Uncategorized

It’s no secret to anyone who’s read previous posts here that artificial intelligence (AI) and machine learning are a boon for revenue cycle management — probably one of the strongest use cases for this type of technology, in fact, as reported by RevCycle Intelligence. “Integrating artificial intelligence into an RCM solution allows us to have data driven approaches to automate each step in the process, whether it’s when that first letter is going out, that first contact is happening, or that payment is going into a payment plan. Each step, there’s a model supporting that decision which helps a person to take the right action at the right time,” says Greg Allen, senior director of data science and product management at Ontario Systems.

Read MoreCredit Unions and their members tend to pride themselves — rightfully so — on being much more “customer-centric” than the average financial institution. They are, after all, serving “members,” and that spirit permeates their approach in all aspects of their business. The relationship has become, in fact, a differentiator that draws (and keeps) loyal members on a long-term basis.

Read MoreForensic document examination is foundational to OrboGraph’s OrbNet Forensic AI technology. To assist in describing the applicability of forensics in banking, fraud detection, and payments, we talked to forensic expert and author, Khody Detwiler, for this week’s Modernizing Omnichannel Check Fraud Detection post.

Read MoreThe Federal Reserve is actively exploring ways to streamline FinTechs’ access to the payment system, and pymnts.com reports that financial institutions will need sharpen their systems to retain a competitive edge.

The Federal Reserve could be taking steps toward a much more open and competitive financial services landscape as it considers allowing FinTechs to gain access to the payment system directly. The Fed announced last week that it is inviting comment on the proposal to develop guidelines for allowing non-banks to access accounts and payment services, rather than relying on bank partnerships to facilitate that connectivity.

Read MoreStanford University’s 2021 AI Index Report is now available, and it goes into significant detail regarding Computer Vision, which is integral to the sorts of recognition tasks important in fraud detection and EOB processing.

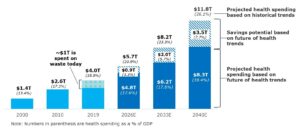

Read MoreA recent article from RevCycleIntelligence.com focuses on a new report published by Deloitte — and the predictions are a stark contrast to the current business model for healthcare. In a new report, experts estimated that healthcare spending will be $83 trillion by 2040, about $3.5 trillion less than what CMS actuaries estimate using their own methodology.

Read MoreKey4Women, an organization dedicated to supporting the financial progress and empowerment of business women, presented a terrific, highly useful discussion of the latest in fraud threats and how to protect yourself at home and in the office with best practices shared from industry experts.

Read MoreHindsight is 20/20, but it turns out that many medical practices and providers didn’t put into motion much digital preparation pre-pandemic, and that places them in a current payments predicament. This is according to Colin Mellon, senior vice president of Healthcare and Insurance Solutions at Fiserv. During a PYMNTS TV Trend Talk, Mellon noted that “the pandemic…

Read MoreTrade Finance is recognized as a vital tool to fuel global growth and support the world economy, but, as pymnts.com notes, it is far from a perfect instrument. For decades, trade finance has been caught in a web of paper-based documents, creating bottlenecks and friction at nearly every point of the process, from onboarding to financing payouts. As the industry pushes to modernize, it’s also facing scrutiny over its relationship with credit risk. Critics argue that some trade financing products have actually encouraged large corporates to pay their vendors late or force those suppliers into expensive financing arrangements. At the same time, as witnessed in the ongoing Greensill Capital saga, the success of trade finance largely relies upon insurers’ ability to cover for losses in the case of non-payment.

Read MoreIn a story from The Boston Globe, we learn about a counterfeit check scheme involving recruitment (and intimidation) of homeless and transient people from Providence to commit fraud in Maine, Massachusetts, Rhode Island, and Connecticut. This was not a pandemic-related scheme; the four suspects began their scam in the fall of 2018, cashing or attempting to cash 450 counterfeit checks amounting to an estimated $450,000, according to an affidavit filed in U.S. District Court in Providence.

Read More