Uncategorized

AFP 2021 is coming November 7-11 both virtually and in-person Frank D’Amadeo, director of treasury at Con Edison, sees new sophistication in fraudsters “We’re no longer fighting the so-called ‘amateur fraudsters’” The Association for Financial Professionals — known by industry professionals by its acronym AFP — will be hosting its AFP 2021 Annual Conference both…

Read MoreWith “never go to a bank” Millennials becoming a bigger and bigger market force, compounded by the fact that pandemic lock-downs have encouraged even formerly tech-averse people to use online banking tools, one might think the reign of the bank and credit union physical, walk-in branch system is coming to a close.

Read MoreThe next weapon against check fraud has arrived Huge potential increase in fraud-loss savings to FI’s Performance Validation Analysis (PVA) to the rescue! Financial institutions have it down when it comes to check processing, posting, automation, and IT. However, when it comes to check fraud prevention, many live in fear. Why? Because they either have…

Read MoreBillerica, MA, June 7, 2021 – OrboGraph, a premier developer and supplier of intelligent electronic and paper automation for check fraud detection, recognition solutions as well as healthcare payment electronification, announced the market launch of OrbNet Forensic AI as the core image analysis technology to the Anywhere Fraud software application version 4.1. Details are now available on recently modernized company’s website, www.orbograph.com.

Read MoreCredit Unions and their members tend to pride themselves — rightfully so — on being much more “customer-centric” than the average financial institution. They are, after all, serving “members,” and that spirit permeates their approach in all aspects of their business. The relationship has become, in fact, a differentiator that draws (and keeps) loyal members on a long-term basis.

Read MoreForensic document examination is foundational to OrboGraph’s OrbNet Forensic AI technology. To assist in describing the applicability of forensics in banking, fraud detection, and payments, we talked to forensic expert and author, Khody Detwiler, for this week’s Modernizing Omnichannel Check Fraud Detection post.

Read MoreThe Federal Reserve is actively exploring ways to streamline FinTechs’ access to the payment system, and pymnts.com reports that financial institutions will need sharpen their systems to retain a competitive edge.

The Federal Reserve could be taking steps toward a much more open and competitive financial services landscape as it considers allowing FinTechs to gain access to the payment system directly. The Fed announced last week that it is inviting comment on the proposal to develop guidelines for allowing non-banks to access accounts and payment services, rather than relying on bank partnerships to facilitate that connectivity.

Read MoreStanford University’s 2021 AI Index Report is now available, and it goes into significant detail regarding Computer Vision, which is integral to the sorts of recognition tasks important in fraud detection and EOB processing.

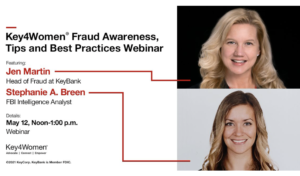

Read MoreKey4Women, an organization dedicated to supporting the financial progress and empowerment of business women, presented a terrific, highly useful discussion of the latest in fraud threats and how to protect yourself at home and in the office with best practices shared from industry experts.

Read MoreTrade Finance is recognized as a vital tool to fuel global growth and support the world economy, but, as pymnts.com notes, it is far from a perfect instrument. For decades, trade finance has been caught in a web of paper-based documents, creating bottlenecks and friction at nearly every point of the process, from onboarding to financing payouts. As the industry pushes to modernize, it’s also facing scrutiny over its relationship with credit risk. Critics argue that some trade financing products have actually encouraged large corporates to pay their vendors late or force those suppliers into expensive financing arrangements. At the same time, as witnessed in the ongoing Greensill Capital saga, the success of trade finance largely relies upon insurers’ ability to cover for losses in the case of non-payment.

Read More