Uncategorized

As we noted in a previous blog, business remote deposits continue to be a leading service — particular for checks, with tremendous growth of +25%. And, according to Fiserv’s Mobile Deposits Adoption Program Director, Ryan Williams, 85% of consumers currently using mobile deposit plan to continue doing so. With all that being said, Williams recently shared…

Read More41% increase in attempted fraud from 2020 to 2021 — 2022 NICE Actimize Fraud Insights Report Cost of fraud is up 10% from pre-pandemic Fraud can occur at any step in the user journey and from any device or workflow The proliferation of fraud across the globe is no secret. While numbers vary from source…

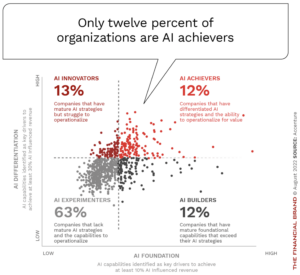

Read MoreA post at The Financial Brand by Jim Marous, Co-Publisher of The Financial Brand, CEO of the Digital Banking Report, and host of the Banking Transformed podcast, paints a grim picture of AI development and adoption progress in the banking industry. Despite the importance of leveraging data and artificial intelligence for risk management, enhanced operations,…

Read MoreCheck fraud is “the oldest fraud in America” Postal carriers are being physically assaulted “Supply and demand” of checks for fraud is elevated these assaults even further Fraud is a major topic throughout the business world. No matter the type — from retail to big tech — fraud remains one of the biggest challenges. This…

Read MoreLinkedIn — the world’s largest internet professional network — is a great way for professionals to connect with colleagues and other industry leaders, strengthening relationships to advance their careers. Over the past few years we’ve seen many of these professionals use the LinkedIn platform to take an active role in spreading news and content that…

Read MoreThe newest episode of This Week on PYMNTS.COM covered, among other topics, the impending entry of Walmart into the banking space. PYMNTS’ Karen Webster spoke to Ingo Money CEO Drew Edwards, who is sometimes referred to as “the OG [Original Gangster] in FinTech.” Source: PYMNTS.com (jump to 12:55 for Walmart segment) Walmart is beginning neobank services for its…

Read MorePeer-to-peer payments services are being targeted by scammers Because the victim technically initiates the payment, banks in many countries refuse to refund losses incurred this way The CFPB may raise banks’ financial obligations to customers who lose money in a payment-services scam According to a report published in The Wall Street Journal, the Consumer Financial Protection…

Read MoreA report entitled An Analysis of Outpatient Revenue Cycle Management Outsourcing, the result of a collaboration between HFMA and health information technology company XIFIN and reflecting responses from 157 US-based HFMA members, reveals that over one in five revenue cycle leaders handle their own inpatient revenue cycle management (RCM) operations. However, according to a study conducted…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreThe San Diego Business Journal asked a group of banking leaders for their impressions of the digital revolution in banking, and received valuable insights regarding human interactions, response to pandemic-era restrictions, and fraud prevention. Even before the COVID-19 pandemic impacted the world economy in early 2020, the financial sector was developing and deploying digital tools…

Read More