OrboNation Newsletter: Check Processing and Fraud – August 2024

Another Publication Attempts to Discredit Checks — Are They to Blame for Inherent Issues?

Evan Sparks, editor-in-chief of the ABA Banking Journal and senior vice president for member communications at the American Bankers Association, poses the question: Is it time to kill the paper check?

Mr. Sparks points out that, for routine transactions, check usage has shrunk to the point that the Federal Reserve’s Survey of Consumer Payment Choice relegates them to a category of “other.” Along with prepaid cards and money orders, "other" accounted for less than 9% of all payments in 2022. However, despite a decline in overall usage, paper checks are still widely used, with 11.2 billion checks written in 2021. Checks persist, of course, due to their convenience and the float period before they clear -- a routine "cushion" for many businesses and individuals.

As we noted earlier, "the decline of checks" is a bit overstated, particularly when it comes to B2B payments. From the most recent 2024 AFP Payments Fraud and Control Survey Report, "Seventy-five percent of survey respondents report that their organizations use checks, and nearly 70% of these organizations do not have plans to discontinue the use of checks over the next two years."

Using Bank Customers Feedback to Curb Check Fraud?

Commerce Bank has developed an innovative Texting for Check Fraud program that alerts customers to potentially suspicious check activity. The bank uses advanced fraud detection tools to quickly identify suspicious checks and sends a text message to the customer's registered mobile number.

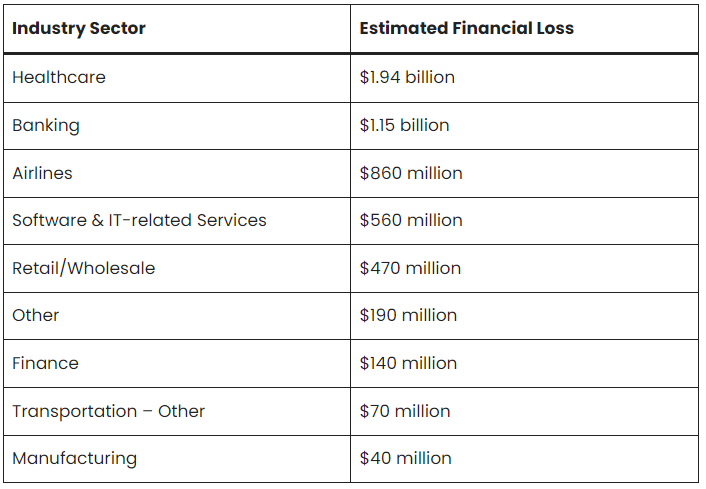

CrowdStrike Outage: Financial Institutions Experience an Estimated $1.15B Loss

A few weeks ago, the world was disrupted by the CrowdStrike outage -- with air travel, healthcare, and even the financial industry feeling the impact. Almost everyone knows someone who was somehow inconvenienced by the event, as a logic error in a CrowdStrike update -- not a hacking incident -- caused the "blue screen of death" to appear on many Windows systems, disrupting operations for widespread personal and business sectors.

NBC11 news reported that many large financial institutions reported no disruptions.

Eventually, however, the story unfolded over the several weeks and we did indeed see many banks of all sizes across many different countries reporting issues.

Arrest of Telegram CEO Pavel Durov Will NOT Deter Fraudsters

The internet buzzed with news that Telegram CEO Pavel Durov was arrested in Paris.

According to APNews:

Durov was detained in France as part of a judicial inquiry opened last month involving 12 alleged criminal violations, according to the Paris prosecutor’s office. It said the suspected violations include complicity in selling child sexual abuse material and in drug trafficking, fraud, abetting organized crime transactions and refusing to share information or documents with investigators when required by law.

Featurespace and OrboGraph Partner to Help Financial Institutions

Prevent Check Fraud Using World-Class Analytics and Image Forensics

Atlanta, GA, and Burlington, MA, July 23, 2024 – Global fraud and financial crime prevention company Featurespace has partnered with OrboGraph, supplier of check processing automation and fraud detection software and services, to better protect the financial services industry from check fraud.

