OrboNation Newsletter: Check Processing and Fraud – August 2025

Has a Reactive Approach to Check Fraud Backfired?

While various publications and other media point out the sharp increase in check fraud over the past few years, many industry experts pinpoint the start of check fraud over a decade ago. OrboGraph's own James Bi, Marketing Manager and Check Fraud Detection Specialist, has spoken at dozens of payment and industry events over the past 2-3 years, noting in his presentations that all the data points back to introduction of the EMV chip as "starting line" for fraudsters gravitating towards paper checks.

The reason? The industry largely ignored vulnerabilities in the check channel and delayed meaningful preventive investments -- equating to "easy pickings."

As noted in the chart below from our Understanding Check Fraud webpage, check fraud attempts in 2025 are projected to surge nearly 600% since 2014 with a CAGR of 19.1%.

How Fraudsters are Leveraging AI for Check Fraud

In a recent article, FOX News addressed the dangers of check fraud, going through the basics of how it's committed, while also explaining how AI is being utilized by fraudsters to alter checks ("check washing").

The surge in fraud reports reflects more than just isolated criminal acts. Organized crime rings are increasingly turning to check washing as a hybrid crime, blending old-school mail theft with new digital tools like AI. Fraudsters now use advanced technologies to forge identities, alter check images and exploit gaps in banking security, making check washing more sophisticated than ever.

Flaws of Traditional Positive Pay Highlighted in VALID Systems’ Webinar

Among those in tune with the check fraud landscape, there are some who strongly advocate Positive Pay as the solution to significantly reducing check fraud -- with a select few saying it can eliminate check fraud. And, while we advocate financial institutions' deploying Positive systems with all their corporate clients, we also understand that it has limitations and must stress that it cannot stop end check fraud alone.

Global Mule operators Adopt Adanced Fraud Schemes

Money mules are a major component of fraud operations of organized crime rings. From opening legitimate accounts at financial institutions to depositing and extracting funds, they can be characterized as the "foot soldiers" for these organizations. What many FIs need to understand is that these operations span across the globe, not just the United States. And, just like in the U.S., their tactics continue to evolve.

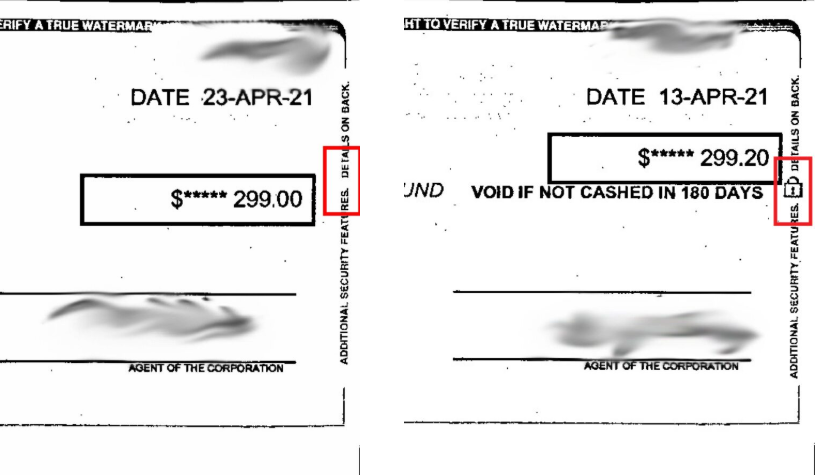

A Closer Look at Security Features on Paper Checks

A few weeks ago, we took a look at the re-emergence of check security symbols, noting that fraudsters -- attempting to maximize their counterfeiting output -- are either unable to recreate the security symbols or have decided it's not worth the effort.

After reading the post, several organizations and #FraudFighters reached out to us to provide additional information on the topic. Inquiries ranged from what security features are still visible after binarization to which are able to be analyzed by image forensic systems.

In the previous article, we noted a specific use case of a padlock icon within the border. This is just one method; there are dozens of other security features that are placed on checks, depending on which printer from which the individual or organization purchases their check stock. From the perspective of check fraud detection there are several types of security symbols that are flawed or erased during binarization, including microprinting, multi-colored backgrounds, and chemical reactive check stock.

Let's take a look at check security features and how they are analyzed by image forensic AI check fraud detection.

Federal Reserve Publishes Check Fraud Mitigation Toolkit

Recently announceed via LinkedIn, the United States Federal Reserve has created and published two new resources — the Check Fraud Mitigation Toolkit and Scams Mitigation Toolkit. Both are welcome tools, intended to "support education and increase awareness about scams and check fraud, enable the payments industry to better identify and fight them, and foster industry collaboration on fraud and scams mitigation."

Is Social Media Resurrecting Check Kiting?

Social media is known for resurrecting old trends, bringing nostalgia to the older generations and exposing them to the newer generations. Unfortunately, social media appears to be resurrecting some old fraud schemes as well, disguising them as "money hacks."

Core Banking: Integration, Not Reinvention

According to a recent opinion piece on the BAI website by Mike Nicastro, CEO and principal of Coppermine Advisors, LLC., the banking industry’s core challenge isn’t reinventing the core processing systems, but integrating them more effectively with modern, customer-facing technologies. Despite widespread dissatisfaction with legacy core providers, most banks are hesitant to switch due to the high costs, disruption, and risk involved in core conversions.

Transforming Technology – Legacy or Limitation?

According to a recent Samsung Business Insights article, banks are struggling to modernize their outdated legacy technology systems, which are holding them back from delivering the seamless, personalized customer experiences that today's consumers expect and demand. In fact, a survey found that over 53% of bank executives are concerned about their reliance on legacy infrastructure and the growing "technology debt" it creates.

Singapore’s Efforts to Eliminate Corporate Paper Checks — Will Results Mirror Other Countries?

Back on July 28, 2023, the Monetary Authority of Singapore (MAS) made an announcement to eliminate corporate cheques (checks) by the end of 2025. This announcement came with an aggressive timeline, which was amended back in December of 2024, where banks would stop issuing new check books to corporates by December 31, 2025 and cease processing of corporate checks on December 31, 2026.

RTP Adoption Hindered by Fear of Fraud

Widespread anxiety about fraud is hindering the full-scale adoption of real-time payments (RTP) in the U.S., according to a recent analysis by PYMNTS.

Many financial institutions (FIs), especially large banks, limit their participation in real-time networks to receive-only service, citing fears that fraud will surge as payment speed increases. In fact, 85% of payment professionals surveyed expect fraud rates to rise as RTP usage expands.