OrboNation Newsletter: Check Processing and Fraud – The Best Articles from 2023

Washington Post: “Checks Are Dead”…Not So Fast!

This proclamation comes from reporter Andrew Van Dam in a recent article from the Washington Post.

In a few years, comically oversized foam-board novelty checks will be the last remaining evidence of a 20th-century icon, as the paper check goes the way of the landline phone and the floppy disk. Even the most dubious cliché of the past century — the promise that the check’s in the mail — has fallen from common usage.

Van Dam points to a few data points to prove his point:

- In the early 2000's, 6 out of every 10 noncash purchases, gifts and paid bills were handled with checks. Now, just 1 in 20 are paid with paper checks.

- In 2003, the FED ran 45 check-processing centers. In 2023, the FED only runs one (Atlanta).

- In the Survey and Diary of Consumer Payment Choice, only 4% of transactions were made with paper checks

So, it's safe to assume that paper checks are dead, right? Not so fast!

OrboGraph News and Updates from 2023

- 11/13/2023: OrboGraph Partners with Dr. David Maimon, Expert in Proactive Fraud Intelligence... Read the full press release →

- 9/20/2023: Bit Builders, Inc. Delivers Turnkey Image Fraud Detection with OrboGraph... Read the full press release →

- 8/10/2023: OrboGraph Leads the Industry in Check Fraud Detection, Welcomes 8 New Partner/Clients... Read the full press release →

- 4/4/2023: OrboGraph Writer Verification Technology Wins Business Intelligence Group’s 2023 AI Excellence Award for Detecting Altered and Fictitious Checks... Read the full press release →

- 1/26/2023: OrboAnywhere Version 5.0 Released with OrbNet AI Free Read... Read the full press release →

NY Times Highlights the Check Fraud Epidemic

As has been made abundantly clear via this blog, check fraud is on the rise and merits serious attention by financial institutions. The New York Times recently reported on the enduring popularity of checks and the resultant "scam economy" being created and nurtured:

What was once a routine way to pay your bills — handwriting paper checks at the kitchen table, dropping envelopes into a blue metal box on the street — has become a high-risk endeavor: It provides the raw materials for low-level fraud artists and sophisticated crime rings, costing financial institutions billions...

GPU Cost vs. Performance: Assessing Financial Institutions’ Artificial Intelligence Needs

In the ever-evolving landscape of technology, demand for processing power has grown exponentially -- particularly in the realms of artificial intelligence (AI) and data analysis.

Central Processing Units (CPUs) have long been the backbone of computing -- particularly in banking. However, Graphics Processing Units (GPUs) have emerged as a game-changer, outshining CPUs in processing capabilities, especially for data-intensive tasks like AI.

Let's take a deeper dive into the superiority of GPUs over CPUs and explore how banks can affordably leverage GPUs for AI technology adoption.

