OrboNation Newsletter: Check Processing and Fraud – July 2024

Check Processing Industry Experiences Temporary Turmoil

The fintech and banking sectors are highly dynamic industries wherein even established vendors face leadership changes – including multiple vendors in check processing and fraud detection.

For example, several companies have replaced their CEOs, experienced compliance violations leading to internal audit, and faced investor confidence challenges leading to market volatility.

Additionally, we’ve seen upstarts fail without warning, such as the abrupt collapse of Synapse where banks’ customers were unable to access their accounts.

While fintech’s often boast breakthrough technologies, financial institutions (FIs) should balance innovation by thoroughly evaluating current and potential partners based on longevity, profitability, and reliability to mitigate disruption risks and ensure long-term success...

BAI Publishes Guide for Identifying and Preventing Check Fraud

Financial institutions (FIs) understand that there are several factors involved in creating a strong defense for check fraud. Even though fraudsters are exploiting contactless channels like ATMs and mRDC, there are still many examples of fraudsters going into a bank branch to deposit stolen/fraudulent checks (mostly through mules).

Recently, BAI published a handy guide entitled "Identifying and Preventing Check Fraud" to assist FIs in training its employees to spot fraudulent checks as well as provide an overview of some technologies that can assist in detection.

Cash Usage Following Same Path as Checks?

ATM Marketplace -- an organization with particular interest in paper currency -- asks the question: Will Cash Ever Go Away?

They note that cash usage in the U.S. declined from 26% of all transactions in 2019 to 19% in 2020 due to concerns over cleanliness during COVID-19. However, in 2021 and 2022, cash use leveled off at around 18-20% of all payments, indicating a potential "floor" for its usage.

So, has the "cash usage decline" leveled off?

Jack Henry’s 2024 Strategy Benchmark Report: 75% of FIs Indicate Check Fraud as a Major Concern

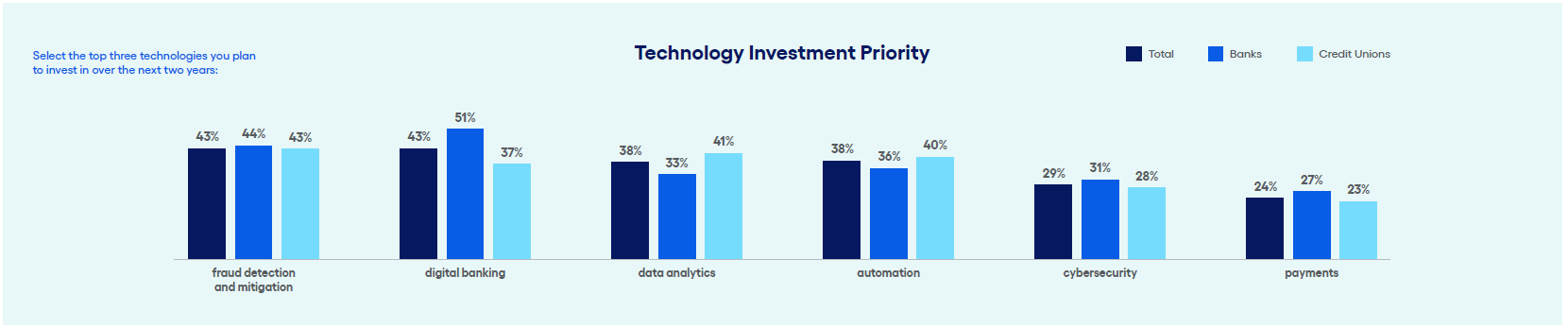

Our friends at Jack Henry & Associates have recently published the 2024 Strategy Benchmark report. Conducted between January and February of 2024, an online survey was distributed to core clients with responses from 127 bank and credit union CEOs -- representing a diverse sample of Jack Henry clients across the U.S., with assets ranging from under $500 million to more than $10 billion.

The reports that "80% of all financial institutions plan to increase technology spend over the next two years, but credit unions are more bullish on budgets."

37% of credit unions plan to increase technology investments between 6% and 10%, while only 30% of banks are targeting that investment level. Most banks (37%) plan to increase their investments between 1% and 5%.

Featurespace and OrboGraph Partner to Help Financial Institutions

Prevent Check Fraud Using World-Class Analytics and Image Forensics

Atlanta, GA, and Burlington, MA, July 23, 2024 – Global fraud and financial crime prevention company Featurespace has partnered with OrboGraph, supplier of check processing automation and fraud detection software and services, to better protect the financial services industry from check fraud.

According to data from the Financial Crimes Enforcement Network (FinCEN)*, check fraud is becoming more prevalent compared to other types of fraud, making up more than one-third of all fraud at depository institutions in 2023.

This partnership will see the two organizations integrate their fraud-detection services to significantly improve accuracy and efficiency in identifying and preventing fraudulent check activities for both deposit and “on-us” fraud (whereby a check or other transaction is deposited or processed by the same bank that issued it).

U.S. Postal Workers Caught Stealing $40 Million in Treasury Checks

Another story of mail theft -- this time, an inside job.

NBC New York’s Gus Rosendale reports that several postal workers were arrested after being accused of stealing checks -- and, we're not talking about hundreds or thousands of dollars; these were U.S. Treasury checks worth millions.

