Podcast: Interview with Ex-Check Fraudster Turned #FraudFighter

- An ex-fraudster provides inside information on fraud methods

- Checks are a target because they are inexpensive to spoof

- Fraudsters have favorite targets

Recently, we covered insider check fraud and the reasons individuals perpetrate it -- even when they may not need the money. But what about the other side of the coin? The professional fraudster who is perpetrating check fraud as a business?

Over the past few years, we have covered many stories on different scams and the criminals perpetrating the fraud, including:

- Ermenildo “Ernie” Castro, a 28 year-old software engineer, whom took inspiration from the movie Office Space to perpetrate fraud

- Former mortgage broker and admitted mortgage fraudster Matthew Bevan "Matt" Cox who perpetrated check fraud in conjunction with mortgage fraud

- YouTuber Pleasant Green going undercover to be the "personal assistant" to a fraudster

- A Florida man using a desktop printer to pay for a Porsche

- And, of course, we cannot forget the Nigerian Email Scammer Ramon Olorunwa Abbas, aka "Hushpuppi",

Now, we are taking a deeper dive into the story of ex-fraudster turned #FraudFighter Alexander Hall. Mr. Hall took the time to do an exclusive interview with The Loss Prevention Magazine Podcast, detailing the ins and outs of check fraud. He describes, from set-up to recruiting, how inexpensive and profitable this sort of fraud can be -- and why, therefor, it's important to have effective defenses in place.

Pivoting from Credit/Debit Cards to Checks

The first question of the interview is, of course, what drew Mr. Hall to check fraud?

"The difference between what it takes to counterfeit a credit card, versus what it takes to counterfeit a check. When we talk about cards, when you consider the hardware that's required -- you, one, need the card information, whether it's track information, the account number and CVV number to duplicate a physical representation. Going down the physical path, you need the card stock, you need a reader/writer, you need an embosser, you need a 'tin tipper' -- or whatever it's called professionally, that what we used to call it -- you need all of these items to line up. At the end of it, if you buy everything brand new, you're in for thousands of dollars."

