Blog Post

Recently, Royal Bank of Canada (RBC) has taken an approach similar to that of OrboGraph’s OrbNet AI Innovation Lab to bring AI technology to the financial industry; partnering with NVIDIA and Red Hat to create Borealis AI. But what is Borealis AI? And what do they do? Well, Borealis AI describes themselves as: A world-class AI research…

Read MoreStimulus and unemployment check proliferation requires higher-than-ever vigilance Scammers are using the phone to go after checks Which states are the biggest targets? As noted in this space previously, an unfortunate side-effect of the distribution of stimulus checks has been heightened activity by scammers attempting to take advantage of the situation via various fraud tactics.…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreAFP 2021 is coming November 7-11 both virtually and in-person Frank D’Amadeo, director of treasury at Con Edison, sees new sophistication in fraudsters “We’re no longer fighting the so-called ‘amateur fraudsters’” The Association for Financial Professionals — known by industry professionals by its acronym AFP — will be hosting its AFP 2021 Annual Conference both…

Read MoreThe next weapon against check fraud has arrived Huge potential increase in fraud-loss savings to FI’s Performance Validation Analysis (PVA) to the rescue! Financial institutions have it down when it comes to check processing, posting, automation, and IT. However, when it comes to check fraud prevention, many live in fear. Why? Because they either have…

Read MoreThe United States Secret Service does more than protect elected officials. They also protect the American public in many ways from fraud — one look at their press release page gives you an indication of their ongoing work. The page also presents an interesting cross-section of fraud varieties that are popular now.

Read MoreBillerica, MA, June 7, 2021 – OrboGraph, a premier developer and supplier of intelligent electronic and paper automation for check fraud detection, recognition solutions as well as healthcare payment electronification, announced the market launch of OrbNet Forensic AI as the core image analysis technology to the Anywhere Fraud software application version 4.1. Details are now available on recently modernized company’s website, www.orbograph.com.

Read MoreForensic document examination is foundational to OrboGraph’s OrbNet Forensic AI technology. To assist in describing the applicability of forensics in banking, fraud detection, and payments, we talked to forensic expert and author, Khody Detwiler, for this week’s Modernizing Omnichannel Check Fraud Detection post.

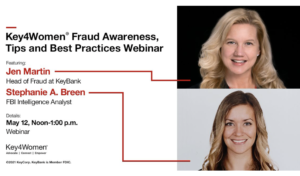

Read MoreKey4Women, an organization dedicated to supporting the financial progress and empowerment of business women, presented a terrific, highly useful discussion of the latest in fraud threats and how to protect yourself at home and in the office with best practices shared from industry experts.

Read MoreIn a story from The Boston Globe, we learn about a counterfeit check scheme involving recruitment (and intimidation) of homeless and transient people from Providence to commit fraud in Maine, Massachusetts, Rhode Island, and Connecticut. This was not a pandemic-related scheme; the four suspects began their scam in the fall of 2018, cashing or attempting to cash 450 counterfeit checks amounting to an estimated $450,000, according to an affidavit filed in U.S. District Court in Providence.

Read More