Will the Future Checking Account Include Checks?

In a digital society where the younger generation has created new nomenclature such as "I'll Venmo you" to send person-to-person payments or asking if a vendor accepts PayPal (and perhaps soon, "Do you accept Bitcoin?") The Financial Brand took a look at the future of checking accounts. The article provides an interesting perspective, starting off with the label -- a term which has stood for nearly a century.

Many industry observers argue the term “checking account” is a misnomer and that these accounts — at least as we have known them — will no longer exist in the coming years.

While checking accounts remain central to consumers’ lives, they’re now far more driven by mobile devices and digital functionality than actual checks, which even older consumers now use only infrequently.

Even though many of the younger generation are less likely to write checks, checking accounts remain an integral part of their financial lives. According to a Bankrate Survey, approximately 80% of adults say they have a checking account with a bank or credit union. While the younger generation might utilize popular payments apps such as PayPal and Venmo, their accounts are typically tied to a checking account or savings account.

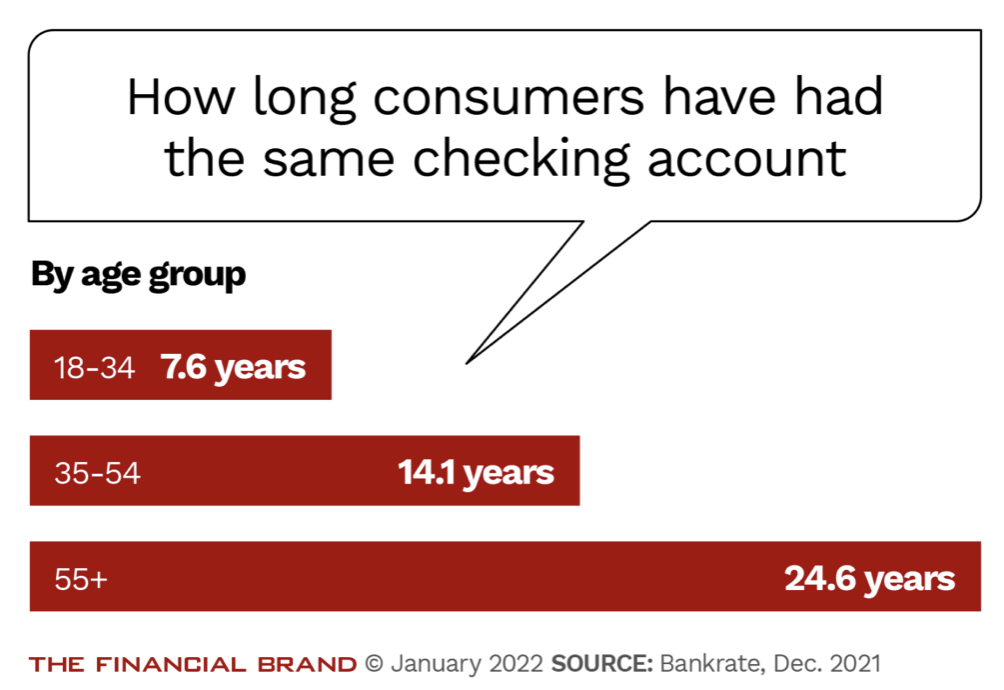

And we cannot ignore the loyalty and longevity of checking account holders:

“We’ve seen a tremendous amount of innovation in recent years, but the fact that these accounts are still held among majorities of age groups is quite noteworthy,” says Hamrick. “It remains the primary account.”

The Modern Role of the Checking Account

In today's environment, the widespread use of digital payment and banking options has led to a “hub and spoke” financial system with checking accounts serving as the hub, as Bill McCracken, President of Phoenix Synergistics, explained to The Financial Brand. People think of their checking account as a transit point and intermediary to integrate with other accounts and fintechs, he says, not as a "holding point."

For example, a consumer may now get paid via ACH, then make payments with Zelle and Venmo and have a series of auto withdrawals established for bill payments and automatic savings or investment apps. “You have funds hitting the account, but in many cases immediately going out on these spokes towards a variety of different purposes,” McCracken explains. “The checking account is still very functional and at the heart of the consumers’ life, but it has a different definition.”

“It’s more of a vehicle for moving money than for writing checks,” agrees Paula O’Reilly, Senior Managing Director, Accenture. She adds that “even as we have moved to a more mobile and digital environment, people still move money from their checking account, even though that name is now a bit of a misnomer.”

Ms. O'Reilly goes on to note the new innovations and partnerships with fintechs that are increasing the value for checking accounts, improving everything from the customer experience to value-added services. It is also important to note that most banks are reducing fees for overdrafts and insufficient funds. But what is most important is that these accounts remain the place deposits go.

Checking Accounts Remain Important, What About the Check?

An article from Innovation & Tech Today makes clear that checks are not going away -- and let's not forget the resistance the Payments Council of the UK received when they announced a plan to phase out checks (or cheques).

While checks aren't the main payment channel for day-to-day purchases, checks remain the payment choice for a variety of other purchases or payments. In fact, it is the payment of choice for many businesses, as there are no transaction fees. These include landlords for rent, small businesses who provides services like home improvements, home upkeep, and legal services, and charities that rely heavily on donations.

Checks also provide the added benefit of providing a physical copy of a payment. Who among us has not taken a look at their credit card statement and seen purchases to vendors with obscure names and wondered, "What the heck is this?"

Indeed, while a company's brand may be recognizable to the outside world, when it comes to purchases using a credit card the charges are often associated with outside organizations -- leaving consumers to scratch their head over what it was they purchased from "TriBillingCo," or some other equally oblique name.

So, while it is no longer commonplace get out the checkbook for that morning cup of joe at the local coffee house, checks clearly still serve a purpose as a stalwart payment tool. Checking of the future is about innovation, digital integration, and support of legacy payments.