Customer Experience (CX): Community Banks Increase 2022 Tech Budget by 11%

Want to keep up in the banking industry? Follow the example of executives at eight in ten banks, who noted that their 2022 technology budget was up from the previous year, with an average increase of 11% over 2021. In fact, Gartner Inc. predicts that in 2022, banks and financial firms will invest an estimated $623B in technology.

So what could be their primary target? Enhancing customer experience (CX).

In an annual survey, Bank Director found that 81% of the respondents had boosted their 2022 tech budget, with the median increase being 11% from 2021. About 140 independent directors and C-suite leaders at U.S. banks with less than $100 billion assets participated in the survey. Roughly half of the respondents came from banks with under $1 billion in assets and 35% from banks with $1 billion to $5 billion in assets.

To maximize the impact of the extra spending, these executives typically zeroed in on where they thought it would help most, with many reporting a careful focus on digital capabilities that would improve customer experience and competitiveness of the bank.

Challenge for Community Banks: Budget and Resources

As we've noted previously, large banks have already taken steps to bolster their technology spending to varying degrees (the Bank Director survey above pegged the median 2022 bank tech budget at $1 million). To remain competitive, smaller banks have to keep pace to the extent possible.

“Community banks, with far fewer dollars to spend, have to budget wisely and invest where it makes the most sense,” Laura Alix, Bank Director’s director of research, wrote in the report. “For many, that means prioritizing new technology features and updates in areas like security or where customers frequently interact with the bank, like payments or digital loan applications.”

And what was widely regarded as "a good idea" is becoming more and more absolutely crucial.

This growing focus on technology and innovation is now “a matter of survival” for many community banks and credit unions, Zach Walker, credit union account executive at the fintech software company Total Expert, told The Financial Brand in an interview.

Digital account opening processes — available not just at fintechs, but on some websites for banks and credit unions — have made it easier for consumers to switch financial institutions, Walker says. As a result, executives at smaller financial institutions have become far more open than they have been in the past to trying new things.

Challenge for Community Banks: Focus on Fraud

When reviewing all aspects of the customer experience, nothing is more harmful than fraud. When a person is a victim of fraud, the customer experience is immediately affected and damages the reputation of banks.

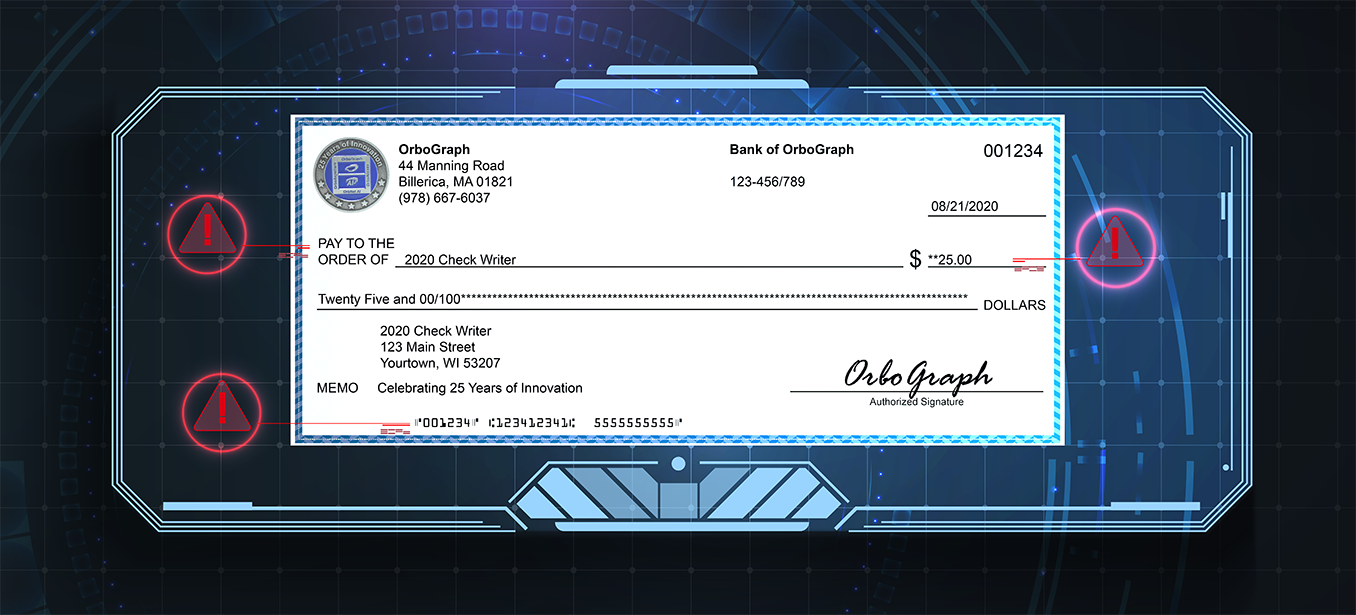

Check fraud has been a major spotlight for both traditional and social media. There are hundreds -- even thousands -- of reports daily detailing the victims' experience, with many questioning how the bank did not detect it before funds were stolen. This is exacerbated by the fact that check fraud has been bolstered through mRDC by the "casual fraudster."

In order to curb check fraud, banks need to integrate new technologies to increase their fraud detection capabilities. This is why they are turning to image-forensic AI that analyzes check images to detect forgeries, counterfeits, and alterations. Remember, banks are seen as the "safe place" for money, and by complementing analytics-based systems with image-based detection, banks can effectively improve the customer experience by proactively protecting their customers funds.

Bringing in Tech Help from Outside

One key to success for smaller financial institutions is to bring in tech expertise from outside.

Most financial institutions represented in the Bank Director survey are looking outside of their own walls for help with technology adoption. Nearly 40%, primarily representing banks with more than $1 billion in assets, said they have collaborated with technology partners. Additionally, a quarter have participated in a venture fund that invests in technology companies, while 11% have directly invested in one or more of these companies.

Fortunately for community banks and small financial institutions, core platform vendors like FIS, JHA, Fiserv, and Alogent have developed in-house solutions and "built the bridges" to close the technology gap so new and innovative technologies are able to integrate seamlessly. This includes AI and machine learning technologies to automate check payment processing and fraud detection, enabling banks with limited internal IT resources to nevertheless benefit from innovative technologies -- minimizing costs while also ensuring a smooth transition and seamless CX for any channel their consumer choses for their banking.