According to data from the Financial Crimes Enforcement Network (FinCEN)*, check fraud is becoming more prevalent compared to other types of fraud, making up more than one-third of all fraud at depository institutions in 2023.

This partnership will see the two organizations integrate their fraud-detection services to significantly improve accuracy and efficiency in identifying and preventing fraudulent check activities for both deposit and “on-us” fraud (whereby a check or other transaction is deposited or processed by the same bank that issued it).

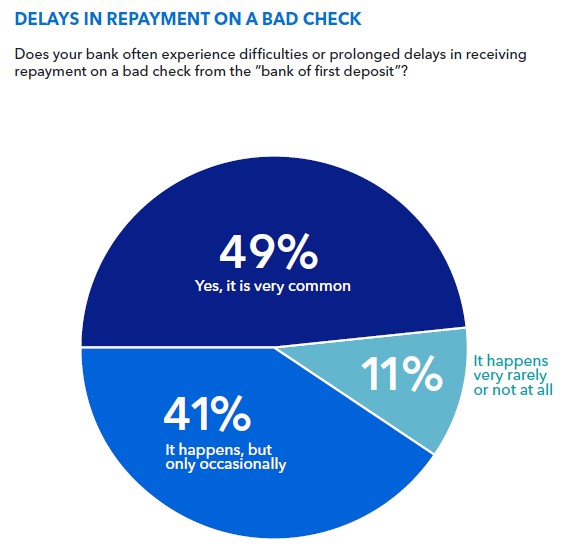

IntraFi Q2 2024 Bank Survey: 62% Support Shifting Liability for Check Fraud to BoFD

The recently released IntraFi Executive Business Outlook Service report makes it clear that check fraud has significantly increased, with 90% of community bankers reporting higher levels of fraudulent check-writing. Furthermore, 28% of community bankers noted an increase of over 50% in fraudulent check writing over the last three years.

One major factor concerns issues with repayments -- specifically when larger banks prolong the process of returning funds from fake deposited checks. Megabanks (those with assets over $700 billion) are identified as the primary source of delays in repayment on bad checks, with 59% of respondents pointing to them. Large regional banks (those with assets between $250 billion to $699 billion) were cited by 18% of respondents as contributing to repayment delays.

A majority – 62% of respondents to IntraFi’s survery – say that policymakers should address check fraud by shifting liability for the fraud to the BOFD, or “bank of first deposit.”

Checks Are Preferred Method For High Dollar Payments

PaymentsJournal reports that, in spite of news that Target stores have stopped accepting checks (joining other major merchants such as Whole Foods and Aldi), the "grand old payment method" is anything but going extinct.

Target cited “extremely low volumes” for the decision, which should not come as a surprise. According to 2022 data from the Federal Reserve Bank of Boston, only 1% of all retail purchases were made via check. However, there are still areas where check writing makes sense.

As PaymentsJournal goes on to explain, check usage has indeed declined in recent years, down from 18.1 billion checks written in 2015 to 11.2 billion checks in 2021...

Up Close and Personal: YouTuber Visits Scammer’s Operation

A recent YouTube video by Tommy G. offers a pretty comprehensive, 30-minute dive into the pervasive world of scammers. Various types of fraud -- including check scams, credit card fraud, and skimming devices used at gas stations -- are explored with actual scammers.

Early on an eerily hooded scammer meets with the filmmaker and explains -- keeping the hood on throughout -- how he got into the scam game, including a look at his first racket, which involved Telegram and checks.

