OrboNation Newsletter: Check Processing and Fraud – January 2026

Why Explainable AI is Critical for Fraud Defense

How large of a challenge was fraud in 2025? Well, according to the Gasa Global State of Scams 2025 Report, global fraud losses reached an estimated $442 billion, with nearly 70% of adults worldwide encountered a scam in 2025. With losses this massive, there is really no excuse for any individual or organization to ignore the problem.

With this in mind, WorldLine Financial Service has posted a new article on the five fraud trends to watch for in 2026 and beyond:

- Synthetic identities

- Deepfakes and real-time scams

- First-party and money mule fraud

- Account takeover

- Emotional scams

So, what tools are available to address the fraud problems?

Understanding the Technologies for Banking Automation

AI in financial services increasingly relies on machine learning to turn vast historical datasets into live decision engines. Analytics Insight, in its overview of AI in finance and banking, points out that banks train models on years of transaction, customer, and market data so algorithms can uncover subtle patterns and relationships, then use those patterns to forecast outcomes such as credit risk, churn, or likely product needs.

Penny for Your Thoughts: Penny Phase-Out Parallels Treasury Checks

On March 25, 2025, the current US administration signed an executive order entitled Modernizing Payments To and From America’s Bank Account -- with September 30, 2025 as the deadline for the issuance of paper checks for all government disbursements. The deadline has long past, and the US government has backtracked on this to ensure those who we know as "underbanked" or those who do not have access to online banking receive their payments.

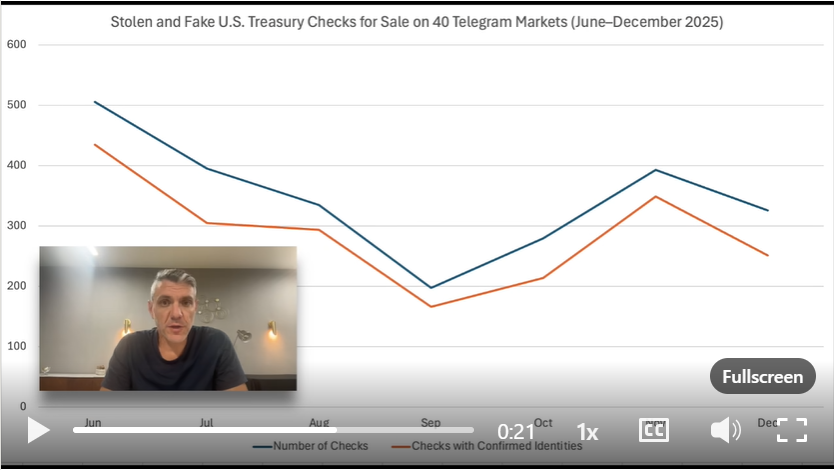

Stolen Check Prices Drop on the Dark Web — What It Means for Financial Institutions

Back in February 2025, The Trump administration announced plans to end penny production with the Treasury Department placing a final order for blank pennies in May. The Mint’s final production runs of circulation pennies took place in November 2025, ending a more than 230‑year run of one‑cent coin production.

Jackpotting: Fraudsters in the US Targeting ATMs for Latest Fraud Trend

Which deposit channel are you most concerned about when it comes to fraud? Each financial institution will have a different opinion due to their experience and geographic location -- but, for many, ATMs are ranked near the top. Some of the concerning factors include isolated location of the ATM, the ability for anyone to wear a face cover to avoid video detection, and the fact that they contain cash, which is almost impossible to trace.

However, as noted in a podcast by Bank Customer Experience Podcast, a fraud trend that has been circulating in Europe is reaching the United States -- and it's more concerning than ever.

ATM “jackpotting” has become the dominant form of ATM fraud in the U.S., driven by organized criminal crews exploiting technical gaps and human complacency. In the discussion, host Bradley Cooper and his guests describe jackpotting as the process of taking remote control of the dispenser, so the machine pays out cash on command.

Instant Payments: Implications for Real-Time Fraud Liability

Real-time payment platforms like FedNow are often framed as an elegant way to sidestep traditional check fraud, but the uncomfortable truth is that they mostly change the tempo of fraud, not its existence. Instead of weeks or days to exploit a bad check and move the money, fraudsters now get a clean exit in seconds.

Congress: Are Regulators Moving “Too Slow” to Address Check Fraud?

In August of 2025, we approached readers with the question: "Has a Reactive Approach to Check Fraud Backfired?" Most notably, we referenced an American Banker article that notes that the FED Vice Chair is finally taking action to find a solution for check fraud -- pointing out that "efforts by regulations have been slow to advance and seem to have done little to address this growing threat."

Platform Modernization Through Fintech/Core Provider Integrations

Fintechs are increasingly turning toward community banks and credit unions, and the fastest way to bring those innovations to market is through the core and item‑processing providers that institutions already use.

A recent PYMNTS Intelligence report entitled “Credit Union Innovation Readiness: How FinTechs Are Shifting Their Partnership Strategies,” a collaboration with Velera, found fintechs are now 19% more likely to partner with credit unions than a year ago, with nearly half of end‑user fintechs reporting at least one credit union partnership.

Stopping New Account Fraud — From Application to First Transaction

One of the major components of fraud are drop/mule accounts -- particularly when it comes to new accounts and check fraud. In fact, according to NICE Actimize's 2024 Fraud Insights report, new accounts experience 17X higher fraud rates.

Video: How Fraudsters Use Gen AI to Alter Checks in Seconds

Way back in 2023, we wrote a post about how generative AI will be a major tool for fraudster to create realistic counterfeit checks, noting that "It doesn't take too much imagination to see how fraudsters could use this readily available technology to quickly and efficiently create incredibly realistic checks."

In a recent LinkedIn Post, Uri Rivner, CEO and Co-Founder of Refine Intelligence, shares a shocking video showing just how easy it is for generative AI to assist fraudsters.

The Account Lifecycle Pattern Behind Today’s Check Fraud

Check fraud is no longer a simple paper-based crime; it has become a lifecycle threat that tracks closely with how long an account has been open and how well it has learned to “look” trustworthy.

In a recent Forbes Technology Council post, Rodney Drake of VALID Systems outlines how synthetic identities, sleeper accounts and stolen checks now converge with data-driven tactics, reshaping the risk landscape for financial institutions.