Blog Post

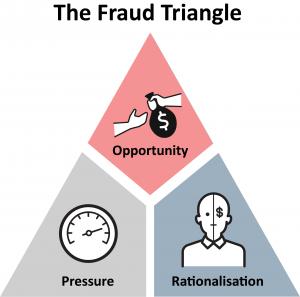

An ex-fraudster provides inside information on fraud methods Checks are a target because they are inexpensive to spoof Fraudsters have favorite targets Recently, we covered insider check fraud and the reasons individuals perpetrate it — even when they may not need the money. But what about the other side of the coin? The professional fraudster…

Read MoreCheck alterations by employees can be an issue City government employees sometimes alter checks to pay themselves They are usually small amounts and therefor rarely attract attention Over the past year, most of the media coverage has spotlighted post office insider check fraud — where a postal employee is responsible or part of scheme to…

Read MoreCheck fraud is surging, particularly in business transactions Check fraud has a reputation as a low- or no-tech scam Scammers are “graduating” to high-tech strategies Abrigo’s new and informative downloadable PDF, Check Fraud: New Tech Driving Old School Scam by Kate Stoneburner, is a succinct look at the ways in which modern scammers are deploying…

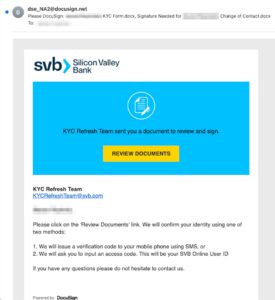

Read MoreIntroducing the “Threat Actor” Threat Actors respond to news trends and resultant anxiety The fall of Silicon Valley Bank is the newest boon for Threat Actors The Cloudflare Blog takes a look at the activities of a specific category of fraudster, the Threat Actor, in relationship to news events like the collapse and takeover by the…

Read MoreAite-Novarica Group fraud executives at Aite-Novarica Group’s 2022 Financial Crime Forum Check fraud and scams are growing disproportionately to other forms of fraud In spite of check fraud growth, some banks remainl hesitant to invest in anti-fraud technology Aite-Novarica Group’s expert, Trace Fooshée, shares their research to help fortify fraud platforms via Fraud Trends for…

Read MoreMobile remote deposit capture, or mRDC, is wildly popular among banking consumers – and why not? Upon receipt of a paper check, rather than having to travel to a local bank branch to deposit the money into an account, today’s bank consumer has only to sign the check and use their smartphone to photograph it…

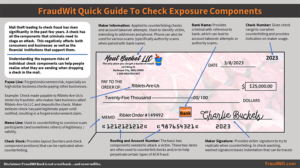

Read MoreChecks contain many “exposure components” Fraudsters can use one of more of these components to instigate theft Banks that deploy image forensic AI tech can greatly reduce these fraud opportunities Stolen checks continue to be one of the major events covered in today’s media — specifically when it comes to assaults and robberies against mail…

Read MoreFinCEN reports a large increase in check fraud They characterize it as a “nationwide surge” Physical checks via mail theft seem to be favored targets The Financial Crimes Enforcement Network (FinCEN) has made it clear: There is a nationwide surge in check fraud, and it is targeting the US mail. “Criminals have been increasingly targeting…

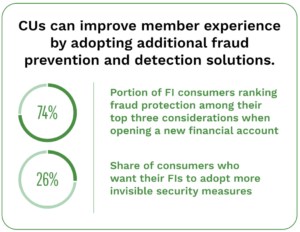

Read MorePYMNTS.com reports that there is a fairly glaring disconnect between credit unions and their members when it comes to fraud concerns. While members see a real threat, CUs do not seem to be responding in kind: Despite the growing fraud risk and subsequent member concern, many credit unions (CUs) do not appear to be actively…

Read MoreFraud has grown from creating TENS of millions in losses to HUNDREDS of millions Fraudsters can sell their wares digitally Now there are even refunds made available by fraudsters selling to new criminals Suparna Goswami, associate editor at the ISMG network, recently spoke to David Maimon, professor of criminal justice and criminology at Georgia State…

Read More