OrboNation Newsletter: Check Processing and Fraud – November 2024

Check Fraud Detection: The Intersection of Forensic Document Examination and Image Forensic AI

OrboGraph's Marketing Manager and Check Fraud Detection Specialist James Bi was recently a featured speaker at the 2024 Scientific Association of Forensic Examiners Conference (SAFE) International Conference, a global gathering of forensic document examiners. Mr. Bi delivered a compelling presentation focused on the evolving landscape of check fraud and how OrboGraph's OrbNet Forensic AI was developed using the 21 discriminating elements or principles forensic document examination.

Check Consortiums: The Advantages of Open Models for Fraud Detection

Consortiums have been a major resource in the fight against check fraud. Many financial institutions are leveraging consortiums like Advanced Fraud Solutions TrueChecks and Early Warning Systems as part of their deposit fraud detection.

An article from Global Fintech Insights notes that, while Fintechs are increasingly turning to fraud consortiums to bolster their defenses against more and more sophisticated fraud attacks, these consortiums come with their own set of challenges.

How Trump’s Administration May Affect Payments Policies

The election of Donald Trump as President will have a significant impact on the payments industry, reports Payments Dive. His administration will have the opportunity to revamp federal government approaches to emerging payments technologies and services.

With payments processes caught up in rapid change, new laws and regulatory policies put forward by his administration will be influential, for better or worse, in creating a climate in which new digital payments and cryptocurrency schemes will develop. His administration will also be referees for the environment in which new fintechs, such as Stripe and Block, take on larger legacy companies, like Visa and Amazon.

Supercharging Positive Pay Systems to Combat Check Fraud

Positive pay is not a new innovation for fighting check fraud. Many financial institutions offer this service through Treasury Management; with the increase in check fraud, many businesses have deployed this solution to mitigate check fraud losses.

As noted in a blog post from our friends at Advanced Fraud Solutions:

Standard Positive Pay: This basic form of Positive Pay service matches the check number, dollar amount, and account number of each check presented against a list provided by the business. It ensures that only checks with matching details are processed.

Congratulations to Peter Shortino — Certified AML and Fraud Professional (CAFP)

Education and certifications are important achievements for anyone in the banking industry. Here at OrboGraph, we encourage our team members to continually improve their knowledge base and seek out opportunities for professional accreditations.

This includes OrboGraph's Chief Strategy Officer Joe Gregory, who earned his National Check Professional (NCP) certification. Most recently, OrboGraph's Fraud Implementation Engineer Peter Shortino received AML and Fraud Professional Certifications (CAFP) from the American Bankers Association.

Peter and James Bi, OrboGraph's Marketing Manager and Check Fraud Detection Specialist, attended the ABA's AML and Fraud School this past August. Peter completed his certification in early November, passing the rigorous final exam; James is looking to complete his certification later this month.

Please join us in congratulating Peter on his tremendous accomplishment!

Peter Shortino

Fraud Implementation Engineer

Connect on LinkedIn →

Claude.AI’s New Analysis Tool a “Game-Changer” for Fraud Fighters?

For nearly a decade, we've heard about the potential of artificial intelligence for the bank industry and how it is a "game-changer." For checks processing and fraud detection, we've seen many major innovations -- from behavioral analytics to image forensic AI.

In the past few years, the potential for ChatGPT to be used in fraud detection has been discussed. As noted by Dataleon:

ChatGPT can effectively detect real-time fraud by analyzing text-based data, such as emails, chat messages, and social media posts. By analyzing the text in these communications, it can identify patterns and anomalies that may indicate fraudulent activity.

Farmers Contribute $203B to US GDP — Mostly Paid by Checks

In a new blog post and video, PYMNTS points out that "the only thing bigger than the agriculture sector’s contribution to daily sustenance could be its reliance on paper payments."

In 2023, agriculture, food, and related industries contributed a staggering $1.5 trillion to the U.S. GDP, representing about 5.6% of the total economy. Despite this major economic role, farmers — who contributed $203 billion to that figure — are still primarily relying on an outdated method of handling their finances: paper checks.

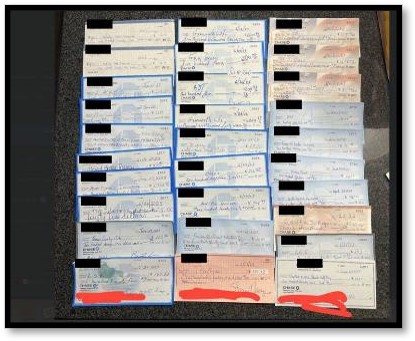

Nearly 20,000 Stolen Checks Worth Over $485M Found on Telegram

In order to commit check fraud, the first step for a fraudster is simple: obtaining a legitimate check. Sure, a fraudster can purchase blank check stock, but they still need to obtain the routing and account numbers to print onto the check stock. This is why the majority of stolen checks are obtained via USPS mail.

