Uncategorized

We live in a world where pretty much everyone carries a phone in their pocket that is capable of instantaneously sending and receiving digital payments, virtually eliminating the need for paper money or checks. So, checks should be an artifact of the past — something you have to explain to a checkbook-oblivious younger generation, like…

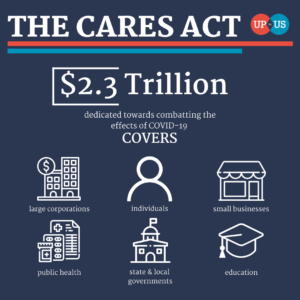

Read MoreFraudsters are being targeted by the United States Secret Service Nearly $100 billion in pandemic relief funds have been stolen Stimulus check scams are used to get personal information The National Review reports that fraudsters have stolen nearly $100 billion in pandemic relief funds. This has resulted in the arrests of more than 100 suspects, and…

Read MoreAmerican Banker features the story of The Milford Bank, a 149-year-old community institution in Connecticut that wants to attract a younger audience. It faces a challenge, of course, in how much it can do in-house in terms of enhancing its tech, or even researching, testing, and eventually integrating products from potential fintech partners. So, a…

Read MoreAs the final days of 2021 wind down, we’d like to thank all our partners and clients for supporting OrboGraph in a record breaking year. Also enjoy our holiday video below! Season’s Greetings! The OrboGraph Family

Read More“Scambaiters” go the extra mile to expose — and sometimes punish — scammers These “entertainment-based” scam busters are often more effective than “official” scam reporting channels The bottom line: seeing is believing There’s a somewhat well-known trope among persons who work at home or independently that, whenever an obvious scammer calls and you have time…

Read MoreIn his FinExtra Blog, Dmitry Dolgorukov, the CEO of GiniMachine, takes a look at the newest trends and tech that the industry will need to be aware of ASAP in order to remain competitive. Back when we first heard of Bitcoin in 2009, many brushed off the cryptocurrency as just a new fad, refusing to…

Read MoreDigital fraud attacks rise during the holidays Many attacks are automated “Credential stuffing” takes advantage of the growth of digital accounts While fraud is, unfortunately, a year-round activity not bound to any particular season, the holidays present fraudsters with what could be called a “rich target field.” Digital Transactions cites a report from Arkose Labs…

Read MoreMost — if not all — individuals and organizations in the banking industry is at least familiar with the Federal Register, the Daily Journal of the United States Government. This is an important resource for banks, particularly for the Chief Compliance Officer, the BSA Officer, and their departments, as it provides banks with new regulations…

Read MoreIndustry reports confirm fraud attempts and losses are still a concern Fraudsters take advantage of the “need for speed” FI’s can adapt quickly with layers of protection As checks continue to hold their position as a viable payment channel, the past five years yielded a rise in check fraud that was difficult to foresee. Meanwhile,…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read More