Technology

In a little over a month, OrboGraph will host the ORBOIMPACT Virtual Conference: AI Innovation for Check Payments, Check Fraud, and Healthcare Remittance Automation.

Read MoreIn a little over a month, OrboGraph will be hosting it’s first virtual conference since 2014: ORBOIMPACT Virtual Conference: AI Innovation for Check Payments, Check Fraud, and Healthcare Remittance Automation.

Read MoreRachel Woolley, global director of Financial Crime at Fenergo, tells FinTech Futures that penalties against financial institutions have come “fast and furious” over the past few years.

Read MoreIn a summary of Mercator Advisory Group’s new Insight Summary Report, 2020 Small Business PaymentsInsights, COVID-19 and B2B Payments & Cards – The Result of the Pandemic, PaymentsJournal.com summarizes their findings.

Read MoreBy now, many of you have heard of the arguments between utilize GPU vs CPU. towardsdatascience.com provides a simple explanation on the reasoning behind the need for GPUs for machine learning:

GPUs are optimized for training artificial intelligence and deep learning models as they can process multiple computations simultaneously.

They have a large number of cores, which allows for better computation of multiple parallel processes. Additionally, computations in deep learning need to handle huge amounts of data — this makes a GPU’s memory bandwidth most suitable.

Read MoreCheck writers and depositors have become accustomed to a next day or two day check clearing process for the majority of items. But when an extended clearing process does happen, i.e. 2-3 days, it becomes a real inconvenience, especially for millennials accustomed to instant digital payments, or for those folks who still get payroll checks. There are many other examples.

Read MorePymnts.com explores the various hurdles banks face when taking that big — and increasingly necessary — step. They note that migrating to the cloud is a vital tool traditional financial institutions (FIs’) will need in order to compete with digital-native FinTechs.

Read MoreTo the layman, much of the language in the AI space can be mystifying, particularly in deep learning. Take for example one of the core elements; the node. A deep learning node is “a computational unit that has one or more weighted input connections, a transfer function that combines the inputs in some way, and an output connection. Nodes are then organized into layers to comprise a network.”

Read MoreEnsenta/EPS has put together an excellent report exploring NINE DRIVERS OF MOBILE DEPOSIT GROWTH (You can download a copy HERE). They come out of the gate by noting that large financial institutions continue to invest in increasingly better mobile deposit user experiences for two reasons: Improving return on investment (ROI) Growing their deposit base Given…

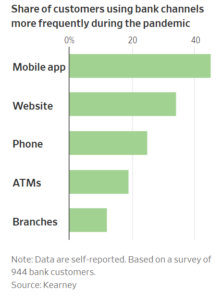

Read MoreModern bank consumers are more and more comfortable interacting with their accounts online, often from a portable device. It’s never been easier to make deposits — using an app on an always-handy phone — and see the “funds available” right in an account, reassuring the user that the money is indeed deposited and… available. MyBankTracker…

Read More