal Reserve Bank of Atlanta comes an informative overview of check usage entitled U.S. Consumers’ Use of Personal Checks: Evidence from a Diary Survey. The authors look at 1,600 individual transactions to gain an understanding of what check payments are currently used for—by dollar value, and by payee—and who uses checks (in terms of demographics and income).

Read MoreUse of Personal Checks: Drilling Down to “Who and Why” A report by the Federal Bank of Atlanta reveals some useful trend information regarding check usage in the United States. The report is described as “a snapshot of U.S. consumers’ use of paper checks in 2017 and 2018, combining data from the 2017 and 2018…

Read MoreThe array of digital payment vehicles available is dizzying — Google Pay, Apple Pay, PayPal, Venmo — the list is long. Still, checks remain popular. And, it turns out, a better payment instrument when it becomes necessary to stop payment due to error or suspected fraud! MoneyWise describes easy step-by-step directions for canceling or stopping…

Read More