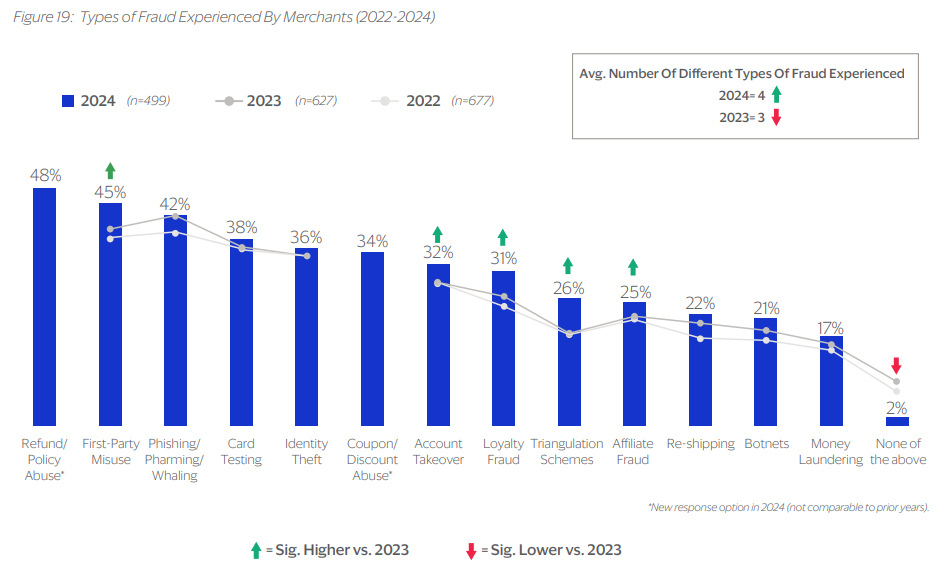

61% of Merchants Plan to Increase Spending on Fraud Tools and Technology

While our blog's main focus is the checks payment channel, it's worth taking a look at other payment channels and their fraud trends -- particularly from end-users (merchants).

The 2024 Global Fraud & Payments Report, conducted by Verifi and Visa Acceptance Solutions, provides key insights into the challenges faced by eCommerce merchants in effectively updating and refining their strategic approaches to payments and fraud management.

IBM: Open Banking Among Top 2024 Trends for Financial Services

We're beginning the second half of 2024, a great time to examine the trends of the year.

In a recent post, IBM examined what they consider the seven top financial services trends of 2024. They are as follows:

- Generative AI

- Hybrid cloud technology

- Cybersecurity risk management

- Sustainability

- Customer experience

- Open banking...

Warning: HELOC Check Fraud on the Rise

Many individuals within the banking sector and homeowners are familiar with a "Home Equity Line of Credit" or "HELOC" -- a type of second mortgage that allows you to borrow against the value of your home to make purchases as needed and repay them over time. While a HELOC is a great way to leverage the value of a home to do things like make improvements on your house, they are unfortunately not immune to fraud.

Writing Fraud-Proof Checks? Think Again…

Recently, Kiplinger Personal Finance Magazine posted a helpful article that explains how to safely write a check in a world where fraud is not only prevalent, but fairly easy to execute.

It may seem as though check-writing is becoming a lost art, but it remains a popular way to send money. A recent study from Abrigo, which makes fraud-prevention software, found that 61% of Americans still write checks.

Financial Institutions: Strategic IT Investments for Growth

A new article at Kiplinger examines how strategic IT investments and enterprise architecture innovation can drive transformative growth in the finance industry, highlighting several key strategies for financial services firms to leverage technology and achieve better business outcomes:

Financial services firms need to embrace the latest technologies to achieve better business outcomes...

ICBA Podcast: Community Banks Addressing Check Fraud Challenges

Scott Anchin, VP, operational risk and payments policy at ICBA, and David Long, Bryant Bank’s executive vice president, correspondent banking/capital markets, joined Charles Potts, host of the Independent Bank Podcast, to talk about some of the breakthrough efforts and approaches being applied to the growing problem.

The Podcast opens with a question by host Charlie Potts:

Who thought in 2024 we'd be talking about this [check fraud]? While this threat seems out of place in a world where cyber tax and data breachers grab all the headlines, in our industry, it's become a significant concern, especially post-pandemic, and it continues to grow in prominence today...