Industry News – Check

PNC Bank N.A. announced on Jan. 27 that it has struck a definitive deal to buy payment gateway provider Tempus Technologies, Inc. This new team-up will allow their business customers to handle their receivables and payables via one channel, covering all rails. According to a report at Pymnts.com:

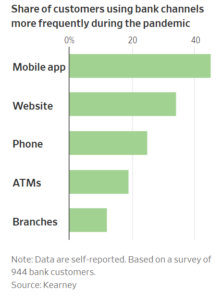

Read MoreThe trading platform Blocktrade recently published their predictions for the coming year in the fintech and payment worlds. “We all know that 2020 was a highly unusual year – the Covid pandemic not only impacted the global economy, it also accelerated ongoing changes and developments in the Fintech and Payment industry.”

Read MoreWe have seen the banking and payments industries recover from the challenges of the COVID-19 Pandemic with a resurgence of checks and sustained volumes of other payments. With this recovery, banks and financial institutions can now refocus on automation and fraud prevention projects which have been delayed while the economy recovers.

Read MoreThe Amazon Web Services website reports that Capital One is completing its migration as the first US Bank to go all-in on the cloud — and it’s making waves in the industry. “Capital One, one of the largest banks in the United States, announced in November 2020 that it had completed the migration from all eight of its on-premises data centers to Amazon Web Services (AWS), becoming the first US bank to report that it was all in on the cloud.

Read MoreHaving already announced our client and partner virtual technology conference in late September, OrboGraph has completed it’s speaker line-up for the ORBOIMPACT conference for the afternoons of October 29th and 30th (see agenda here). Day 1 (Thursday, Oct. 29): Healthcare Payments Sessions Day #1 is highlighted by Keynote speaker Mr. Michael Manna at 12:15 PM ET. During the…

Read MorePredicting an economic recovery in today’s COVID-19 environment is far more complex than reading traditional individual economic indicators. As seen by the recent run in the stock market, there are certain market components somewhat disassociated from traditional indicators, i.e. unemployment rate, GDP growth, etc.

Read MoreIn a little over a month, OrboGraph will be hosting it’s first virtual conference since 2014: ORBOIMPACT Virtual Conference: AI Innovation for Check Payments, Check Fraud, and Healthcare Remittance Automation.

Read MoreIn a summary of Mercator Advisory Group’s new Insight Summary Report, 2020 Small Business PaymentsInsights, COVID-19 and B2B Payments & Cards – The Result of the Pandemic, PaymentsJournal.com summarizes their findings.

Read MoreBy now, many of you have heard of the arguments between utilize GPU vs CPU. towardsdatascience.com provides a simple explanation on the reasoning behind the need for GPUs for machine learning:

GPUs are optimized for training artificial intelligence and deep learning models as they can process multiple computations simultaneously.

They have a large number of cores, which allows for better computation of multiple parallel processes. Additionally, computations in deep learning need to handle huge amounts of data — this makes a GPU’s memory bandwidth most suitable.

Read MoreCheck writers and depositors have become accustomed to a next day or two day check clearing process for the majority of items. But when an extended clearing process does happen, i.e. 2-3 days, it becomes a real inconvenience, especially for millennials accustomed to instant digital payments, or for those folks who still get payroll checks. There are many other examples.

Read More