Artificial Intelligence and Deep Learning

For all the upbeat and optimistic talk about Artificial Intelligence and its emerging role in the banking industry (not to mention healthcare), it’s certainly well worth taking the time to examine the issues of ethics and privacy as they relate to deployment of these new tools. David Lott, a payments risk expert in the Retail…

Read MorePYMNTS.COM takes a look at the implementation of Artificial Intelligence solutions in Financial Institution fraud departments — or, rather, the stunning lack thereof: AI systems are unique, can process large volumes of data in real time and can “learn” to quickly identify suspicious financial activity. Yet, few FIs leverage this technology in their anti-fraud efforts…

Read MoreLast week’s OrboGraph Conference theme in Charlotte, NC was 2019: The Year of AI and Modernization, and the attendees were treated to a variety of presentations by and interactions with experts on various aspects of Artificial Intelligence (AI) and Machine Learning (ML) – – the Deep Learning topics that are of vital importance to any…

Read MoreHealthcareDive takes a look at changes and trends it anticipates in the coming year, mainly due to political ripples from Washington (for instance, a judge’s declaration that the Affordable Care Act is no longer constitutional) and emerging consumer preferences. Their snapshot of a few big trends for the payer and provider crowds to watch for…

Read MoreThe 2019 Healthcare and Check Payment Technology Conference is nearly upon us. Hot off the presses, we’ve added new stars to the speaker line-up and have a Top 10 List of highlights. Check them out! Jason Schwabline, Alogent, Chief Strategy Officer – check capture innovations Robert “Bob” Frimet, RMF Consulting Group, Chief Rain Maker –…

Read MoreA Special Guest Host Blog Post by Bob Frimet, CAMS Millions of Americans depend on banking services each and every day, for everything from writing checks and paying bills to wiring money. But when was the last time you thought about the millions of “under-banked”? Where does that customer go? There are many reasons why…

Read MoreBank fees have been in the news lately, particularly with the ramp up of 2020 presidential candidates. Not only is the aggregate number, $15B, in question, but so also is the issue of whether or not fees are unfairly targeting persons with lower incomes. From WashingtonExaminer.com: One of the Democrats vying to run against President…

Read MorePymnts.com reports on JP Morgan Jamie Dimon’s latest shareholder letter (which appeared on April 4) noting that AI and Machine Learning are mentioned prominently. Why is this important? Dimon’s shareholder letters are closely read and parsed for nuggets of insight regarding the economy, the investment climate, and even revelations about America’s standing in the world.…

Read MoreFIS was recently recognized by leading industry research and advisory firm Aite Group for its Code Connect application programming interface (API) gateway, naming it “Most Advanced API Strategy” in a newly released report. FisGlobal.com noted in an article: Code Connect provides a growing, constantly updated hub of APIs from both FIS and third-party developers for…

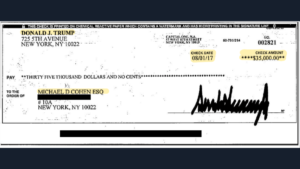

Read MoreBy now, images of the checks submitted into evidence by Michael Cohen as he testified before Congress have become ubiquitous. One of the checks, shown below, illustrates the power of data that is generated on a check. You see the courtesy and legal amounts, the date issued, maker/payer, payee and payee address, check number, and,…

Read More