Industry News – Check

In a little over a month, OrboGraph will be hosting it’s first virtual conference since 2014: ORBOIMPACT Virtual Conference: AI Innovation for Check Payments, Check Fraud, and Healthcare Remittance Automation.

Read MoreIn a summary of Mercator Advisory Group’s new Insight Summary Report, 2020 Small Business PaymentsInsights, COVID-19 and B2B Payments & Cards – The Result of the Pandemic, PaymentsJournal.com summarizes their findings.

Read MoreBy now, many of you have heard of the arguments between utilize GPU vs CPU. towardsdatascience.com provides a simple explanation on the reasoning behind the need for GPUs for machine learning:

GPUs are optimized for training artificial intelligence and deep learning models as they can process multiple computations simultaneously.

They have a large number of cores, which allows for better computation of multiple parallel processes. Additionally, computations in deep learning need to handle huge amounts of data — this makes a GPU’s memory bandwidth most suitable.

Read MoreCheck writers and depositors have become accustomed to a next day or two day check clearing process for the majority of items. But when an extended clearing process does happen, i.e. 2-3 days, it becomes a real inconvenience, especially for millennials accustomed to instant digital payments, or for those folks who still get payroll checks. There are many other examples.

Read MoreAs seen in the above video, scammers representing themselves as officials of government agencies is a common tactic. Victims are caught off-guard by the scammer’s aggressive tone and threats of legal repercussions, raising the victim’s anxiety and clouding their judgement to extract money from them. The scammers have adopted a new angle, utilizing the pandemic to their advantage.

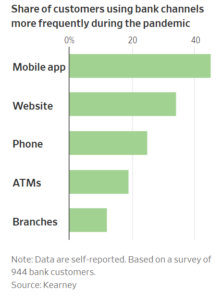

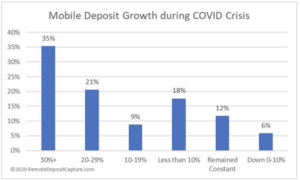

Read MoreRemoteDepositCapture.com had a hunch that the Covid-19 pandemic would lead to an increase in RDC deposits (Mobile Deposit, Desktop, ATM, etc.). So, in late February, they started polling the industry, asking the following question: For Financial Institutions: What has been the rate of growth or decline in your mobile deposit volume over the past year?…

Read MoreIt is important to understand that while check fraud is a significant problem in the US, similar trends are occurring in Europe as well. In Europe, there was a shared view of paper checks as a payment vehicle on the road to the junkyard years ago — only to find out that it remains a popular payment method in many countries.

Read MoreNutanix presented an informative webinar exploring the findings in their new publication, the Nutanix Enterprise Cloud Index Report. Kevin Lash, Director of Global Financial Services Strategy and Solutions at Nutanix; and Callum Budd, Research consultant with Vanson Bourne, held forth on issues and trends encountered on the path to hybrid cloud capability. First, a cloud…

Read MoreDuring 2019, more than 1.9 million consumers cashed FTC checks received as a result of law enforcement cases. When consumers don’t cash their refund checks, the FTC uses that money to send additional mailings to ensure the maximum amount of money is returned to consumers. Any remaining refund money is sent to the U.S. Treasury.

Read More- « Previous

- 1

- …

- 5

- 6

- 7