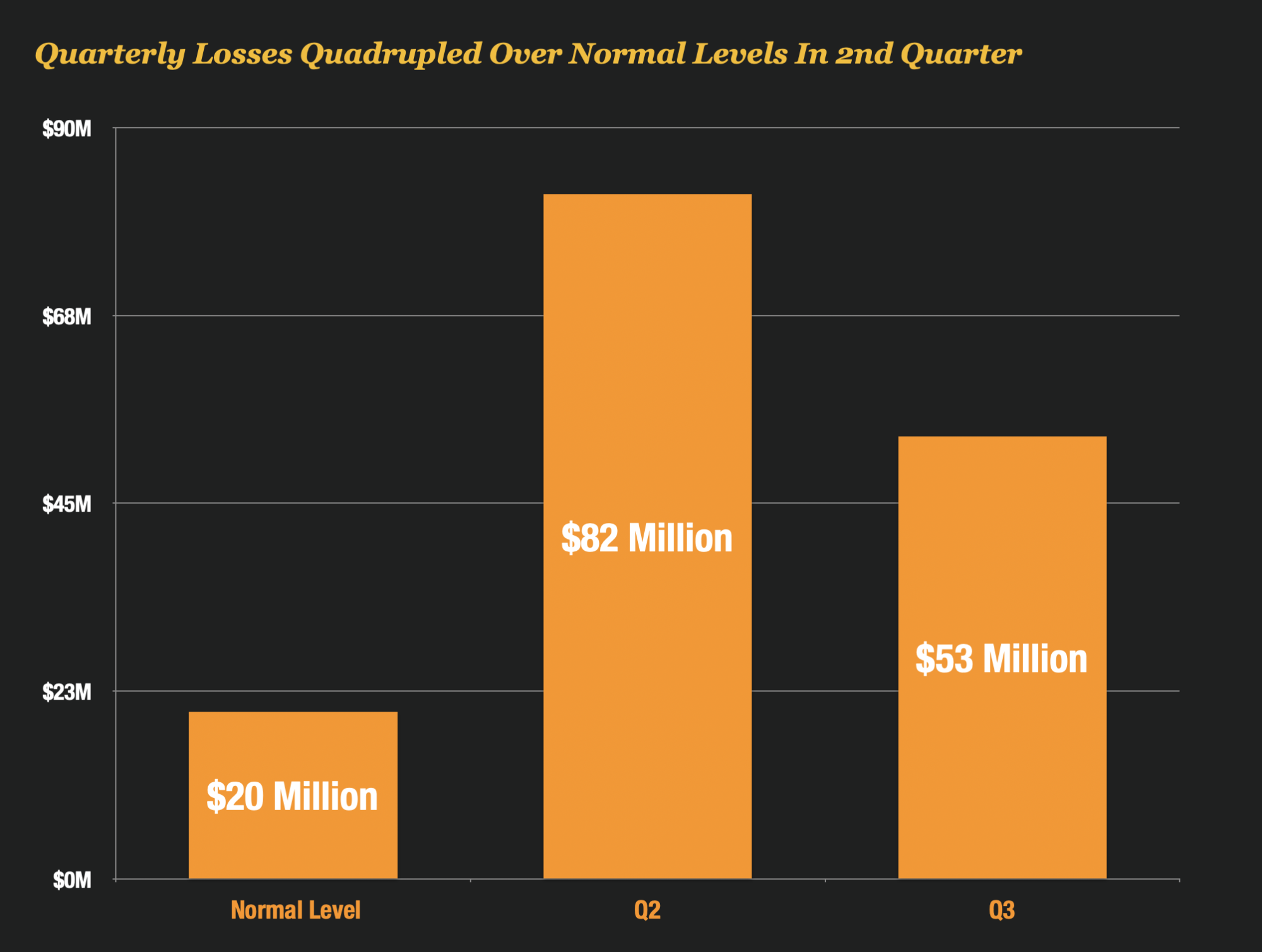

A Deeper Dive into the Reported $155M in Check Fraud Losses

It's widely accepted that industry check fraud attempts and losses have grown 200% to as high as 400% since pre-pandemic levels. However, as all are well aware, each bank is different; attempts and losses can be mitigated by improving processes and selecting the right tools, technologies, and vendors to combat check fraud.

Such is the case for one large financial institution: Regions Bank. In its third quarter earnings call held on October 20, 2023, executives from Regions Bank reported some shocking numbers on check fraud losses:

- Q1 2023: $20M in check fraud losses (“Normal level”)

- Q2 2023: $82M in check fraud losses

- Q3 2023: $53M in check fraud losses

- Q4 2023: Estimated $25M in check fraud losses

In this case, these check fraud losses at their peak amounted to as much as 10% of pretax income, ultimately affecting eps and other metrics downstream.

Jack Henry & Associates Interview: Check Fraud Increased 180% Over 2022

At BankInfo Security, Suparna Goswami spent some time talking to Rene Perez, director of financial crimes sales and financial crimes consultant for Jack Henry & Associates, to review the major fraud scams we saw in 2023.

