Deep Dive: Why Paper Checks Still Factor Into B2B Firms’ Payment Optimization Plans

In an era of digital payment avenues that seem to double in number every month, checks may seem old fashioned and ready to be left behind, However, as we've illustrated here previously, checks remain key tools for many individuals and businesses.

Eighty-one percent of business professionals expect the growing availability of real-time or 24/7 payments — electronic transactions that can be made or received at any time of day — to “dramatically transform” how business is conducted. Other studies point to the increasing prevalence of digital payment methods like ACH, which is quickly becoming the payment method of choice for some companies.

However, the same article goes on to point out a seeming paradox:

Paper check use accounted for 81 percent of U.S. B2B payments in 2004, for example, but they represented just 42 percent of such payments by the end of 2019. Data from a March 2020 PYMNTS playbook found that 81 percent of businesses still pay other firms via paper checks, however, making it the most common B2B payment method, even amid companies’ pandemic-driven digitization efforts. Another study found that, while check payments’ overall volume is declining, the average value of typical paper check payments is increasing, rising from $526 in 1998 to $2,600 by the end of 2020.

Checks Still Maintain High Status

The article goes on to say that transitioning away from paper checks can be a challenging and gradual process for companies, especially small to medium-sized businesses (SMBs). This, PYMNTS says, is leading some firms to examine how they can move toward B2B payments digitization while accommodating the manual payment process they are used to.

Numerous business professionals have foretold the death of the check for decades, but the payment method remains an essential part of the B2B payments process for many companies. Firms today rely on paper checks for several reasons, including the simple fact that many firms are more familiar with the payment method and likely to utilize it despite its friction points. Many companies’ traditional accounts receivable (AR) and accounts payable (AP) processes are designed to accommodate all aspects of paper check payments, making it difficult for some to shift to entirely digital B2B payments.

At the same time, processing traditional paper checks in the traditional, manual manner becomes more and more expensive.

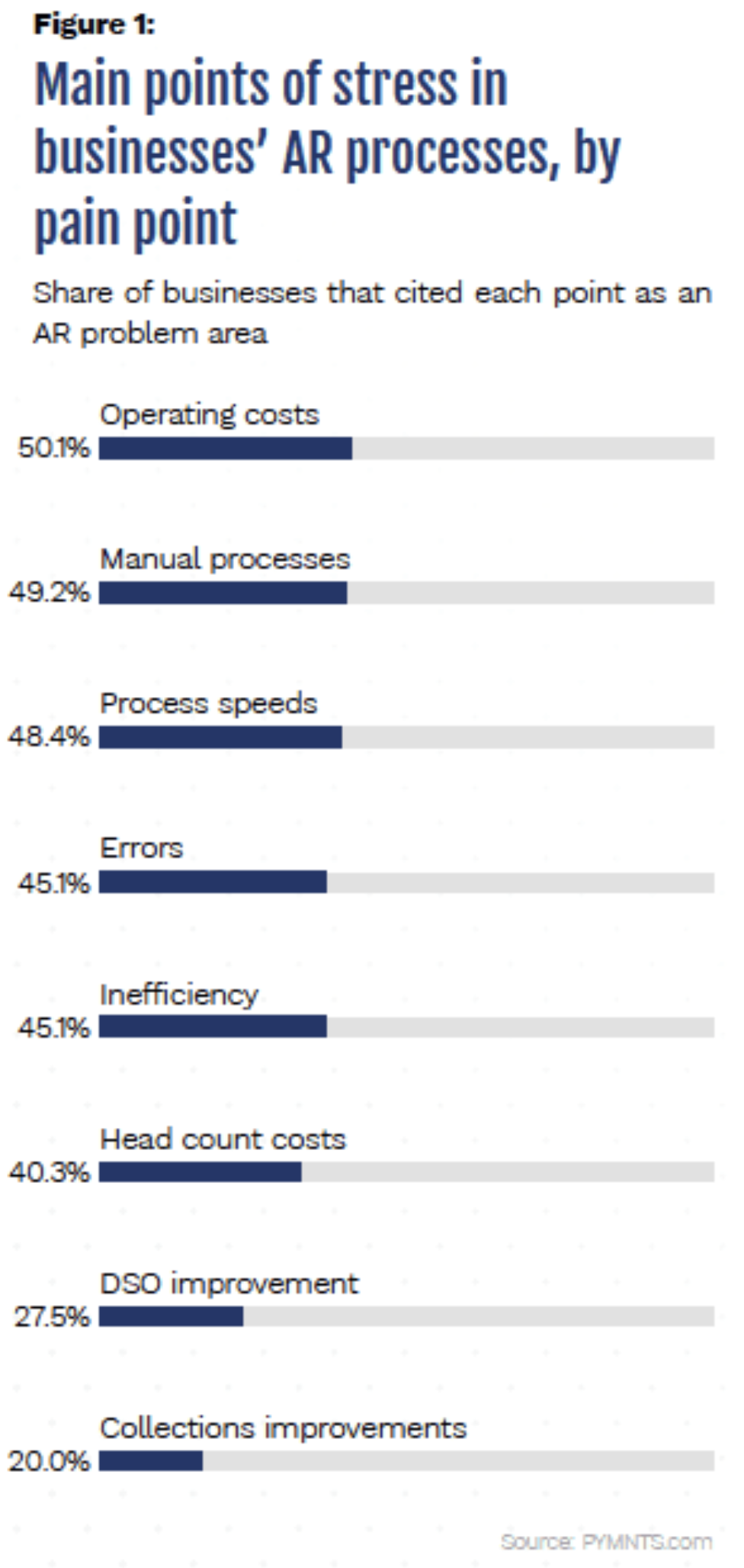

Despite paper checks’ foothold in the B2B payments space, many companies — specifically SMBs — are beginning to struggle as the payment method grows more costly and complicated to maintain. One report found that it can cost SMBs $22 on average to process a single paper invoice, for example. The costs and other pain points related to checks and paper invoices have only increased since the pandemic began, with a September 2020 PYMNTS study revealing that more than 49 percent of businesses cited manual processes as one of their most critical friction points within their AR processes.

Digital Solutions Must Coexist with Check Payments

Companies are, therefore, examining how to integrate automation technologies and other tools into their B2B payment processes to remove key friction points and reduce costs.

- Eighty-three percent of businesses have made their AR processes digital in some capacity over the last year

- 70 percent plan to implement technology to optimize their AR processes within the next few years.

However, PYMNTS points out that, while businesses are undoubtedly beginning to reexamine their B2B payment strategies as their needs shift, it is important to acknowledge that not all of these companies wish to ditch paper checks entirely and they must "rethink their approaches to payments optimization to ensure that their newer digital solutions can coexist with long-established methods like paper checks."

PYMNTS offers The Treasurer's Guide To AR Payment Optimization for a deep dive into the subject.

This situation is similar to how banks are approaching checks, as many are adopting AI and machine learning technologies to optimize check processing and fraud detection. These technologies are enabling banks to achieve straight-through processing of checks to create new efficiencies, while also increasing fraud detection capabilities to mitigate risks and decrease losses to the bank and their customers.