But, how many stolen checks are available for purchase on the dark web. Well, Dr. David Maimon -- now SentiLink's Head of Fraud Insights -- recently took a "deep-dive" into some of the "darker" Telegram channels.

Solving Paper Check Fraud’s “Weakest Link” … Paper Checks Themselves?

We have previously noted that the rise in check fraud can be traced back to the deployment of EMV chips back in the mid 2010's -- by securing debit/credit card transactions in this manner, fraudsters were forced to move to a different, less secure payment channel. At the same time, for decades it became "common knowledge" that checks are dead, a sentiment held by many in the industry that led to a lack of urgency to improve and secure the channel and little to no investments from financial institutions.

While it's true that check volumes have continued their slow decline, many businesses and even entire industries still utilize checks as their preferred payment, in spite of costs between $3 and $8 to create, send, and manage them, according to a recent interview from PYMNTS.com. In the interview, Karen Webster, PYMNTS CEO, spoke to Rusty Pickering of Ingo Payments about the topic of check fraud.

The “Open Banking Era” Begins as Financial Data Rights Rule Finalized

As we noted previously, Open Banking is a hot topic for financial institutions. It allows consumers to share their financial data with third-party providers and enables access to a wider range of financial services. It's popular all over the world, but only recently emerging in the United States

Global Government Fintech reports that the U.S. Consumer Financial Protection Bureau (CFPB) has finalized a transformative open banking rule under the Dodd-Frank Act, enabling consumers to control their financial data and share it with third-party service providers. This initiative aims to increase transparency and competition within the financial sector, granting consumers more freedom to choose services that best fit their needs.