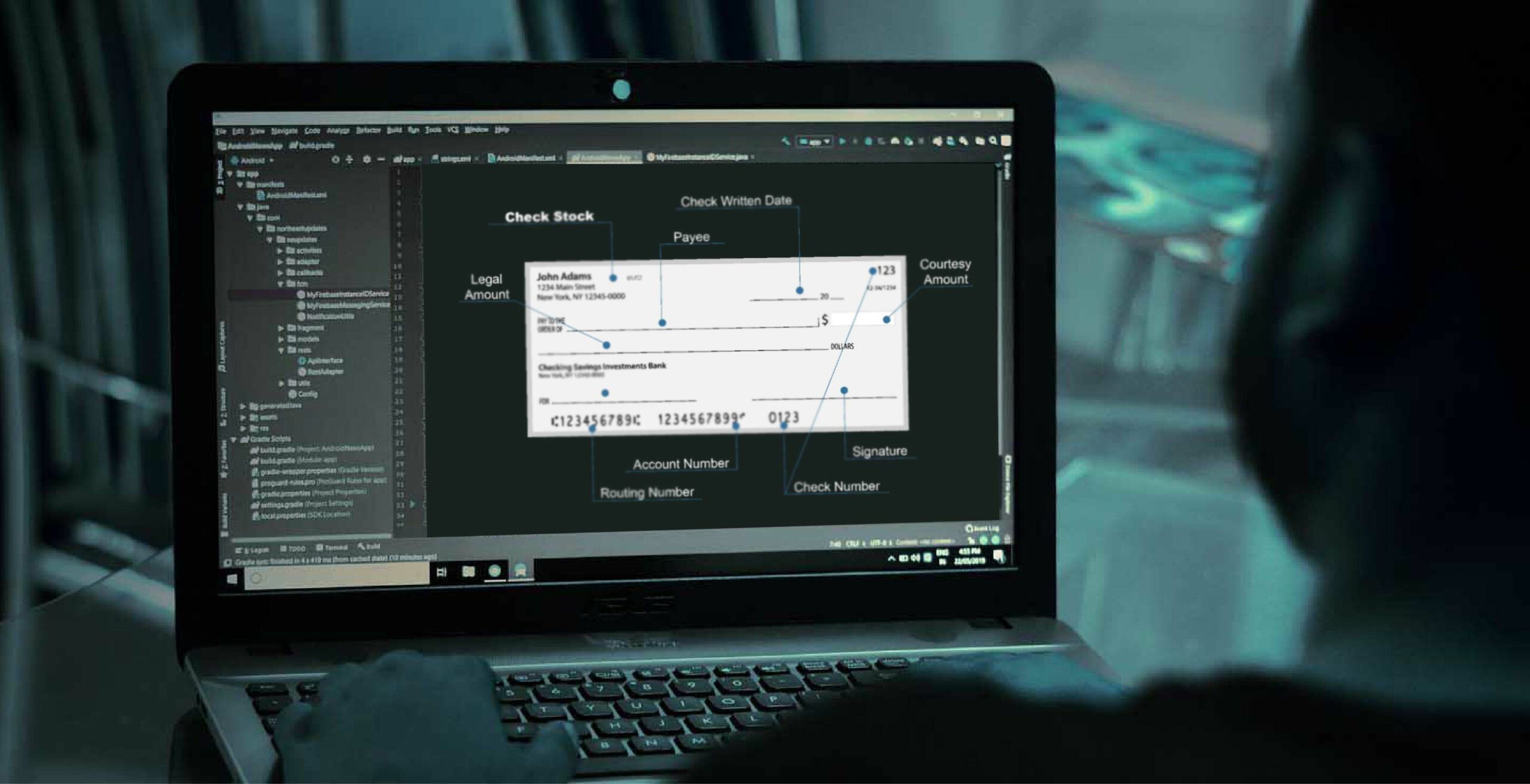

He then noted what he called the "stark contrast" of up-front expenses between credit card fraud and check fraud, which requires "a box that you can pick up in-store locally" for blank checks, an ink-jet or laser-jet printer, plus the information that can be extracted from any other check.

"That, all-in, can be... three, four hundred dollars."

This is the case for many fraudsters, as since the deployment of EMV chips in credit/debit cards, fraudsters are pivoted to checks.

Check Fraud: The In's and Out's

Checks are still widely used in the US. While many individuals have shifted towards digital payments, there are many who still use checks for things such a groceries, rent, utilities, etc. And, as Mr. Hall notes, merchants still accept them as payment::

"What got me into it was, I put together the dots, there are many merchants who still accept checks -- they don't want to alienate the older generation that still wants to pay with checks, and they still have to accept payments from businesses," Hall said. "They have to cash paychecks, they have to cash checks that are being handled for interpersonal transactions, payday loans."

It is highly viable and very cheap, Hall noted, to reproduce what is effectively an identical, undetectable end result. He started with washing, using chemicals that can be purchased at big box stores. When he noticed that the caustic chemicals roughed up the checks, he began working from scratch, using boxes of blank check stock readily available at office supply stores. The third option leveraged business checks and the manner with which they are printed, which allows the ink to be effectively (and fairly easily) scraped off with a razor blade because they are typically printed with laser-jet toner.

As described above, Hall started with altering checks to perpetrate fraud. What made this more difficult for him is that mRDC was not yet popular in the US -- which made the checks harder to pass visual inspection by a human. This is where he pivots from alterations to counterfeits.

Hall would find "good" accounts by accessing transaction histories via the account information he lifted from the checks and, perhaps, the last four digits of the check owners social security number, actually contacting the depositor's bank to learn what kinds and amounts of transactions can "sneak by."

Hall went on to explain that all targets are not alike. Experienced check fraudsters, in addition to doing proper preparation, target some accounts more than other others. His "top three" are:

- Doctor's offices that offer elective procedures

- High-end leasing agent offices. "People would drive trucks through windows, steal the entire file cabinet and come out."

- Furniture stores that offer in-store financing

Take-Aways from the Interview

There are many things banks can take away from the interview. Here a few highlights:

Fraudsters are always evolving their methods

As seen in the interview, fraudsters continue to change the way they operate -- shifting from credit/debit cards to checks, pivoting from altering checks to counterfeits, etc. Banks need to keep on top of the trends and take a proactive, rather than a reactive approach to their fraud strategies.

Check Fraud is Easy to Perpetrate

Hall notes key reasons why check fraud is easy for fraudsters to perpetrate -- whether it the low entry costs, the ease in acquiring stolen checks, and how stolen checks contain a vast amount of information. Banks are in the unenvious position of having to ensure that not only are their customer's funds safe, but also their information -- putting a focus on detection of check fraud being perpetrated, but also preventing account takeovers or false new accounts.

Check Fraud is Detectable

After listening to the entire interview, a seasoned fraud professional can see that the tactics used by fraudsters are not foolproof. Banks need to take a look at their internal policies and the technologies they are deploying to stop fraudsters in their tracks -- including the utilizations of behavioral analytic systems complemented by image forensic AI. This enables banks to detect anomalous behaviors and transactions on accounts, while also analyzing the images of checks for key indicators of alterations, counterfeits, and forgeries.

Fighting fraud is going to take a considerable effort from the whole banking industry, not just single organizations or individuals. That's a major reason OrboGraph is hosting its first, in-person Check Fraud Roundtable on May 22-23, 2023 at the Hilton Charlotte Airport. If you are interested in participating in the meeting, use the link above to register!