During the interview, Mr. Perez highlights three major fraud categories that "dominated" 2023:

- Check Fraud

- Scams directly targeting consumer for send funds to them

- Account Takeovers

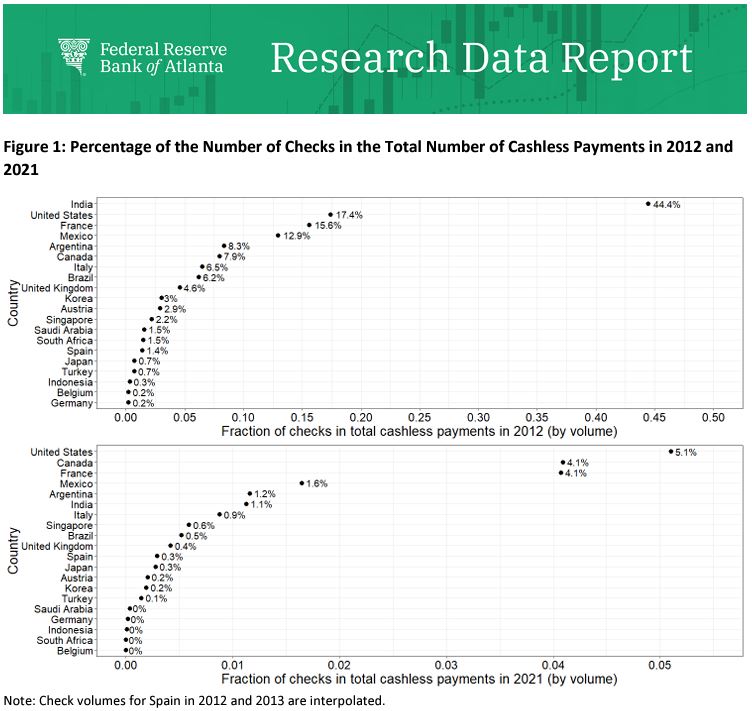

Federal Reserve Report: US Check Usage Exceeds Other Countries

Over the past decade, the payments landscape has evolved rapidly. While there have been a variety of new payments introduced, checks still remain a major player for a variety of reasons, particularly in the USA.

Payments Dive points out that, according to a recent report from the Federal Reserve Bank of Atlanta, the United States outranks 19 other countries in the percentage of checks used in relation to all cashless payments in 2021.

The U.S. held the top position In 2021 for number of checks used for cashless payments at 5.1%, followed by Canada (4.1%), France (4.1%) and Mexico (1.6%). And, while we have seen a decline in check usage, 5.1% of cashless payments (slightly more than 1 in 20 payments) represents a significant segment. A major reason is that, despite a variety of digital payment channels available, PYMNTS.com reports that 81% of businesses still pay other firms via paper checks, making it the most common B2B payment method, even amid companies’ digitization efforts.

UK Finance Reports Cases of Check Fraud Increased +35% in H1 2023

While we typically focus on fraud as it occurs here in the USA, many financial institutions operate in multiple countries. This includes our friends "from across the pond": the United Kingdom.

Recently, UK Finance released their 2023 Half Year Fraud Update, a report on fraud statistics for the first half of this year.

As noted in the foreword of the report:

The latest UK Finance figures show that fraud continues to be one of the most prevalent crimes in the UK. From impersonating companies and creating fake investment adverts, to stealing card details and taking over personal accounts, criminals are using social engineering to ruthlessly target their victims. In the first six months of this year alone, criminals stole over half a billion pounds.

63% of Businesses Report Experiencing Check Fraud Activity

One would think that, with digital payments becoming more and more pervasive, we should expect the check fraud threat to begin shrinking.

Unfortunately, that is not the case.