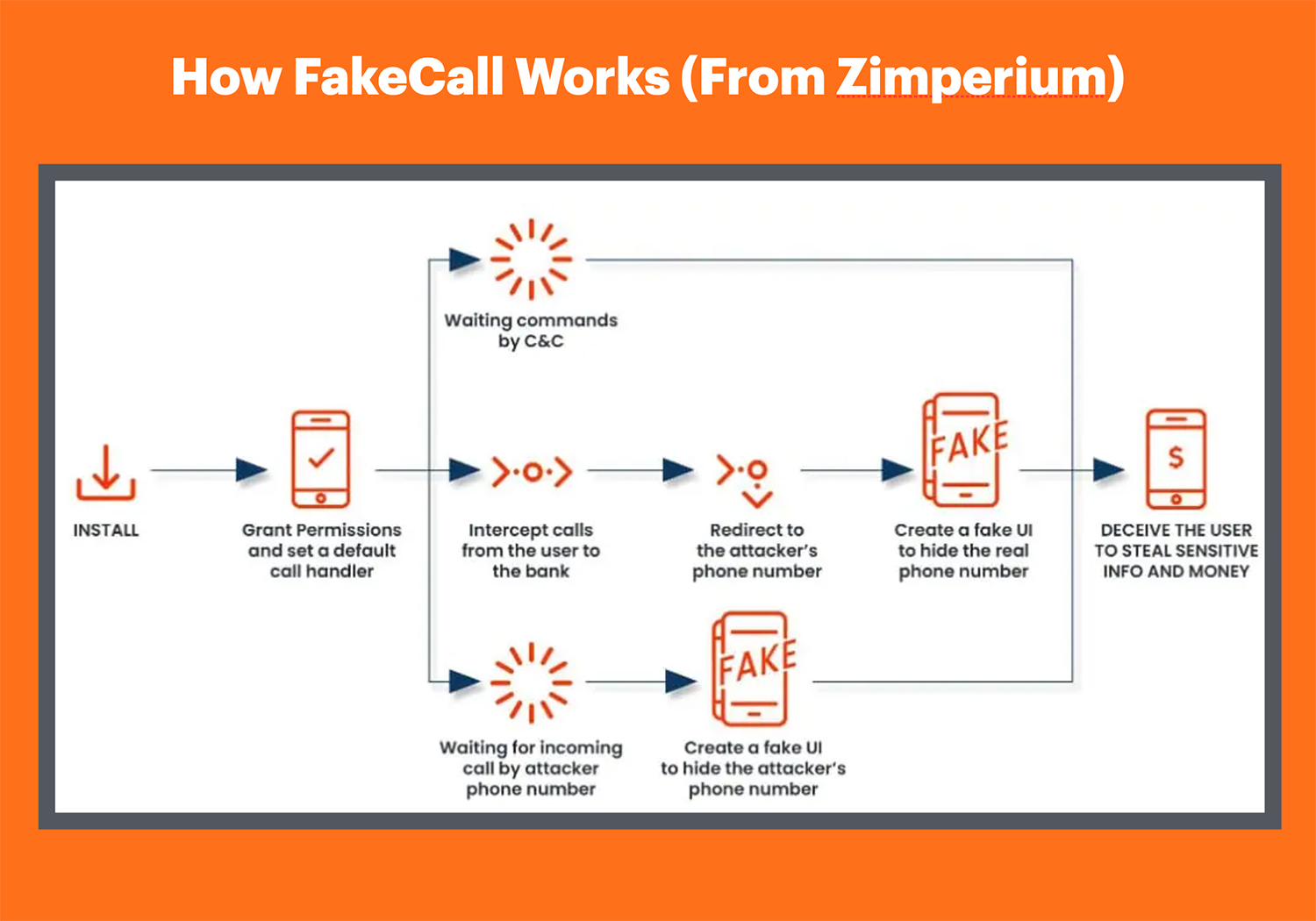

“FakeCall” Malware for Android Phones Intercepts Calls to Your Bank

During the pandemic, we saw a shift of banking customers -- who, at the time, could not or would not go to their local branch -- utilizing their mobile phones for daily banking. This behavior has continued to this day, as banking apps make it convenient for everything from determining balances to depositing checks.

Unfortunately, mobile phones users, specifically Android, have a new dangerous threat...

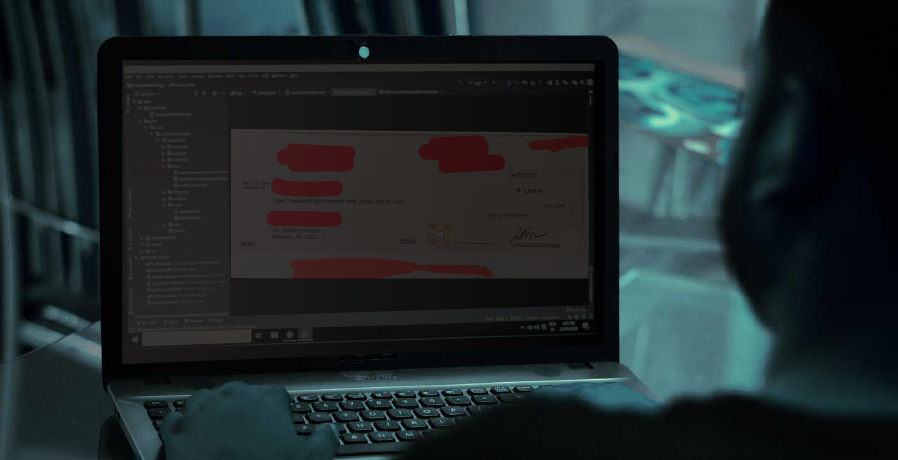

AI in Check Fraud: Are Fraudsters Staying One Step Ahead?

Recently, OrboGraph's Marketing Manager and Fraud Detection Specialist, James Bi, had an interesting conversation with an industry expert on mRDC and Check Fraud. The expert noted that "Fraudsters are one to two generations ahead of financial institutions when it comes to leveraging new technologies such as AI."

This seems to be the case. Payments Dive notes in a recent Payments Brief that, as artificial intelligence (AI) becomes more advanced, it's creating a paradox in the world of financial fraud. On one side, banks and payment processors are using AI to better detect and prevent fraud. However, on the other side, sophisticated criminals are also leveraging AI to create more convincing and harder-to-detect scams.

Intelligent Banking and the Future of Finance: Forbes’ Insights on Digital Transformation

Derek White, the CEO of Galileo, a fintech pioneer with over 20 years of experience modernizing financial services globally, recently contributed his thoughts via Forbes regarding how to "future-proof" banking -- primarily via a transition from digital to intelligent, or AI.

The banking industry is undergoing a major digital transformation, he notes, with traditional banks losing ground to digital-first competitors. The last four years, in fact, have seen digital banks and fintechs increase their share of new checking accounts from 36% to 47%.

Many Americans Believe Checks are More Secure Than Digital Payments…Are They Wrong?

Over the past several months, it's been suggested by industry experts and technology vendors that the "checks are dead" sentiment has lead to the surge in check fraud -- and fraudsters took full advantage of.the lack of investment by financial institutions to secure checks as an active payment channel.

Well, PaymentsJournal observes that, despite the rise and popularity of digital payments, paper checks are still widely used -- which will continue to make check fraud a major threat to individuals, businesses, and financial institutions. In fact, over half of Americans wrote a check last year, and many organizations rely on them for payments.