Automated Endorsement Analysis

Artificial Intelligence can be a dizzying technology to understand. While the term gets tossed around everywhere you turn, it’s important for financial institutions to have a strong baseline of knowledge on the different types of AI, in order to better leverage the technology.

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreAs a subscriber to the OrboNation Blog, you have undoubtedly seen articles involving Artificial Intelligence (AI) and GPUs and how this combination of breakthrough technologies are part of the future for banking. The adoption of GPU hardware is enabling the combination of a “New Standard” for solving the difficult problems of the industry in many…

Read MoreWith “never go to a bank” Millennials becoming a bigger and bigger market force, compounded by the fact that pandemic lock-downs have encouraged even formerly tech-averse people to use online banking tools, one might think the reign of the bank and credit union physical, walk-in branch system is coming to a close.

Read MoreCredit Unions and their members tend to pride themselves — rightfully so — on being much more “customer-centric” than the average financial institution. They are, after all, serving “members,” and that spirit permeates their approach in all aspects of their business. The relationship has become, in fact, a differentiator that draws (and keeps) loyal members on a long-term basis.

Read MoreThe Federal Reserve is actively exploring ways to streamline FinTechs’ access to the payment system, and pymnts.com reports that financial institutions will need sharpen their systems to retain a competitive edge.

The Federal Reserve could be taking steps toward a much more open and competitive financial services landscape as it considers allowing FinTechs to gain access to the payment system directly. The Fed announced last week that it is inviting comment on the proposal to develop guidelines for allowing non-banks to access accounts and payment services, rather than relying on bank partnerships to facilitate that connectivity.

Read MoreForbes took a look at new research from Cornerstone Advisors and found that that more than three-quarters of Americans who have a smartphone are now mobile banking users. Mobile banking adoption is approaching ubiquity among Gen Zers and Millennials (ages 21 to 40) with 88% of each of the two generations accessing their bank accounts using a mobile device. The adoption rate dips just a bit to 78% among Gen Xers (41 to 55 years old), and then drops to 57% of Baby Boomers and 41% of smartphone-owning Seniors.

Read MoreTried-and-true merges with new digital tech — Venmo recently announced that it will begin to offer a new check-cashing service, “Cash a Check,” in the Venmo mobile app. Via TechCrunch.com: The feature … can be used to cash printed, payroll and U.S. government checks, including the new stimulus checks, the company says. Though typically there will be fees associated with the Cash a Check feature, Venmo says these are being waived on stimulus funds for a limited time.

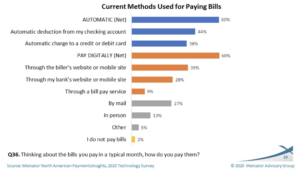

Read MoreThe report presents results from questions exploring how adults in the United States use and pay for “box of the month” clubs and online subscription services. It also explores the ways consumers pay their bills and the increasing importance of digital bill payment. …When it comes to paying bills, the majority of consumers (6 in…

Read MoreIn a recent OrboNation Blog article, we covered the need for key fintech players — like banks and firms — to continue to invest in modernizing their processes and payment methods as “the need for automation has never been more pressing. Clients want quick, efficient solutions that enable them to do more with less. From lending decisions to payments risk management, only technology can provide the necessary support that businesses need.” One approach that banks and financial institutions are starting to pay attention to is Open Banking.

Read More