Detectives with the NYPD tell us they were initially tipped off by a bank that red flagged suspicious deposits. They ended up joining forces with federal authorities, and that joint effort led to arrests earlier today.

Podcast: For Modern Banks, Evolution Leads to Customers As Key to Success

Michael Haney, head of product strategy at Galileo Financial Technologies, recently spent time with Hal Levey, senior writer at PYMNTS, discussing the fact that banking infrastructure has undergone a significant evolution over the past few decades -- an evolution that’s important to both customers and their money.

Mr. Haney explained:

"There's a misperception about bankers and banking. That misperception is that money — in all its forms — is the most important asset. The reality is that customers are the most important asset, because if there are no customers there is no money."

Which Type of Check Fraud Has Been Most Common Over History?

Did you know that the origin of checks can be traced back to 312 BC? Would it be a surprise that, even back then, fraud was rampant? According to a historical record from CrossChecks:

321 – 185 BC: A letter of credit called 'adesha' was used by merchants in ancient India when presented to a banker from a third party. The nature of these written documents (i.e. promissory notes) left the door open for forgery and counterfeiting. Criminals could easily forge the documents or create counterfeit versions to defraud third parties or banks.

Now, an informative chart posted on LinkedIn by Denise Calisi, SVP, Regional Manager, Wealth Management Metro Detroit at Comerica Bank, depicts the three most common forms of check fraud.

OrboGraph Announces Open Consortium Strategy at Innovation Conference,

Initiating with Advanced Fraud Solutions TrueChecks®

Burlington, MA, June 11, 2024 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, announced the successful integration of Advanced Fraud Solutions TrueChecks® within its OrboAnywhere Sherlock 5.3 release as part of an open consortium strategy to reduce deposit and on-us fraud across the industry. The AFS check consortium mega-metadata currently consists of fraud information from over 2,500 financial institutions, 25,000 routing numbers, and nearly 100 million accounts represented in total.

LexisNexis: UK Firms Spend the Equivalent of £21k Hourly to Fight Financial Crime

While we focus on fraud in the US, it's important to understand fraud trends across the globe as well -- these markets can bring valuable insights.

A recently released report by LexisNexis, working in collaboration with leading research agency Oxford Economics, reveals that UK firms spend the equivalent of £21k (roughly $26,625 USD) hourly to fight financial crime.

We carried out in-depth qualitative surveys of over 300 UK firms to quantify spend and split of activities across the full range of compliance obligations, exploring how people and technology are employed in the fight against fraud and money laundering and asking the question: is the sector doing enough of the right things?

Fraud Helping Kill Pay-by-Check in Stores

As noted far and wide via media, Target has stopped accepting personal checks due to what they call "low usage." Instore Media took a look at this new development and its relationship to check fraud.

Business school professor Jay Zagorsky, writing on The Conversation.com, argues that fraud is another major reason retailers are shying away from taking checks.

Statistics from The U.S. Treasury Financial Crimes Enforcement Network back him up, indicating a near doubling of check fraud cases from 2021 to 2022. Merchants suffer dual financial losses from check fraud – they lose merchandise and incur fees from banks for returned counterfeit checks. Counterfeit checks presented at cash registers are a primary source of check fraud, easily produced using graphics software and high-quality printers.

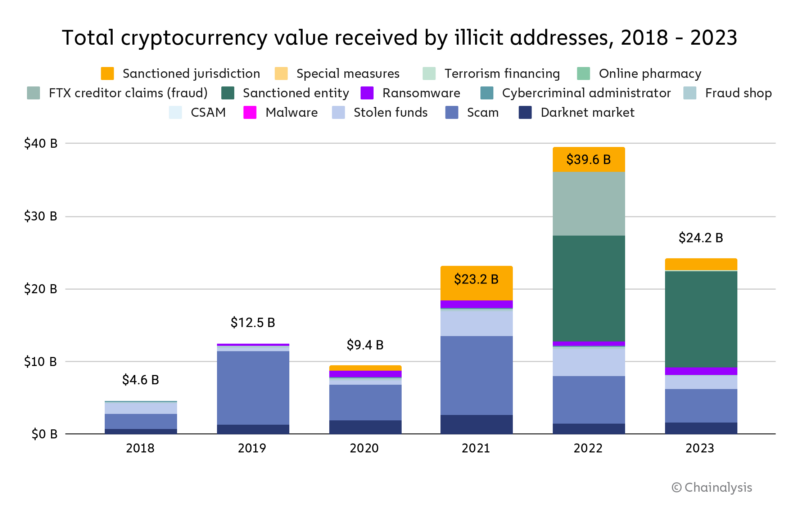

FinCEN Warns of Increasing Use of Crypto for Money Laundering… But, How Bad Is It?

On June 20, 2024, the US Financial Crimes Enforcement Network (FinCEN) issued an updated advisory to US financial firms that Mexican drug cartels are increasing their utilization of cryptocurrency to purchase chemicals for drug manufacture.

According to FinCEN, criminal organizations in Mexico are “increasingly purchasing fentanyl precursor chemicals and manufacturing equipment” from suppliers based in China, with payments often conducted via digital assets.

FinCEN urges that financial institutions beef up detection of crypto transactions within their AML programs. While this is a strong use case for how cryptocurrency's assist criminals in illegal activities, is the government -- and, in turn, the media -- overstating the problem?