Artificial Intelligence and Deep Learning

We love this time of year! It’s a week when everyone the payments industry can take a deep breath, celebrate successes, reflect, and then blog about the future. And now that 2020 is upon us, what better time to “look ahead” toward 2030! PYMNTS.com is one of the first publications to make a prediction related…

Read MoreAnd another year comes to a close! It’s been our pleasure to share observations, insights, and solutions from across the industry via the OrboNation Blog. As 2019 comes to end, we have much to be thankful for. Most importantly, however, we’re thankful for the clients and customers that are crucial to OrboGraph’s success. Looking back,…

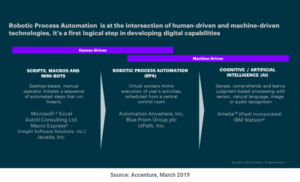

Read MoreAs part of a recent series of blog posts about Intelligent Automation, Adam Swinglehurst of Accenture offered the chart below to illustrate the necessary “overlap” as AI solutions develop and improve. The role of intelligent automation is important to Chief Financial Officers (CFOs) across the globe. CFOs seek to drive efficiencies, create team capacity, meet…

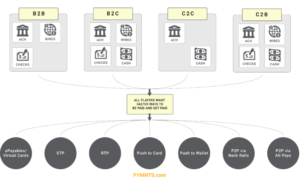

Read MoreRemember “cash, check, or credit card”? Ah, the simpler days of yore. As reported in PaymentsJournal.com, we are experiencing more payments choices at the consumer level than ever before. Indeed, their article starts out with a parade of options: “Swipe, dip, tap. Credit, charge, debit, prepaid, reloadable. Apple Pay, Google Pay, Samsung Pay, Starbucks, Dunkin’.…

Read MoreThe Medical Lockbox is an essential part of the AR process as it is the first touchpoint where paper-originated insurance remittances, payments, and patient payments are received. However, recent new technologies like AI and Deep Learning are evolving the once legacy system into a high-valued, innovative platform that provides healthcare payments professionals with the ability…

Read MoreJust when you thought you heard it all when it comes to financial crimes, here comes … accidental? A Pennsylvania couple thought they were tokens on a Monopoly board when they had $120,000 mistakenly deposited into their bank account. As far as they were concerned, they’d passed “GO” and picked a pretty good Community Chest…

Read MoreAs technological innovation continues to evolve society, so does the way it affects society’s interaction with businesses, including their banks!

Read MoreThe US real-time payments network currently reaches about 50% of the population, and was on track, via private sector channels, to provide complete coverage by the end of next year, as noted in an article at Forbes.com by Ike Brannon, a senior fellow at the Jack Kemp Foundation.

Read MoreWant to go deep on financial fraud and crime, and learn the difference between the two while also learning about the role of modern cybersecurity tools in curtailing both? Get comfortable and spend some time with this comprehensive article from McKinsey & Company covering Financial crime and fraud in the age of cybersecurity. Their analysis…

Read MorePaymnts.com reported recent data (from West Monroe Partners) that found 77 percent of banks are already putting AI solutions to use in some way. Count Chase as one of the forefront adopters of Artificial Intelligence solutions and technology. Chase is embracing AI and ML to help customers conduct business while preventing fraudsters from making off with data or financial…

Read More