Payments

And another year comes to a close! It’s been our pleasure to share observations, insights, and solutions from across the industry via the OrboNation Blog. As 2019 comes to end, we have much to be thankful for. Most importantly, however, we’re thankful for the clients and customers that are crucial to OrboGraph’s success. Looking back,…

Read MoreIf you’ve seen the Leonardo DiCaprio movie Catch Me If You Can, then you know who Frank Abagnale is, and why he’s a good guy to listen to when it comes to protecting yourself from fraudsters – – he is (or was) the best, after all. Abagnale is using his powers for good these days,…

Read MoreRemember “cash, check, or credit card”? Ah, the simpler days of yore. As reported in PaymentsJournal.com, we are experiencing more payments choices at the consumer level than ever before. Indeed, their article starts out with a parade of options: “Swipe, dip, tap. Credit, charge, debit, prepaid, reloadable. Apple Pay, Google Pay, Samsung Pay, Starbucks, Dunkin’.…

Read MoreThe US real-time payments network currently reaches about 50% of the population, and was on track, via private sector channels, to provide complete coverage by the end of next year, as noted in an article at Forbes.com by Ike Brannon, a senior fellow at the Jack Kemp Foundation.

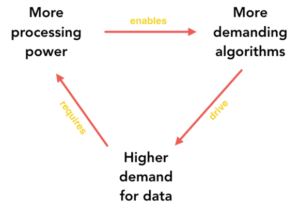

Read MoreMoore’s Law famously states that the number of transistors on a microchip doubles every two years, though the cost of computers is halved. A new essay on Medium.com explores how Moore’s Law had actually been “phasing out” for a period of time: Moore’s Law, one of the fundamental laws indicating the exponential progress in the…

Read MoreThe ability of fraudsters to create an image of a check is not necessarily a new technique. What is newsworthy is accessibility.

Read MoreWhen Facebook announced its Libra payment system, reactions were varied, to say the least. Can a gigantic company that cannot be trusted to safeguard our heretofore private information be ready to handle cryptocurrency? PYMNTS.com wonders if another giant company, Walmart, might have a better chance to succeed in the payments field, particularly in light of…

Read MoreAs reported at McKinsey.com, an analysis by the McKinsey Global Institute (covering more than 800 jobs and over 2,000 work activities) showed that: Globally, almost half the activities employees perform—which account for nearly USD 16 trillion in wages—could potentially be automated using existing proven technologies. Automation will transform far more jobs than it will eliminate.…

Read MoreThe Federal Reserve announced last week that it is working on a real-time payments system, the biggest infrastructure upgrade embraced by the government body since the ACH system went online in 1972. At a speech in Kansas City, Mo., Fed Governor Lael Brainard confirmed what the payments industry has long awaited, and she said the…

Read MorePYMNTS.COM takes a look at the implementation of Artificial Intelligence solutions in Financial Institution fraud departments — or, rather, the stunning lack thereof: AI systems are unique, can process large volumes of data in real time and can “learn” to quickly identify suspicious financial activity. Yet, few FIs leverage this technology in their anti-fraud efforts…

Read More