Uncategorized

The Amazon Web Services website reports that Capital One is completing its migration as the first US Bank to go all-in on the cloud — and it’s making waves in the industry. “Capital One, one of the largest banks in the United States, announced in November 2020 that it had completed the migration from all eight of its on-premises data centers to Amazon Web Services (AWS), becoming the first US bank to report that it was all in on the cloud.

Read MoreSimply put, check washing means you procure a check or checks by whatever means necessary, remove the amount and “pay to” information (the “washing”), and alter it to serve your own nefarious purposes. No chart needed. Not even a printer.

Read MoreAs we noted in our Check & Fraud recap earlier this week, the ORBOIMPACT VIRTUAL CONFERENCE, our two-day online event — which covered Healthcare Payments on Thursday, October 29, and Banking & Payments on Friday, October 30 — was a huge success! Industry speakers coupled with OrboGraph experts focused on AI innovation and payment strategy helped drive strong attendance, while innovative polling encouraged attendee participation and interaction.

Read MorePaymentsJournal.com relays the news that, since the beginning of the COVID-19 outbreak, a LIMRA survey shows 40% of financial services firms have seen an increase in fraudulent activity. This has lead notable banks and even the FBI to actually issue fraud alerts to their communities. Current stay at home orders have led more and more people to — wisely, in light of safety issues — do their banking digitally via apps and chatbots, making technology the primary barrier to fraudulent activity.

Read MoreWe’re pleased to announce that our ORBOIMPACT VIRTUAL CONFERENCE, a two-day online event which covered Healthcare Payments on Thursday, October 29, and Banking & Payments on Friday, October 30, was a huge success! Industry speakers coupled with OrboGraph experts focused on AI innovation and payment strategy helped drive strong attendance, while innovative polling encouraged attendee…

Read MoreKaren Olson, Treasury Management Banking Officer and Vice President at Dubuque Bank and Trust, notes at TelegraphHerald.com that COVID-19 has forced many businesses to quickly change their methods of operation — and, as a result, created additional avenues for payments fraud to occur.

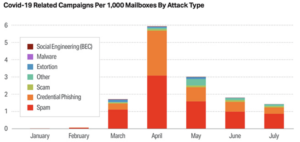

Read MoreHelpnetsecurity.com, quoting an Abnormal Security report, explains that there seems to be a peaking and plateauing of COVID-19-themed email attacks, an increase in BEC (Business Email Compromise) attack volume, and acceleration of payment and invoice fraud. Most of these scams rely upon impersonating a known company or brand. The report also uncovered changing trends in these brand impersonation attacks, a form of fraud where a bad actor assumes the identity of a trusted or known entity. Will it surprise you to learn, given the current remote meeting trends, that ZOOM (NASDAQ: ZM) became the most impersonated brand in Q2?

Read MoreHopefully you’ve already registered for the ORBOIMPACT VIRTUAL CONFERENCE scheduled for October 29th and 30th. If not, what are you waiting for?

ORBOIMPACT will explore AI innovation in the fields of check payments, check fraud, and healthcare remittance automation. The event is FREE and is accepting a limited number of virtual attendees , so register today if you haven’t already!

Check out our star-studded lineup of speakers!

Read MoreIf you’ve been following the news, you’ve heard warnings about COVID-19 infection spikes as a result of seasonal and behavioral factors. Another unfortunate spike related to the pandemic is check fraud.

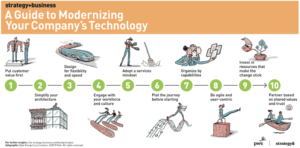

Read MoreEven as we see our industry create and adopt newer and better, more precise tools for improving check processing and preventing fraud (we proclaimed 2019, remember, the Year of AI and Modernization), it’s important to be aware of how to most effectively integrate new technology the current ecosystem in a manner that maximizes return on investment.

Read More