Check Processing

While Bitcoin cryptocurrency has been for many years held at arms length by mainstream consumers — it’s been considered volatile because of how much and how quickly its value can change, and the 2018 Bitcoin crash is still fresh in the mind of the industry — there are signs that it is gaining more widespread acceptance.

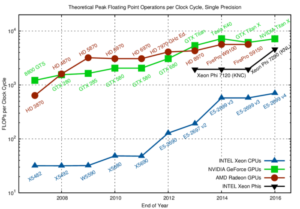

Read MoreLast week, we took a deep dive into a video by Mythbusters on CPU vs GPU, detailing how GPU provides a higher rate of speed and accuracy than CPU, essential for check processing and fraud detection. But, why are GPU processors necessary for artificial intelligence and machine learning?

Read MoreBack in August, we explored the importance of Nvidia’s data centers to real-time check processing. The blog post garnered a huge amount of attention from our readers, yielding requests to take a deeper dive of the featured video from Mythbusters and the subject of GPUs vs CPUs.

Read MoreThe Amazon Web Services website reports that Capital One is completing its migration as the first US Bank to go all-in on the cloud — and it’s making waves in the industry. “Capital One, one of the largest banks in the United States, announced in November 2020 that it had completed the migration from all eight of its on-premises data centers to Amazon Web Services (AWS), becoming the first US bank to report that it was all in on the cloud.

Read MoreWe’re pleased to announce that our ORBOIMPACT VIRTUAL CONFERENCE, a two-day online event which covered Healthcare Payments on Thursday, October 29, and Banking & Payments on Friday, October 30, was a huge success! Industry speakers coupled with OrboGraph experts focused on AI innovation and payment strategy helped drive strong attendance, while innovative polling encouraged attendee…

Read MoreHopefully you’ve already registered for the ORBOIMPACT VIRTUAL CONFERENCE scheduled for October 29th and 30th. If not, what are you waiting for?

ORBOIMPACT will explore AI innovation in the fields of check payments, check fraud, and healthcare remittance automation. The event is FREE and is accepting a limited number of virtual attendees , so register today if you haven’t already!

Check out our star-studded lineup of speakers!

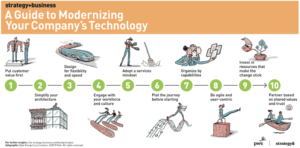

Read MoreEven as we see our industry create and adopt newer and better, more precise tools for improving check processing and preventing fraud (we proclaimed 2019, remember, the Year of AI and Modernization), it’s important to be aware of how to most effectively integrate new technology the current ecosystem in a manner that maximizes return on investment.

Read MoreHaving already announced our client and partner virtual technology conference in late September, OrboGraph has completed it’s speaker line-up for the ORBOIMPACT conference for the afternoons of October 29th and 30th (see agenda here). Day 1 (Thursday, Oct. 29): Healthcare Payments Sessions Day #1 is highlighted by Keynote speaker Mr. Michael Manna at 12:15 PM ET. During the…

Read MoreThe “death knell” for checks has been sending false alarms for a decade; year after year we are told it’s time for checks to fade away, and 2020 is no different. However, the paper check hangs on and remains undeniably popular in spite of the frequency with which it is derided.

Read MorePredicting an economic recovery in today’s COVID-19 environment is far more complex than reading traditional individual economic indicators. As seen by the recent run in the stock market, there are certain market components somewhat disassociated from traditional indicators, i.e. unemployment rate, GDP growth, etc.

Read More