Teller Image Capture

Our own Vice President of Marketing, Joe Gregory, is featured in an article in Banking CIO Outlook magazine (you can read the story here). OrboGraph is proud to be featured as one of Banking CIO Outlook’s Top 10 KYC Solution Providers for 2018. Gregory notes that OrboGraph’s embrace of AI and Deep Learning technologies provides…

Read MoreBob Legters of American Banker goes out on a limb and makes the following predictions for the new year. Visit the link for his expansion of each prediction. Legters begins with specifying things he thinks we won’t see in 2019, followed by developments he believes will come to fruition before year’s end. How many do…

Read MoreThe Federal Reserve, following through on plans disclosed earlier this year, formally unveiled the U.S. Faster Payments Council, an industry group charged with collaborating to spur the adoption of faster payments and identify market opportunities. According to DigitalTransactions.net: The 22 inaugural members range from retailing giant Walmart Inc. to Visa Inc. and Mastercard Inc. to…

Read MorePYMNTS.com reports on the Federal Reserve’s efforts to gather input on making payments faster across all channels. Federal Reserve Governor Lael Brainard said, in remarks made on Oct. 3rd., that the Federal Reserve’s infrastructure underpinning payments could use a bit of modernization in a bid to support fast payments “for all.” Brainard, speaking in Chicago at the Fed…

Read MorePersons who are older than 30 may feel the urge to gloat about this: Millennials – – the cohort, according to the Pew Research Center, born between the years 1981 and 1996, and who watch with glee as older folks struggle with social media and Ubers – – are currently the primary target when it…

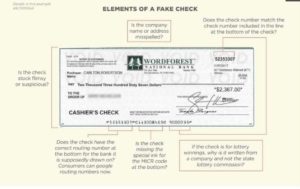

Read MoreWhile the consumer “civilian” world has pretty much learned and accepted the “don’t take checks from strangers” rule, the corporate world is both slow to adopt that guideline — and often unable to. This is due to the fact that suppliers like the “float” advantage they enjoy with check payments. (“We paid you on Tuesday…

Read MoreWhile steadily declining in overall usage, cash remains “as relevant in retail as it has ever been,” according to an article by Bob Meara, Senior Analyst with Celent, in an article previewing his presentation at November’s AFP 2018, “Fewer Cash Receipts Still Mean Big Retail Challenges.” RCC (Remote Cash Capture) is noteworthy for the collaborative service delivery required to…

Read MoreThere are many reasons for the resilience of checks (including the small- and mid-sized businesses that rely on the paper check’s “float” for accounting purposes), but one important factor has been fear of fraud and security risks in newer digital transactions. Digital transactions are indeed growing at a rapid rate — particularly among millennials, many…

Read MoreLast week, USA TODAY published a consumer-focused article explaining new deposit requirements from a number of banks: Depositors must now include the phrase “For Mobile Deposit Only” underneath their signature on all checks deposited using mobile apps. Some banks are also suggesting you add “For Mobile Deposit Only at (Bank Name)” or “For (BANK NAME) Mobile Deposit…

Read MorePayments 3.0 columnist George Warfel signs off of his last column for the site by noting what he considers deep trends to watch in banking and payments. One particular point he makes is something we’ve seen borne out again and again as cleverly-named payments technology brands appear and then either disappear or team with more established…

Read More