OrboNation Newsletter: Check Processing Edition – January 2022

Keeping Your Bank Up-to-Date with American Banker’s Top Trends for 2022

As we start off the new year, an article from the American Banker highlights seven bank trends to watch in 2022. The key, according to their analysis, is providing ultraconvenience to customers.

As you take a look at the list, we strongly recommend you compare the trends to your bank's plans for the new year....

Modernization in Action at Viewpointe

American Banker sheds some light on an example of modernization in action at Viewpointe, which was founded by big banks over 20 years ago primarily to store digital images of checks. When the physical transportation of checks temporarily halted after 9/11 -- compounded by legislation known as Check 21...

Post-Pandemic Fraud: Be Proactive, Not Reactive

James Ruotolo, a senior manager in the fraud and financial crimes practice at Grant Thornton, contributed a valuable article to ABA Bank Compliance magazine which discusses ways in which potential fraud victims can turn the tables and actually "play offense" against the fraudsters.

An interesting observation Mr. Ruotolo makes is that pandemic stimulus frauds are likely to "usher in a new generation of fraud actors" who will use newfound techniques on more traditional targets when the pandemic benefit programs cease -- making 2022 fraud risk even higher for most FIs than in the past.

Credit Unions Must Leverage Advanced Tools to Curb Fraud

PYMNTS.com takes a look at how the pandemic has forced consumers to "rush to digital channels to tackle daily tasks including grocery shopping, handling healthcare appointments and meeting banking needs." Consequently, businesses and organizations have been forced to keep up with this tech shift -- or watch their consumers switch to digitally savvy competitors...

Black Market Chat Rooms: A New Source for Check Fraud

Many of us in the banking industry rely heavily on check fraud data from various industry sources such as the American Bankers Association (ABA), Association of Financial Professionals (AFP), and various banks or other industry third parties. These are not the only sources of valuable information on the rise of check fraud.

Dr. David Maimon is the founder and and director of Georgia State University’s Evidence Based Cybersecurity Research Group, which has been created to learn what works and what doesn’t in preventing cybercrime.

