Check Processing

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreCharlie Peterson, SVP for Allied Solutions, a Carmel, Ind.-based provider of insurance, lending and marketing products for financial institutions, addressed the importance of Artificial Intelligence to financial institutions — specifically credit unions — in an article for Credit Union Times. Artificial intelligence (AI) is becoming the norm in both business infrastructure and consumers’ daily lives.…

Read MoreThere are so many intriguing digital payment platforms emerging every week, surely the “antique” check must be fading fast, right? Wrong. On the occasion of its full-year earnings call on Feb. 3rd, Deluxe Corp. reported that their checks segment’s revenue increased just over 6% year over year. Pymnts.com reports that this is due in part to robust…

Read MoreIn a digital society where the younger generation has created new nomenclature such as “I’ll Venmo you” to send person-to-person payments or asking if a vendor accepts PayPal (and perhaps soon, “Do you accept Bitcoin?”) The Financial Brand took a look at the future of checking accounts. The article provides an interesting perspective, starting off with…

Read MoreEven though we’ve just met, no one is standing on ceremony with “Charles,” or even “Charlie.” Nope – it’s CHUCK™ right out of the gate. CHUCK is an open network for instant payments, created by a consortium of community banks. American Banker reports that “more banks will roll out their version of CHUCK in the…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreIn what might very well become an industry standard practice, Bank of America (BAC) is the latest major financial institution to announce that it is ending fees for insufficient funds. They also plan to cut overdraft fees from $35 to $10. These new policies go into effect in February. CNN Business Reports “Bank of America said that once all…

Read MoreAs we start off the new year, an article from the American Banker highlights seven bank trends to watch in 2022. The key, according to their analysis, is providing ultraconvenience to customers. As you take a look at the list below, we strongly recommend you compare the trends to your bank’s plans for the new…

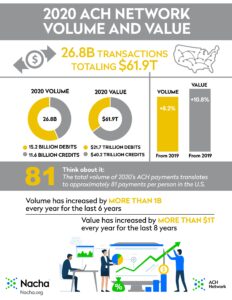

Read MoreThe COVID-19 pandemic has impacted almost every facet of the lives of individuals, as well as how business operates. This also includes how payments are made. With businesses shuttering offices and many millions of jobs moving to hybrid or fully remote positions, the way individuals and businesses make payments for goods and services has changed…

Read MoreAmerican Banker sheds some light on an example of modernization in action at Viewpointe, which was founded by big banks over 20 years ago primarily to store digital images of checks. When the physical transportation of checks temporarily halted after 9/11 — compounded by legislation known as Check 21, which allowed banks to handle more…

Read More