Check Processing Industry Experiences Temporary Turmoil

The fintech and banking sectors are highly dynamic industries, wherein even established vendors face leadership changes – including multiple vendors in check processing and fraud detection.

For example, several companies have replaced their CEOs, experienced compliance violations leading to internal audit, and faced investor confidence challenges leading to market volatility.

Additionally, we’ve seen upstarts fail without warning, such as the abrupt collapse of Synapse where banks’ customers were unable to access their accounts.

Fintech Partnerships: Balancing Risk and Reward

While fintech’s often boast breakthrough technologies, financial institutions (FIs) should balance innovation by thoroughly evaluating current and potential partners based on longevity, profitability, and reliability to mitigate disruption risks and ensure long-term success.

Companies like OrboGraph, with nearly 30 years in business, demonstrate this balance through:

- Stable leadership

- A continuous innovation and technology roadmap

- High customer satisfaction

- Consistent profitability

Serving over 4,000 FIs and other entities, OrboGraph’s success is rooted in these factors emphasizing strong client relationships.

OrboGraph is regarded as the leader in check fraud within the financial industry. Most recently, OrboGraph has fielded guest speaker invitations from a variety of industry associations and events, including:

- The Clearing House – ECCHO

- American Bankers Association

- NACHA

- Wespay

- MACHA

- UMACHA

- Southern Financial Exchange

- NEACH

Leadership Stability

FIs should consider a fintech’s leadership experience within the industry and with their respective organization, along with their tenure. This assures FIs of stable operations, a commitment to innovation, and a strong partnership.

Changes in leadership can signal issues within an organization, including financial struggles, mismanagement of resources, and loss of confidence from internal and external stakeholders. This will directly affect the quality of products/solutions/services that are provided to their customers. Furthermore, new leadership can lead to changes in priority for the organization -- which can impact customers, particularly if the organization escalates pricing to increase profits to satisfy investors or reorganizes internal resources, leading to lack of communication with their customers.

This is a major reason why financial institutions and leading fraud review platforms choose to partner with OrboGraph. OrboGraph has over 28+ years of experience in the check processing and fraud detection industry. Our senior leadership team combines for over 150+ years of industry experience, while also boasting continuity for over a decade – meaning minimum internal struggles with a focus on customer service and innovation.

Additionally, OrboGraph employees contribute to stability of operations. The average tenure of OrboGraph employees exceeds well over 10+ years, with many team members exceeding 15 years with OrboGraph. When customers reach out to OrboGraph, they are greeted with familiar faces and names that have been associated with their accounts from the beginning.

Continuous Innovation

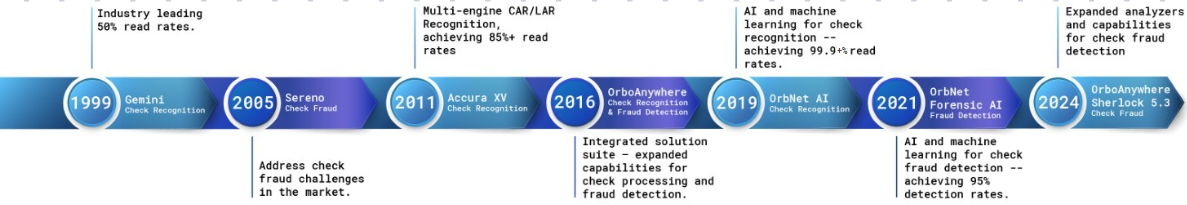

OrboGraph’s commitment to developing its technology for the check processing and fraud detection industry is unmatched – starting with the launch of “Gemini” check recognition in 1999, which achieved industry-leading 50% read rates, to the most recent launch of our "OrbNet AI" for check recognition (launched in 2019 with 99% read rates), as well as "OrbNet Forensic AI" for fraud detection (launched in 2021 with 90-95% check fraud detection rates).

Many vendors in check processing are essentially cash cows, investing minimally in their technologies. OrboGraph, led by CTO Avikam Baltsan, continues major innovation into AI and deep learning technologies – leading to the launch of the OrbNet AI Innovation Lab.

OrboGraph has received multiple awards for its AI technologies, including the “AI Excellence Award” (2021, 2022, and 2023) by the Business Intelligence Group, and “Most Trusted Banking Tech Solution Providers In 2023” by The Enterprise World.

In a rapidly changing industry, OrboGraph's stability, technology investment, and consistent performance make it a trusted partner for FIs. For a personal discussion related to this topic, consider a strategy session with Joe J. Gregory, Chief Strategy Officer. To learn how OrboGraph reduces fraud losses and improves efficiencies, schedule a 30-minute discussion and demonstration.