Modernizing Omnichannel Check Fraud Detection

A special research team has been closely studying fraud Check fraud can lead to cybercrimes such as identity theft Check fraud is growing and supported by an “underground” structure Many of us in the banking industry rely heavily on check fraud data from various industry sources such as the American Bankers Association (ABA), Association of…

Read MoreChecks can be “washed” Many businesses buy checks with anti-fraud features Deploying forensic AI technology thwarts “check washers” Since checks are most often delivered by mail — via what are generally non-secure receptacles that can be emptied by any sticky-fingered thief willing to open a public mailboxes or stolen directly from home mailboxes — they…

Read MoreThe pandemic has made digital solutions more vital than ever Credit unions faced a disadvantage in getting aboard the “digital services train” AI and ML solutions are giving CUs the leverage they need PYMNTS.com takes a look at how the pandemic has forced consumers to “rush to digital channels to tackle daily tasks including grocery shopping,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

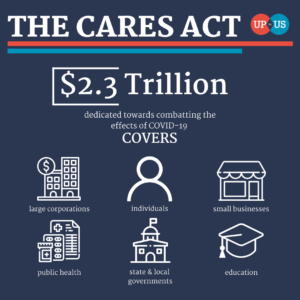

Read MoreFraudsters are being targeted by the United States Secret Service Nearly $100 billion in pandemic relief funds have been stolen Stimulus check scams are used to get personal information The National Review reports that fraudsters have stolen nearly $100 billion in pandemic relief funds. This has resulted in the arrests of more than 100 suspects, and…

Read MoreAs the final days of 2021 wind down, we’d like to thank all our partners and clients for supporting OrboGraph in a record breaking year. Also enjoy our holiday video below! Season’s Greetings! The OrboGraph Family

Read More“Scambaiters” go the extra mile to expose — and sometimes punish — scammers These “entertainment-based” scam busters are often more effective than “official” scam reporting channels The bottom line: seeing is believing There’s a somewhat well-known trope among persons who work at home or independently that, whenever an obvious scammer calls and you have time…

Read MoreDigital fraud attacks rise during the holidays Many attacks are automated “Credential stuffing” takes advantage of the growth of digital accounts While fraud is, unfortunately, a year-round activity not bound to any particular season, the holidays present fraudsters with what could be called a “rich target field.” Digital Transactions cites a report from Arkose Labs…

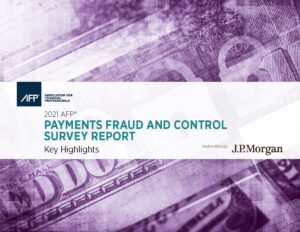

Read MoreIndustry reports confirm fraud attempts and losses are still a concern Fraudsters take advantage of the “need for speed” FI’s can adapt quickly with layers of protection As checks continue to hold their position as a viable payment channel, the past five years yielded a rise in check fraud that was difficult to foresee. Meanwhile,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read More