Blog Post

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreAFP 2021 is coming November 7-11 both virtually and in-person Frank D’Amadeo, director of treasury at Con Edison, sees new sophistication in fraudsters “We’re no longer fighting the so-called ‘amateur fraudsters’” The Association for Financial Professionals — known by industry professionals by its acronym AFP — will be hosting its AFP 2021 Annual Conference both…

Read MoreThe next weapon against check fraud has arrived Huge potential increase in fraud-loss savings to FI’s Performance Validation Analysis (PVA) to the rescue! Financial institutions have it down when it comes to check processing, posting, automation, and IT. However, when it comes to check fraud prevention, many live in fear. Why? Because they either have…

Read MoreThe United States Secret Service does more than protect elected officials. They also protect the American public in many ways from fraud — one look at their press release page gives you an indication of their ongoing work. The page also presents an interesting cross-section of fraud varieties that are popular now.

Read MoreBillerica, MA, June 7, 2021 – OrboGraph, a premier developer and supplier of intelligent electronic and paper automation for check fraud detection, recognition solutions as well as healthcare payment electronification, announced the market launch of OrbNet Forensic AI as the core image analysis technology to the Anywhere Fraud software application version 4.1. Details are now available on recently modernized company’s website, www.orbograph.com.

Read MoreForensic document examination is foundational to OrboGraph’s OrbNet Forensic AI technology. To assist in describing the applicability of forensics in banking, fraud detection, and payments, we talked to forensic expert and author, Khody Detwiler, for this week’s Modernizing Omnichannel Check Fraud Detection post.

Read MoreKey4Women, an organization dedicated to supporting the financial progress and empowerment of business women, presented a terrific, highly useful discussion of the latest in fraud threats and how to protect yourself at home and in the office with best practices shared from industry experts.

Read MoreIn a story from The Boston Globe, we learn about a counterfeit check scheme involving recruitment (and intimidation) of homeless and transient people from Providence to commit fraud in Maine, Massachusetts, Rhode Island, and Connecticut. This was not a pandemic-related scheme; the four suspects began their scam in the fall of 2018, cashing or attempting to cash 450 counterfeit checks amounting to an estimated $450,000, according to an affidavit filed in U.S. District Court in Providence.

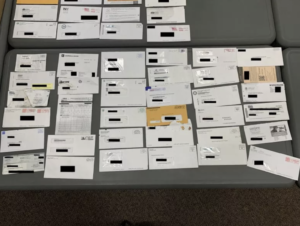

Read More“Wonder when I’ll get my stimulus check? Unfortunately, some Washington state residents are out of luck for a while. They are being warned to be diligent about monitoring mailboxes after police found more than 100 pieces of stolen mail — including some stimulus checks — in a vehicle in Olympic National Park.

Read MoreScammers often flatter targets into submission Social media offers a buffet of possible targets In this case – a happy ending! One thing that can be said for fraudsters is that they know how to take advantage of human nature. The Los Alamitos-Seal Beach Patch reported recently on an enterprising “photographer” who used Instagram to…

Read More