Teller Image Capture

Remember “cash, check, or credit card”? Ah, the simpler days of yore. As reported in PaymentsJournal.com, we are experiencing more payments choices at the consumer level than ever before. Indeed, their article starts out with a parade of options: “Swipe, dip, tap. Credit, charge, debit, prepaid, reloadable. Apple Pay, Google Pay, Samsung Pay, Starbucks, Dunkin’.…

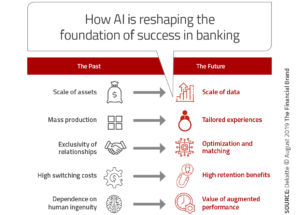

Read MoreAs technological innovation continues to evolve society, so does the way it affects society’s interaction with businesses, including their banks!

Read MoreThe US real-time payments network currently reaches about 50% of the population, and was on track, via private sector channels, to provide complete coverage by the end of next year, as noted in an article at Forbes.com by Ike Brannon, a senior fellow at the Jack Kemp Foundation.

Read MorePaymnts.com reported recent data (from West Monroe Partners) that found 77 percent of banks are already putting AI solutions to use in some way. Count Chase as one of the forefront adopters of Artificial Intelligence solutions and technology. Chase is embracing AI and ML to help customers conduct business while preventing fraudsters from making off with data or financial…

Read MoreA new report by FIS finds that business satisfaction has dipped slightly, but remains high. The FIS research found that 78% of U.S. SMBs report being extremely or very satisfied with their PFIs, down slightly from 81% in the 2018 study. SMBs with $25M-$75M in revenue reported the highest satisfaction in their banking providers (85%).…

Read MoreLet’s face it: Human beings are indispensable, but we are learning that in order to bring the level of service that is expected in today’s marketplace, machines and analytics have to work together and deliver quicker, more intelligent solutions than we’ve previously seen or experienced. This is the root of Artificial Intelligence and its value…

Read MoreChecks are still ubiquitous across generations. They remain popular, and they are — in spite of repeated premature eulogies — still alive and well in the world of treasury and B2B. Let’s say you have a check payment from a friend, or you’re running a small business on check payments, or you’re still getting a…

Read MoreThe ability of fraudsters to create an image of a check is not necessarily a new technique. What is newsworthy is accessibility.

Read MoreThe Federal Reserve announced last week that it is working on a real-time payments system, the biggest infrastructure upgrade embraced by the government body since the ACH system went online in 1972. At a speech in Kansas City, Mo., Fed Governor Lael Brainard confirmed what the payments industry has long awaited, and she said the…

Read MoreMicrosoft Corp. will stop supporting its Windows 7 operating system next January, which is a bellwether to both independent operators of ATM machines and large financial institutions — time to update! Digital Transactions reports that independent ATM operators seem to have the upper hand in the conversion race: Independent ATM owners’ decision to eschew Windows…

Read More