RDC & Mobile

Trade Finance is recognized as a vital tool to fuel global growth and support the world economy, but, as pymnts.com notes, it is far from a perfect instrument. For decades, trade finance has been caught in a web of paper-based documents, creating bottlenecks and friction at nearly every point of the process, from onboarding to financing payouts. As the industry pushes to modernize, it’s also facing scrutiny over its relationship with credit risk. Critics argue that some trade financing products have actually encouraged large corporates to pay their vendors late or force those suppliers into expensive financing arrangements. At the same time, as witnessed in the ongoing Greensill Capital saga, the success of trade finance largely relies upon insurers’ ability to cover for losses in the case of non-payment.

Read MoreForbes took a look at new research from Cornerstone Advisors and found that that more than three-quarters of Americans who have a smartphone are now mobile banking users. Mobile banking adoption is approaching ubiquity among Gen Zers and Millennials (ages 21 to 40) with 88% of each of the two generations accessing their bank accounts using a mobile device. The adoption rate dips just a bit to 78% among Gen Xers (41 to 55 years old), and then drops to 57% of Baby Boomers and 41% of smartphone-owning Seniors.

Read MoreClose on the heels of Venmo’s new check-cashing service for their mobile app, “Cash a Check,” fee-payment processing platform AdvicePay — which is designed specifically for financial advisors — rolled out a new mobile check deposit feature for large businesses, according to their mid-March announcement. This is great news for financial advisors and the like;…

Read MoreThe Center for Statistics and Applications in Forensic Evidence, or CSAFE, hosted a webinar on forensic handwriting analysis on March 11, 2021. OrboGraph was one of hundreds attending the session. The Center for Statistics and Applications in Forensic Evidence (CSAFE) is building a statistically sound and scientifically solid foundation for the analysis and interpretation of forensic evidence, as well as improving quantitative literacy among forensic practitioners, legal professionals and other stakeholders through educational opportunities.

Read MoreTried-and-true merges with new digital tech — Venmo recently announced that it will begin to offer a new check-cashing service, “Cash a Check,” in the Venmo mobile app. Via TechCrunch.com: The feature … can be used to cash printed, payroll and U.S. government checks, including the new stimulus checks, the company says. Though typically there will be fees associated with the Cash a Check feature, Venmo says these are being waived on stimulus funds for a limited time.

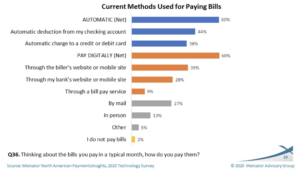

Read MoreThe report presents results from questions exploring how adults in the United States use and pay for “box of the month” clubs and online subscription services. It also explores the ways consumers pay their bills and the increasing importance of digital bill payment. …When it comes to paying bills, the majority of consumers (6 in…

Read MoreIn a recent OrboNation Blog article, we covered the need for key fintech players — like banks and firms — to continue to invest in modernizing their processes and payment methods as “the need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.” One approach that banks and financial institutions are starting to pay attention to is Open Banking.

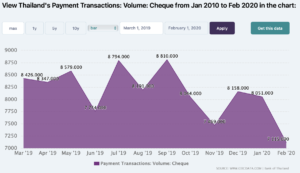

Read MoreCEIC Data was founded in Hong Kong in 1992 by a team of expert economists and analysts, and today employs data analysts in multiple offices around the globe. They currently offer “exclusive access to unparalleled coverage of 200+ economies around the globe, helping analysts and economists make sense of the world economy.” From their website: First and foremost, our products are about people. Our relationships with primary sources in numerous countries around the globe mean that our clients have access to most detailed and credible data in the world…

Read MoreSurprise! Barry McCarthy the CEO of Deluxe, is a proponent of checks as payment tools. Even with the pivot for consumers to digital payment options, business-to-business is still reliant upon an older payment method: checks. Yes, you read that right. Although check usage has decreased significantly since the mid-2000s, physical checks accounted for 42%of B2B transactions in 2019 despite the explosion of digital options.

Read MoreIn a world where COVID-19 has made on-site collaboration a more and more distant memory — with no end in sight for the growth of remote work as the norm — PaymentsJournal reports: The need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.

Read More