Products

We have receive a tremendous amount of positive feedback from our recent #OrboZone launch, with a countless number of clients, partners, and industry experts raving about their “experience.” But what is #OrboZone? It’s dynamic content that combines high-impact videos, visual galleries, energizing music, and entertaining activities for your WFH environment.

Read MoreHere’s a paradox we enjoy seeing: Even as it’s proclaimed all over the place that “checks are in decline,” and “checks are alien to Millennials” — we see a forward-looking, technologically innovative payroll infrastructure startup system launch and call itself — Check.

Read MoreIn a summary of Mercator Advisory Group’s new Insight Summary Report, 2020 Small Business PaymentsInsights, COVID-19 and B2B Payments & Cards – The Result of the Pandemic, PaymentsJournal.com summarizes their findings.

Read MoreBy now, many of you have heard of the arguments between utilize GPU vs CPU. towardsdatascience.com provides a simple explanation on the reasoning behind the need for GPUs for machine learning:

GPUs are optimized for training artificial intelligence and deep learning models as they can process multiple computations simultaneously.

They have a large number of cores, which allows for better computation of multiple parallel processes. Additionally, computations in deep learning need to handle huge amounts of data — this makes a GPU’s memory bandwidth most suitable.

Read MoreCheck writers and depositors have become accustomed to a next day or two day check clearing process for the majority of items. But when an extended clearing process does happen, i.e. 2-3 days, it becomes a real inconvenience, especially for millennials accustomed to instant digital payments, or for those folks who still get payroll checks. There are many other examples.

Read MorePymnts.com explores the various hurdles banks face when taking that big — and increasingly necessary — step. They note that migrating to the cloud is a vital tool traditional financial institutions (FIs’) will need in order to compete with digital-native FinTechs.

Read MoreTo the layman, much of the language in the AI space can be mystifying, particularly in deep learning. Take for example one of the core elements; the node. A deep learning node is “a computational unit that has one or more weighted input connections, a transfer function that combines the inputs in some way, and an output connection. Nodes are then organized into layers to comprise a network.”

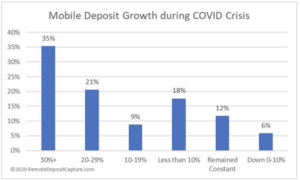

Read MoreEnsenta/EPS has put together an excellent report exploring NINE DRIVERS OF MOBILE DEPOSIT GROWTH (You can download a copy HERE). They come out of the gate by noting that large financial institutions continue to invest in increasingly better mobile deposit user experiences for two reasons: Improving return on investment (ROI) Growing their deposit base Given…

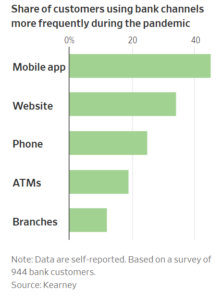

Read MoreRemoteDepositCapture.com had a hunch that the Covid-19 pandemic would lead to an increase in RDC deposits (Mobile Deposit, Desktop, ATM, etc.). So, in late February, they started polling the industry, asking the following question: For Financial Institutions: What has been the rate of growth or decline in your mobile deposit volume over the past year?…

Read MoreOrboGraph will soon be launching a website refresh with the official market announcements around OrbNet AI and OrboAnywhere 4.0. Check recognition is a process which is not perfect, but the gap of unread items is closing. As technology approaches reading all legible items, it is important to look closely at “defect” items which did not…

Read More