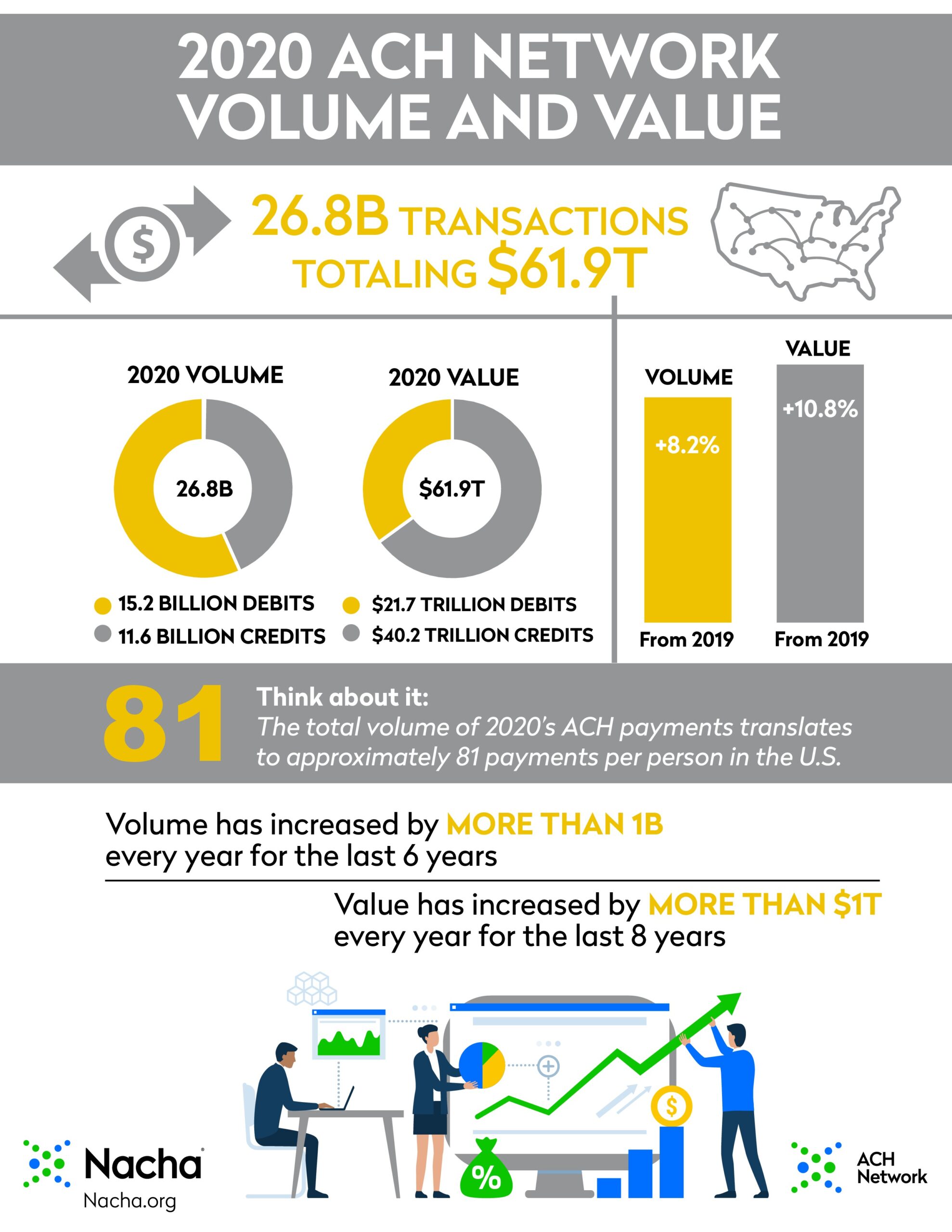

ACH Sees Record Growth to 19.4% of Payments During Pandemic

The COVID-19 pandemic has impacted almost every facet of the lives of individuals, as well as how business operates. This also includes how payments are made. With businesses shuttering offices and many millions of jobs moving to hybrid or fully remote positions, the way individuals and businesses make payments for goods and services has changed in a significant manner.

Digital Transactions reports on the latest payments data released Wednesday by the Federal Reserve Payments Study, showing an interesting shift.

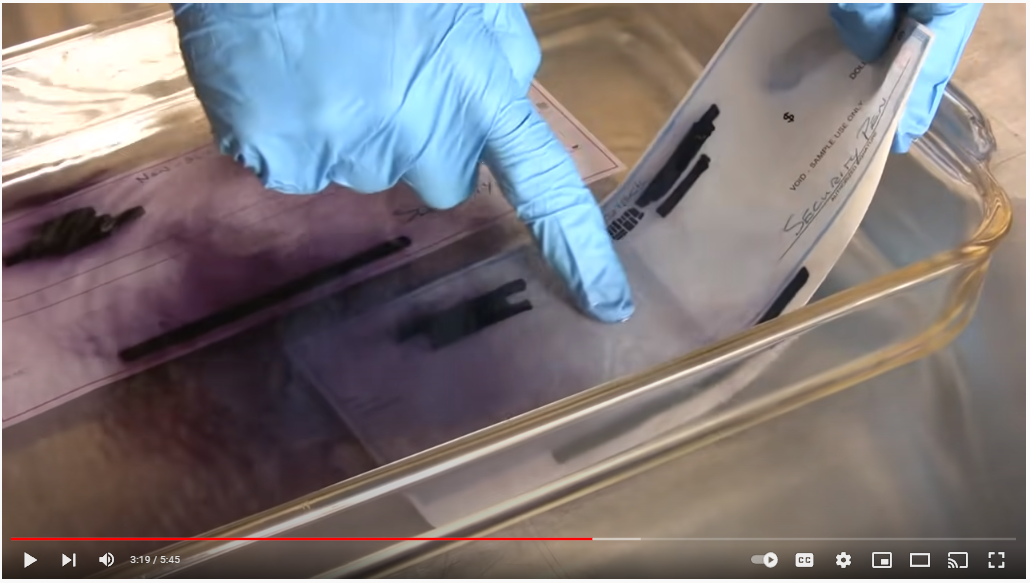

Check Washing is Still Prevalent…How Can Banks Catch It?

Since checks are most often delivered by mail -- via what are generally non-secure receptacles that can be emptied by any sticky-fingered thief willing to open a public mailboxes or stolen directly from home mailboxes --- they are extremely vulnerable to what is known as "check washing." This scam involves a person illegally obtaining a check and then utilizing chemicals to remove ink and change certain fields (typically the payee and amount).