RDC & Mobile

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

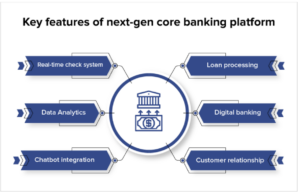

Read MoreAs reported at Mobil App Daily, competition in the banking industry is fierce and at a consistently high level — a good situation for consumers, and an ongoing challenge for the banks themselves. They want to dramatically improve the experience their consumers receive from their optimized digital banking services by utilizing the next-generation banking platform.…

Read MorePYMNTS talked to Manish Jaiswal, chief product and technology officer at Corcentric, about the ways AI technology can and will improve business payments by making them faster and — most importantly — safer. Source: PYMNTS.com “Real-time payments processing is becoming a reality in B2B,” Mr. Jaiswal noted. Still, there are challenges to address. Most companies, no matter the…

Read MoreChatGPT, the artificial-intelligence chatbot, has been making news on a regular basis for its growing list of applications in business and entertainment. We recently highlighted the possible impact ChatGPT may have on the banking industry. So, it was only a matter of time before it emerged in the payments field. Via Digital Transactions, we learn…

Read MoreIf you haven’t heard of it already, OpenAI’s ChatGPT is an artificial intelligence-powered text tool capable of providing cogent answers in seconds to just about any question you throw its way. It is viewed with a mixture of awe and apprehension. Despite the unease, ChatGPT is acquiring new users faster than any of the most popular consumer…

Read MoreSince its acquisition by Elon Musk, Twitter has certainly not lacked interesting storylines and speculation in the media. While most news up to now has dealt with employee discontent or technology issues, Twitter has made progress in deploying a payments option. As noted by Financial Times, Twitter has begun the process of applying for regulatory…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIn the digital era, we tend to think payments are all traveling via this or that payments app. However, the latest PYMNTS/Ingo Money collaboration, “Insurance Disbursements Brief 2022,” noted the surprising prevalence of paper checks used for healthcare claim payments or disbursements. As reported at PYMNTS.com: This is particularly key because healthcare disbursements represent the…

Read MoreThe growth and ubiquity of digital banking is good news for financial institutions, as digital banking availability and usage has been shown to drive customer loyalty and provide a host of other benefits. Fueled by the pandemic, digital banking is now the most popular method for users to perform their financial banking needs — from…

Read MoreBanks and credit unions recognize that they need to modernize Key to modernization is collaboration Product and data silos, outdated infrastructure, and a risk-averse culture are obstacles The Financial Brand cites a recent report from the Federal Reserve that delineates three types of digital banking experience partnerships being sought by banks and credit unions seeking to…

Read More