Remote Deposit Capture

Remember “cash, check, or credit card”? Ah, the simpler days of yore. As reported in PaymentsJournal.com, we are experiencing more payments choices at the consumer level than ever before. Indeed, their article starts out with a parade of options: “Swipe, dip, tap. Credit, charge, debit, prepaid, reloadable. Apple Pay, Google Pay, Samsung Pay, Starbucks, Dunkin’.…

Read MoreJust when you thought you heard it all when it comes to financial crimes, here comes … accidental? A Pennsylvania couple thought they were tokens on a Monopoly board when they had $120,000 mistakenly deposited into their bank account. As far as they were concerned, they’d passed “GO” and picked a pretty good Community Chest…

Read MoreJack Henry & Associates Inc, a provider of technology and payment processing services for the banking industry based in Missouri, recently announced the retirement of their executive vice president and chief technology officer, Mark Forbis. Mark began his career in 1982 with Systemics. He was named vice president and CTO at Jack Henry in 2006…

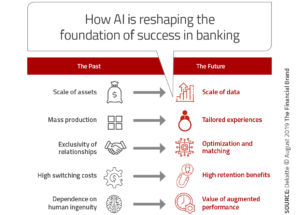

Read MoreAs technological innovation continues to evolve society, so does the way it affects society’s interaction with businesses, including their banks!

Read MoreThe US real-time payments network currently reaches about 50% of the population, and was on track, via private sector channels, to provide complete coverage by the end of next year, as noted in an article at Forbes.com by Ike Brannon, a senior fellow at the Jack Kemp Foundation.

Read MoreWant to go deep on financial fraud and crime, and learn the difference between the two while also learning about the role of modern cybersecurity tools in curtailing both? Get comfortable and spend some time with this comprehensive article from McKinsey & Company covering Financial crime and fraud in the age of cybersecurity. Their analysis…

Read MorePaymnts.com reported recent data (from West Monroe Partners) that found 77 percent of banks are already putting AI solutions to use in some way. Count Chase as one of the forefront adopters of Artificial Intelligence solutions and technology. Chase is embracing AI and ML to help customers conduct business while preventing fraudsters from making off with data or financial…

Read MoreA new report by FIS finds that business satisfaction has dipped slightly, but remains high. The FIS research found that 78% of U.S. SMBs report being extremely or very satisfied with their PFIs, down slightly from 81% in the 2018 study. SMBs with $25M-$75M in revenue reported the highest satisfaction in their banking providers (85%).…

Read MoreLet’s face it: Human beings are indispensable, but we are learning that in order to bring the level of service that is expected in today’s marketplace, machines and analytics have to work together and deliver quicker, more intelligent solutions than we’ve previously seen or experienced. This is the root of Artificial Intelligence and its value…

Read MoreChecks are still ubiquitous across generations. They remain popular, and they are — in spite of repeated premature eulogies — still alive and well in the world of treasury and B2B. Let’s say you have a check payment from a friend, or you’re running a small business on check payments, or you’re still getting a…

Read More