As reported on the Minnwest Bank website, a 2022 survey of businesses revealed the following:

- 63% of businesses have reported check fraud activity, topping the list of payment fraud types. (Corporate card payment fraud came in a distant second at 36%)

- 75% of businesses plan to continue using paper checks to some extent.

Legacy Thinking: How Banks Can Learn From Major League Baseball

You may be asking yourself, "What do sports have to do with banking?" Well, it turns out there's a lesson that banking can take from the major sports leagues.

Let us explain.

Up until the 2000's, baseball was known as "America's Game" and was undoubtedly the most popular in sport in the USA. However, according to a 2021 Washington Post Poll, just 11% of adults listed baseball as their favorite sport to watch -- behind football (34%) and tied with basketball (11%).

Many people point to the fact that baseball had not evolved, relying on "what got us here" instead of forward thinking to change the game to appeal more to the new generation. Only recently they have taken steps to evolve the game, integrating a pitching clock, new extra inning rules, and other directives to speed up the game.

It remains to be seen whether baseball and the MLB waited too long to institute progressive changes... Could banks be making the same mistake?

ACAMS: FIs Pivoting to New Tech as Fraudsters Overcome Traditional Check Fraud Detection Strategies

Recently, Fred Williams -- reporter and journalist for the Association of Certified Anti-Money Laundering Specialists (ACAMS) -- reached out to several check fraud experts, including OrboGraph's own Chief Strategy Officer, Joe Gregory.

For those not familiar with the association, ACAMS is a leading international membership organization dedicated to providing opportunities for anti-financial crime (AFC) education, best practices, and peer-to-peer networking to AFC professionals globally.

The article at moneylaundering.com examines the check fraud challenges financial institutions face and the technologies that they are now utilizing to fight back against the fraudsters.

Why A Multi-Layered Technology Approach Is Needed For Check Fraud Detection

Financial institutions are in the unenviable position of taking on the brunt of check fraud. While, in an ideal world, banks could partner with a single vendor and utilize their solution to detect all check fraud attempts before any funds are lost, this is simply not the case. And, while there are vendors who will claim that their solution can work alone, this is demonstrably NOT the case.

What is true is that artificial intelligence and deep learning technologies are powerful tools for check fraud detection. However, AI and DL are trained for specific purposes and tasks. This means that for check fraud detection, different AI and DL technologies need to be trained to work harmoniously amongst one another -- AKA a multi-layered approach to check fraud detection. Each technology plays a key role, and not utilizing one leaves a gap in a financial institution's capability to detect fraudulent checks.

Paper Checks: Why Individuals Still Use Them

Digital payments are all the rage -- convenient, quick, and accepted almost everywhere.

However, Yahoo!Life reports that in GOBankingRates’ Best Banks 2023 survey of 1,000 Americans, they uncovered some counterintuitive results:

22% of respondents said they still write checks at least once a month. And surprisingly, of these respondents, the largest percentage belonged to those between the ages of 18 to 24 (28%). Paper checks might sound like a mildly antiquated concept, but they can still be used to fulfill specific needs now and into the near future.

Reuters: Over 185K Check Fraud Related SARs Reported in Q1 2023

According to the Thomson Reuters Regulatory Intelligence special report based on analysis of public data released by the U.S. Treasury Department’s anti-money laundering (AML) unit, FinCEN, there has been a significant increase in SARs (Suspicious Activity Reports) recorded in 2022.

The report shows that SARs filings soared in virtually all categories -- with particularly massive spikes in human exploitation, elder fraud, and government-related benefit scams are noteworthy. Such vulnerable populations have grown in both size and susceptibility, especially among migrants and the elderly.

As noted on page 23 of the report:

"Check fraud, was by far the most prevalent fraud type reported in 2022, with over 680,000 SAR filings. It was the second largest of all SAR categories that year. While firms have responded by reinforcing their anti-fraud organizations overall, they have focused particular attention on check fraud. While firms have responded by reinforcing their anti-fraud organizations overall, they have focused particular attention on check fraud."