Modernizing Omnichannel Check Fraud Detection

Fraud attempts affected an estimated $25.1 billion held in deposit accounts, ABA’s survey found, with $22.3 billion protected per the Banking Exchange Prevention was the equivalent of $9 for every $10 in attempted fraud, per Dodd Frank Update Attempted check fraud spiked 43% in two years, per PYMNTS.com The American Bankers Association’s (ABA) 2020 Deposit…

Read MoreAccelerated funds availability allows depositors to instantly access the money they deposit via check. That way, there’s no waiting period for the check to clear and no penalty if the check writer’s account has insufficient funds. An article at BAI Banking Strategies by Victoria Dougherty, director of Payment Management Solutions, Fiserv, opens by wondering why…

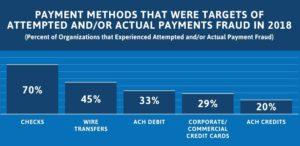

Read MoreABA reported a significant check fraud uptick in 2018 data B2B payments are still dominated by checks – leading to more opportunities for fraud – is it overrated? Assessing real-time, Positive Pay fraud systems with image can stop fraud at various stages of the workflow Corporate Payments Landscape: Checks Still Rule in B2B The Wall…

Read MoreFraud techniques are evolving and check fraud is often intertwined with other types. Anyone involved in fraud detection and prevention needs to stay up-to-date, and Fraud Magazine offers some useful information.

Read More2019 Federal Reserve Payments Study Reports 16B Checks Written It’s back! The 2019 Federal Reserve Payments Study, provides us new insights and metrics for the payment industry: Less Paper, More Fraud Attempts, More Fraud Drilling down to checks, we see that the estimated volume of 16B checks written may have declined by 7.2%. However, read…

Read MoreIn today’s world, abbreviations are utilized on a daily basis. Simple contractions such as “don’t”, “couldn’t”, and “we’ll” are all commonly used in the English language. In the banking world, abbreviations are most common in the date field, as many in society choose to abbreviate the year from 01/08/2020 to 1/8/20. Seems harmless, right? Maybe…

Read MoreAs fraudsters continue to evolve their tactics, it is important to understand what acts of fraud are being committed and what actions banks are taking in order to combat fraudsters. These real-life examples provide much needed clarity into not only the acts of frauds, but also the types of perpetrators and their situations. From the…

Read MoreCheck fraudsters are getting technologically sophisticated; Many bank fraud legacy detection systems are hopelessly out-matched; Proof of Concept is vital to the success of even the newest tech

Read More20 technical questions around fraud detection and models; complicated fraud scenarios must be well defined; AI and machine learning are effective, but multi-model approaches will outperform single models

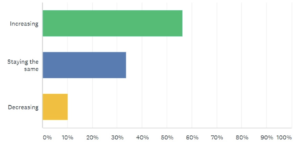

Read MoreWhile instant payment channels grow and multiply by the day, fraudsters remain interested in check fraud as a “reliable” form of illegal income.

Let’s look at the classic Fake Check fraud scheme, which has not lost popularity in spite of the growth of other payment channels.