CEIC: A Tremendous Resource for International Check Volumes

CEIC Data was founded in Hong Kong in 1992 by a team of expert economists and analysts, and today employs data analysts in multiple offices around the globe. They currently offer "exclusive access to unparalleled coverage of 200+ economies around the globe, helping analysts and economists make sense of the world economy."

From their website:

First and foremost, our products are about people. Our relationships with primary sources in numerous countries around the globe mean that our clients have access to most detailed and credible data in the world. Our experts work tirelessly to ensure that every piece of data is accurate and every client is completely satisfied. We set the standard for providing clients with economic information they can trust that is also easy to access, updated almost instantaneously, and implemented by experts on the ground in each country we work with. We pride ourselves on the quality of our data, the convenience of our databases, and our exceptional customer service.

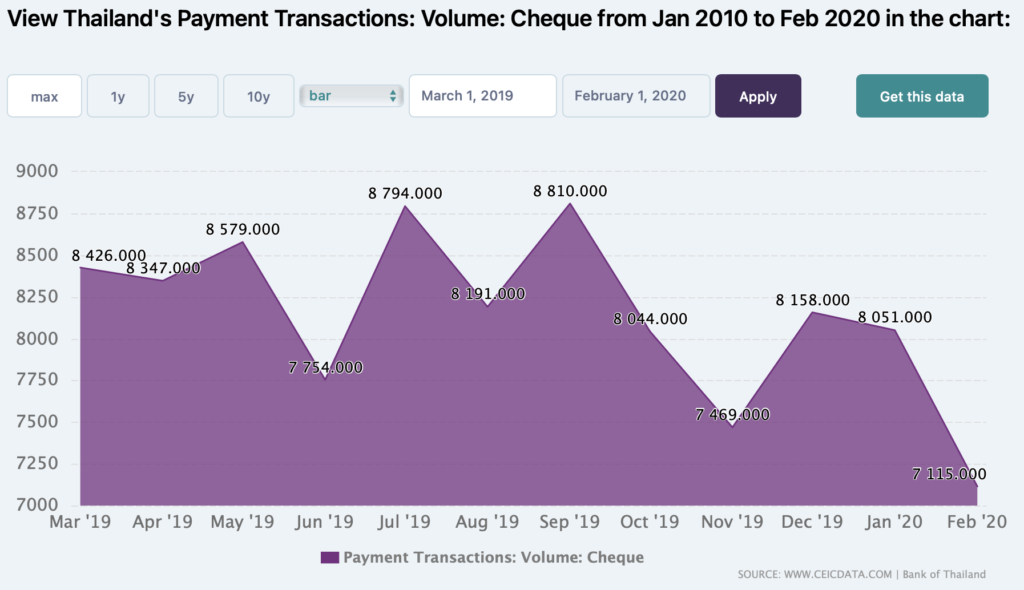

CEIC offers a powerful means of evaluating check processing volumes across a wide range of countries via searches and queries. Here's just one example:

The chart above represents just one of the useful metrics offered via CEIC's free and premium service.

Another useful resource is Statista. The link gives you a sneak-peek at the types of data their premium service offers regarding, for instance, check writing habits per capita.

Good data is important, whether it is for the purpose of investigating into market opportunities, to accurate data being produced by the bank. For check processing, advancements in AI technologies are achieving unparalleled accuracy rates of over 99%, creating data that not only achieves unprecedented levels of automation, but also good data to filter to downstream systems for business analysis.